A new report issued by Rapaport reveals that diamond prices stabilized in March.

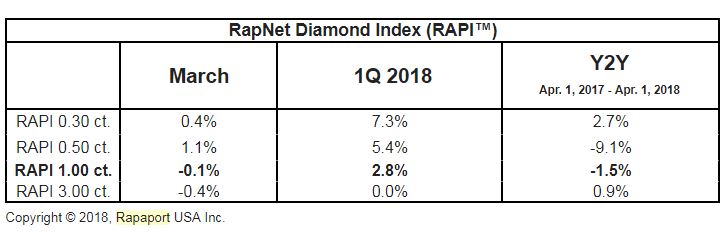

"The RapNet Diamond Index (RAPI ) for 1-carat diamonds slid 0.1% in March. RAPI for 0.30-carat stones went up 0.4%, while RAPI for 0.50-carat grew 1.1%. RAPI for 3-carat diamonds declined 0.4% during the month. RAPI for 1-carat stones rose 2.8% during the first quarter," the document reads.

) for 1-carat diamonds slid 0.1% in March. RAPI for 0.30-carat stones went up 0.4%, while RAPI for 0.50-carat grew 1.1%. RAPI for 3-carat diamonds declined 0.4% during the month. RAPI for 1-carat stones rose 2.8% during the first quarter," the document reads.

The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds offered for sale on RapNet – Rapaport Diamond Trading Network.

According to the group, prices remained flat and did not go up for several reasons. One of those reasons is the famous case against jewelry tycoon Nirav Modi who is being accused of spearheading a $2 billion fraud against India’s state-owned Punjab National Bank. The situation prompted other banks to raise their collateral requirements. "The financial year that began April 1 is likely to see a liquidity squeeze. Some large manufacturers with sizable credit lines are facing greater scrutiny," Rapaport states.

According to the firm, the other reason behind last month's price behaviour is the fact that manufacturers feel under pressure after De Beers raised prices an estimated 2% to 3% in the first quarter. "Cutters are protecting their profits with steady polished prices, and buyers have adapted to the higher rates that emerged in January and February. Retailers are supporting demand by restocking after good US and Chinese holiday seasons," the report reads.

The fact that diamonds are starting to lose status at the Hong Kong show also impacted prices, Rapaport says.

However, the firm forecasts improved performance in Asia. "The outlook for China remains positive. Consumers have acclimated to Premier...