Diamond News Archives

- Category: News Archives

- Hits: 2046

March 29, 18

(IDEX Online) – The 62nd Bangkok Gems and Jewelry Fair 2018 is to be held from September 7-11, at IMPACT Muang Thong Thani, Bangkok, Thailand.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

It will feature 900 companies in over 2,000 booths from selected domestic and overseas exhibitors.

Goods on offer will include gemstones (precious stones, semi-precious stones), rough stones, diamonds, pearls, precious metal, synthetic stones, costume and fashion jewelry, fine jewelry, gold jewelry, silver jewelry, display and packaging, equipment and tools, jewelry parts, and machinery.

The show organizer is the Department of International Trade Promotion, Ministry of Commerce, Thailand

Highlights of the show will include:

1. The Niche Showcase: Metro Men/ LGBT, The Moment, Heritage & Craftsmanship, Spiritual Power, Beyond Jewelry/ Jewelry Cross over with lifestyle products such as glasses, mobile phones, clocks, home décor such as crystal floors

2. The New Faces: Showcasing new brands and designers

3. The Jewellers: Designers from 23 brands that participated in the Talent Thai and Designers’ Room project will be joining activities in the fair, from business matching activities, co-branding exhibition to jewelry design consulting services for jewelry businesses

4. Seminars and a fashion show...

- Category: News Archives

- Hits: 2201

March 29, 18

(IDEX Online) – The Baselworld watch and jewelry show wrapped up its 2018 edition on Tuesday after six days.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

The show previously lasted eight days.

This year's edition also saw a smaller attendance – down to 600+ exhibitors from 1,300 last year and about 1,500 the year before.

Baselworld's organizers announced last year that they were planning to reduce the length of the show and the number of exhibitors to make it smaller and more focused.

Reports have spoken about large numbers of exhibitors refusing to renew contracts, and the latest show was vastly different to shows of the past which featured large numbers of sellers of loose diamonds and gemstones....

- Category: News Archives

- Hits: 2061

Adapted from white paper by SAP

According to Harvard Business Review (HBR 2017), billions of dollars are being invested in blockchain technology, and some of the smartest people on the planet are engaged in understanding how this technology can reinvent organizations and industries. A report from PriceWaterhouse Coopers (PwC 2017) has named blockchain as a ‘tech breakthrough megatrend’ for CIOs, whilst Gartner (2016) has named it as one of the top 10 strategic technologies for 2017.

The potential impact of blockchain is driving businesses to rethink existing business models, re-examine opportunities previously thought non-viable, and explore a new frontier of opportunity that can impact the bottom line and benefit society.

Here is a survey showing current uses and potential uses of blockchain:

Tracking conflict minerals

The mining industry plays a key role in the global economy, with metals and minerals being a key ingredient for the manufacturing, industrial and consumer goods sectors. Mining businesses are currently exposed to a wide array of geo-political, social, financial and brand risk; within their value chain and beyond. There is currently much uncertainty in understanding the fundamental concepts of blockchain and more particularly its application in the Mining industry. It would therefore be useful to shed light on key areas where blockchain can be used to help address the typical challenges across the mining value chain, to help unlock value for mining companies.

Recent disclosures by Tesla and Hewlett-Packard to the United States’ Securities & Exchange Commission (SEC) in 2015 indicate that they found difficulties in tracking conflict materials which could be linked to obtaining minerals from select African nations. This is driving a new wave of rules and legislation making it mandatory for manufacturer’s to not only disclose the source, but importantly reinforce the concept of ethical sourcing.

This makes the concept of ‘chain of custody’ fundamental to transparency across the value chain. Simply put, it is the knowledge of every set of hands the minerals have passed through, between the moment it is extracted, to when it lands in the hands of the final owner. Complete knowledge of the chain of custody is the only way that Tesla or Hewlett-Packard can ensure they are compliant with SEC guidelines.

Labelling diamonds

The diamond business has been one of the first to embrace blockchain technology wholeheartedly.

If you think about the journey of a diamond, from when it’s mined, sorted and sold, to when it is mounted and displayed at a trusted retailer, say Tiffany’s or Harrods, there is so much opportunity to exchange a valid diamond for something of different provenance, like a blood or conflict diamond. Using the blockchain, each step of the production process can be verified, guaranteeing the legitimacy of a diamond.

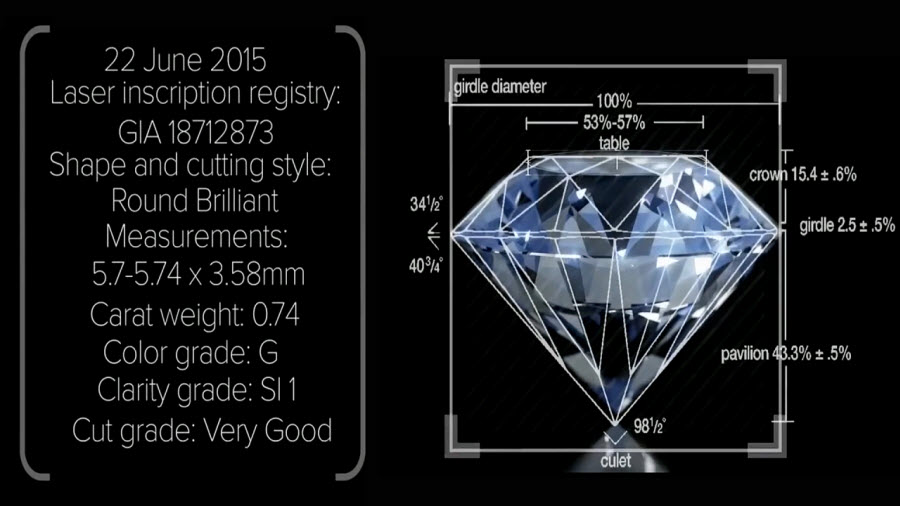

A London-based company called Everledger has placed more than 1.6 million diamonds on a blockchain. Entries on the digital record include dozens of attributes for each diamond, including the color, carat, and certificate number,...

- Category: News Archives

- Hits: 2047

(IDEX Online) – Botswana’s Debswana Diamond Mining said output rose sharply last year – up 11 percent to a three year high – and it expects further growth this year as lower taxes in the United States leave consumers with more money to spend.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

De Beers Executive Vice-President, Diamond Trading, Paul Rowley, explained in an interview with Reuters that diamond sales had received a boost from a weaker dollar. He expects global demand for diamonds to rise further in 2018 after increasing by 3-4 percent last year.

“Coming from the lows of 2015, a growth in consumer demand of between 3-4 percent is quite good for us,” Rowley said on the sidelines of a stakeholders meeting in Gaborone.

Debswana – a joint venture between De Beers and Botswana's government – said annual production rose to 22.2 million carats last year, and sales jumped 16 percent.

Debswana's Managing Director, Balisi Bonyongo, said the company would continue to mine in line with demand.

“With stable and improving macroeconomics, particularly in the USA, we will see growth of the same order of magnitude or perhaps slight higher in 2018,” Bonyongo told the meeting, Reuters reported.

Bonyongo added that Debswana is in the final stages of expansion plans to extend the lifespan of its huge Jwaneng mine.

Around $3 billion has been spent so far to extend Jwaneng mine’s lifespan to 2030 under the Cut 8 plan. He said that about 81 million tonnes of material would be removed in order to recover 92 million carats of rough stones.

Feasibility studies for the next expansion project at Jwaneng mine, Cut 9, will be completed by the end of 2018, he added....

- Category: News Archives

- Hits: 2118

GABORONE, March 27 (Reuters) – Botswana's Debswana Diamond Mining said on Tuesday production jumped 11 percent to a three year high in 2017 and it expects growth this year as lower taxes in the United States leave consumers with more to spend on luxury goods.

Debswana, a joint venture between De Beers and the southern African country's government, said annual production rose to 22.2 million carats last year.

Sales jumped 16 percent, contributing to a 20 percent increase in earnings before interest, tax and amortization.

De Beers Executive Vice-President, Diamond Trading, Paul Rowley, said a weaker dollar had boosted diamond sales and he expected global demand for diamonds to rise again this year after rising 3-4 percent in 2017.

"Coming from the lows of 2015, a growth in consumer demand of between 3-4 percent is quite good for us," Rowley said on the sidelines of a stakeholders meeting in Gaborone.

Debswana's managing director Balisi Bonyongo said the firm would continue its strategy of mining to meet demand.

"With stable and improving macroeconomics, particularly in the USA, we will see growth of the same order of magnitude or perhaps slight higher in 2018," Bonyongo told the meeting.

The firm is in the final stages of expansion plans to extend the lifespan of its Jwaneng mine.

Under a project dubbed Cut 8, Bonyongo said about 25 billion pula ($3 billion) has been spent so far to extend its Jwaneng mine's lifespan to 2030.

He added he expected the firm to remove about 81 million tonnes of material to uncover 92 million carats.

Feasibility studies for the next expansion project at Jwaneng mine, Cut 9, will be completed by the end of this year, he added.

($1 = 9.5057 pulas)

(Writing by Nqobile Dludla; Editing by James Macharia and Alexandra Hudson)

The post Botswana's Debswana says expects further rise in diamond output appeared first on MINING.com....