Diamond News Archives

- Category: News Archives

- Hits: 1929

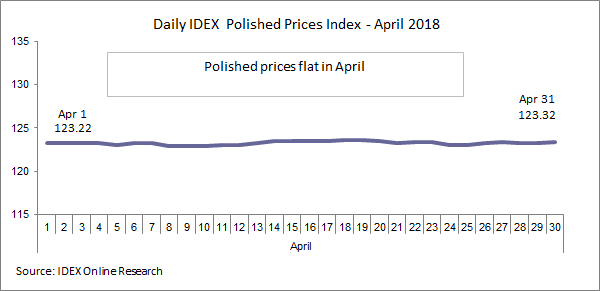

(IDEX Online) – The IDEX polished diamond price index was flat again in April, following a similar performance during March which came after and small increases in January and February.

The Index began the month at 123.22 and ended at 123.32.

Outlook

Trading was generally quiet in April due to the Passover and Easter holidays.

Profit margins were somewhat hit due to the rise in rough polished prices. However, polished dealers generally across the diamond markets have been standing firm on prices, knowing that they will be paying higher prices for goods to be bought for processing.

Both De Beers and Russian diamond mining monopoly ALROSA reported ongoing robust sales at their latest sights in April.

Although there is healthy restocking on the back of sold orders in the United States and China, the financing situation remains fragile in the wake of the Nirav Modi bank fraud case which is creating problems for diamond companies looking for bank credit.

For the full IDEX Online Research article, click here

[1]...

- Category: News Archives

- Hits: 1849

This highlights another of gold’s most attractive qualities: excellent liquidity.

While not all of us have a few billion to plow into our precious metals holdings, the gold market is so liquid that Sawiris can do just that and not worry about how, when the time comes, he can sell without displacing the market.

Some big investors see warning signs ahead for markets but are holding their positions. Egyptian billionaire Naguib Sawiris is taking action: He’s put half of his $5.7 billion net worth into gold.

He said in an interview Monday that he believes gold prices will rally further, reaching $1,800 per ounce from just above $1,300 now, while “overvalued” stock markets crash.

“In the end you have China and they will not stop consuming. And people also tend to go to gold during crises and we are full of crises right now,” Sawiris said at his office in Cairo overlooking the Nile. “Look at the Middle East and the rest of the world and Mr. Trump doesn’t help.”

ORIGINAL SOURCE: This Billionaire Has Put Half His Net Worth Into Gold[1] by Tamim Elyan and Manus Cranny at Bloomberg[2] on 5/1/18...

References

- ^ This Billionaire Has Put Half His Net Worth Into Gold (www.bloomberg.com)

- ^ Bloomberg (www.bloomberg.com)

- Category: News Archives

- Hits: 1309

(IDEX Online News) – There were relatively few price changes in round diamonds in April, particularly in smaller diamonds under 0.50 carats. Diamonds of 1-2 carats saw some downward movement, while larger diamonds saw significant upward movement. This was particularly evident in 3.00-3.99 carat stones and, to a lesser extent, in the 4.00-4.99 and 5.00-5.99 carat categories.

Fancy diamonds also saw relatively few price changes in diamonds of less than 0.5 carat. The 0.70-0.79 category saw declines of 2-3%, and the 0.80-0.89 carat category saw rises in E-K, SI1-12, while 0.90-0.99 carats in D-J, IF-I2 showed notable increases, as did the 1.25-1.49 carat category in D-E, IF-VS1, and in 5.00-5.99 carats L-N, SI1-SI2.

The following are some of the changes in this week's IDEX Online Diamond Price Report.

To receive a free copy of the full IDEX Online Diamond Price Report, please email us at

Rounds

• 0.18-0.22 cts D/ IF +2%

• 0.23-0.29 cts I-K / VVS1 -3-4%

• 0.30-0.39 cts K / VS2-SI1 -3%, K/ IF +3%

• 0.40-0.44 cts K-L / VS2-SI2 -3-4%, J/ IF +2%

• 0.45-0.49 cts F-G / I2 -4%, M / SI3 +5%

• 0.50-0.69 cts F-G / VS1 -2%, H / VVS1 +4%

• 0.70-0.79 cts F / VVS2-VS2 -1-3%, J-K / IF-VVS1 +1-3%

• 0.80-0.89 cts D / VS2-SI1 2-3%, D / VVS1 +3%

• 0.90-0.99 cts I/ I1 -4%, D-I / IF-VVS2 +2-3%

• 1.00-1.24 cts K/ VVS1-SI1 -2%, H / IF +3%

• 1.25-1.49 cts H / SI2 -3%, E / IF +3%

• 1.50-1.99 cts G-H / VVS1 -2-3%, M / SI1 +3%

• 2.00-2.99 cts D-K / VS2-SI2 1-3%, J / VVS1-VVS2 +3%

• 3 cts D-L / IF-SI2 +2-3%

• 4 cts H-J/...

- Category: News Archives

- Hits: 1856

For data wonks like me, the annual Yearbooks from various gold and silver consultancies make for fun reading. You can always find little gems about what’s going on in the markets, and sometimes you can spot changes in trends early on. Seeing a compelling chart, especially one that’s not been widely reported, is almost as exciting as seeing my wife in a short skirt on date night.

Well, I’ve got a series of charts for you that point to a silver trend that is so entrenched in its development, so inevitable in its outcome, so inescapable in its consequences that it comes as close as one can get to a guarantee. And once fully underway, it will have major implications for the silver price, along with the availability of investment metal.

These charts all come courtesy of CPM Group’s 2018 Silver Yearbook. There are a number of precious metals consultancies in the industry, but I’ve found over the years that their Yearbooks[1] have the most comprehensive and in-depth research (I know many readers disagree with their views on manipulation of the metals, but separate that out from the data they’ve uncovered and what it means).

Let’s jump in, starting with the demand side…

Isn’t Silver Investment Demand Down?

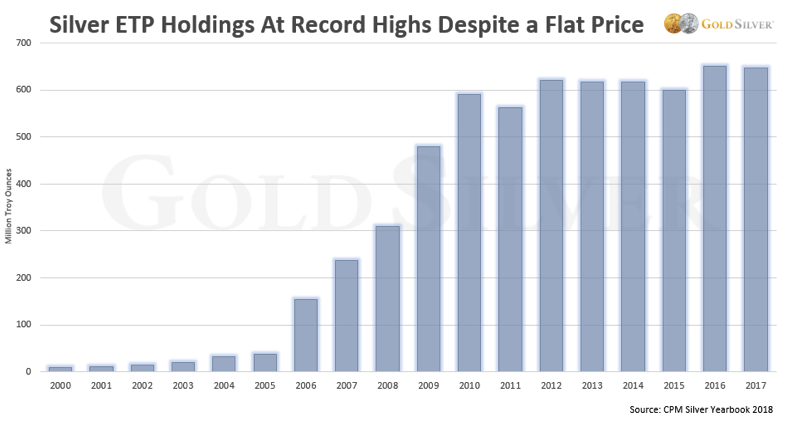

What most investors hear is that silver demand is down. And yes, coin and bar sales fell 52% last year, ending up at approximately the same level as 2007. But demand for ETPs (exchange-traded products, including ETFs) remained near all-time highs, as the data shows.

SLV and other silver paper vehicles saw virtually no drop in holdings last year, in spite of a weak silver price and falling physical demand. You and I don’t buy these products, but interest from...

- Category: News Archives

- Hits: 1976

“Better safe than sorry” seems to be the operative phrase increasingly guiding foreign governments in their approach to gold reserves held in US vault.

Highly questionable internal audits (and zero external audits) leave the US government’s claims of 810 tons of federal gold open to debate. The world’s reaction to this “Come on, just trust us” approach is now resulting in hundreds of tons of gold leaving US custody.

The Turkish government has made the decision to repatriate all of its gold reserves that are currently housed in the US Federal Reserve System (FRS). Overall Turkey was storing 220 tons, valued at $25.3 billion, in the US, which it repossessed on April 19, 2018.

Turkey’s President Recep Tayyip Erdogan has toughened his stance against the US dollar (USD), declaring that international loans should be made in gold instead of the American currency. Ankara is seeking to reduce dependence on the US financial system. The gold’s homecoming was partly prompted by the US threats to impose sanctions if Turkey goes through with the signed deal to purchase Russian S-400 missile defense systems.

This is a dramatic move reflecting an international trend. Venezuela repatriated its gold from the US in 2012. In 2014, the Netherlands also retrieved its 122.5 tons of gold that were stored in US vaults. Germany brought home 300 metric tons of gold stashed in the United States in 2017. It took Berlin four years to complete the transfers. Austria and Belgium have reviewed the possibility of taking similar measures.

Few people believe the US Treasury’s assurances that the 261 million ounces (roughly 8,100 tons) in official gold reserves that are stored in Fort Knox and other places are fully audited and accounted for. The Federal Reserve has never been fully...