Diamond News Archives

- Category: News Archives

- Hits: 2572

Surprise, Surprise, Surprise! [1]

Combine Vlad “The Impaler” Putin, Syria, Brexit, trade jitters and the European banking continuing woes and you get … a catering of Europe’s economic surprise index.

The dimming data — with Russian sanctions and a potential trade war adding to market fears — have also turned Europe into ground zero for a question increasingly bedeviling investors: Has the global synchronized growth story that powered the bull market peaked? It also leaves them with a dilemma: jump back in on the prospect of juicing more gains from an increasingly mature business cycle, or assume the best is now behind them.

The answer will likely hinge on where data goes from here. Even before trade tensions broke out, growth momentum had cooled from lofty levels, with Purchasing Manager Indexes starting to roll over worldwide. The decline in Europe was particularly sharp, and sent the region’s economic surprise index to the lowest since 2012.

“The tone of domestic Europe is weaker than had been anticipated and clearly the trade worries are a compounding factor,” James Bevan, chief investment officer at CCLA Investment Management, told Bloomberg TV.

Once Hot, Now Not

The risk to bulls is that great expectations are already baked into corporate earnings, lowering the bar for disappointments just as cracks emerge in the data.

The outperformance of cyclical stocks — which benefit most from economic expansion — over their defensive counterparts has eased from February highs, underscoring the region’s ebbing momentum.

“The negative impact of a data point that underwhelms on either the macro or micro fronts could be more acute given the elevated valuations of global risk assets,” Katie Nixon, chief investment officer of wealth management at Northern Trust...

- Category: News Archives

- Hits: 2166

HTTP/1.1 200 OK Server: nginx/1.13.5 Date: Thu, 12 Apr 2018 13:15:04 GMT Content-Type: text/html; charset=UTF-8 Content-Length: 185749 Connection: keep-alive Vary: Accept-Encoding, Cookie Cache-Control: max-age=3600, public X-UA-Compatible: IE=edge Content-language: en X-Content-Type-Options: nosniff X-Frame-Options: SAMEORIGIN Expires: Sun, 19 Nov 1978 05:00:00 GMT Last-Modified: Thu, 12 Apr 2018 13:15:03 GMT ETag: W/"1523538903" X-Backend-Server: drupal-8458c8cb4d-rdv65 Age: 0 Varnish-Cache: HIT X-Cache-Hits: 1 X-Served-By: varnish-0 Accept-Ranges: bytes ...

Mortgage Refis Tumble To Lowest Since The Financial Crisis, Leaving Banks Scrambling | Zero Hedge Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)

- Category: News Archives

- Hits: 1853

(IDEX Online) – CIBJO President Gaetano Cavalieri visited Bahrain, as the guest of DANAT, the Bahrain Institute for Pearls & Gemstones, during which he met with the leadership of the country's fast-developing gemstone and jewelry centre, and discussed the possibility of its hosting the CIBJO Congress in 2019.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

Located on an archipelago on the northern flank of the Arabian Peninsula, the energy-rich Kingdom of Bahrain is home to a pearling industry that traces its history back 4,000 years. DANAT, the Bahrain Institute for Pearls and Gemstones, was formerly established in 2017, as a wholly-owned subsidiary of the Bahrain Mumtalakat Holding Company, the country's sovereign wealth fund.

Upgrading a 27-year pearl and gem-testing laboratory that, when it was formed in 1990, was the first such facility in the Middle East, under its new structure and with a state-of-the-art laboratory, it aims to become an internationally-recognized institute for third party verification services and scientific research into pearls and gemstones.

Bahrain was the first of the Gulf states to make the transition from an energy-based economy into one that is today anchored by banking, trade and tourism. Mumtalakat was created by a royal decree in 2006, with the objective of pursuing long-term value-enhancing opportunities for the country's state-owned, non-oil and gas-related assets. It established DANAT from the older Pearl & Gem Testing Laboratory to support the country's distinguished pearling history and heritage, as well as to tap into the rapid growth of the jewelry industry across the world, though the issuance of verification and authentication reports, continuous scientific research and analysis of pearls and gemstones, and the provision...

- Category: News Archives

- Hits: 1945

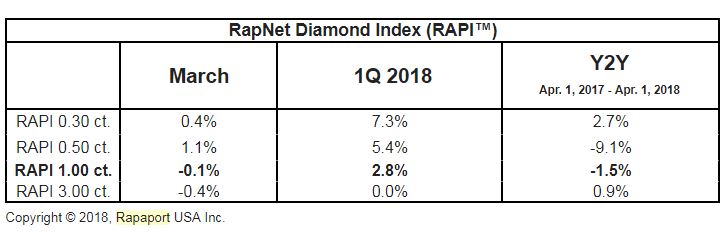

A new report issued by Rapaport reveals that diamond prices stabilized in March.

"The RapNet Diamond Index (RAPI ) for 1-carat diamonds slid 0.1% in March. RAPI for 0.30-carat stones went up 0.4%, while RAPI for 0.50-carat grew 1.1%. RAPI for 3-carat diamonds declined 0.4% during the month. RAPI for 1-carat stones rose 2.8% during the first quarter," the document reads.

) for 1-carat diamonds slid 0.1% in March. RAPI for 0.30-carat stones went up 0.4%, while RAPI for 0.50-carat grew 1.1%. RAPI for 3-carat diamonds declined 0.4% during the month. RAPI for 1-carat stones rose 2.8% during the first quarter," the document reads.

The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds offered for sale on RapNet – Rapaport Diamond Trading Network.

According to the group, prices remained flat and did not go up for several reasons. One of those reasons is the famous case against jewelry tycoon Nirav Modi who is being accused of spearheading a $2 billion fraud against India’s state-owned Punjab National Bank. The situation prompted other banks to raise their collateral requirements. "The financial year that began April 1 is likely to see a liquidity squeeze. Some large manufacturers with sizable credit lines are facing greater scrutiny," Rapaport states.

According to the firm, the other reason behind last month's price behaviour is the fact that manufacturers feel under pressure after De Beers raised prices an estimated 2% to 3% in the first quarter. "Cutters are protecting their profits with steady polished prices, and buyers have adapted to the higher rates that emerged in January and February. Retailers are supporting demand by restocking after good US and Chinese holiday seasons," the report reads.

The fact that diamonds are starting to lose status at the Hong Kong show also impacted prices, Rapaport says.

However, the firm forecasts improved performance in Asia. "The outlook for China remains positive. Consumers have acclimated to Premier...

- Category: News Archives

- Hits: 1819