Diamond News Archives

- Category: News Archives

- Hits: 1199

(IDEX Online) – Greenland Ruby will be appearing at the JCK Show in Las Vegas, from June 1-4, and will each day be displaying a mini “iceberg” in which a real Greenlandic ruby has been frozen.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?> Visitors will be encouraged to guess the carat weight of the encased ruby for a chance to win the gem. Contestants can take 'selfies' in woolly hats with the iceberg, and post “from Greenland” with their guesses on Facebook or Instagram and then at 5pm each day, there will be an online announcement on Greenland Ruby’s social pages of the actual carat weight. The person with the closest guess wins the ruby! Hashtags for the event are: #greenlandrubyreveal, #greenlandruby, #notyourgrandmothersruby, and #responsiblerubies Greenland Ruby gems are mined at a remote mine site in Aappaluttoq, Greenland, 155 miles south of Nuuk, Greenland’s capital. The rubies, and pink sapphires, are embedded in corundum-bearing rock that geologists believe is in the oldest rock formation on earth. The output is processed at an ultra-modern, state-of-the-art cleaning and sorting operation adjacent to the mine. Ruby and pink sapphire from the region have been described as similar to the quality that is found in parts of Burma and in Mozambique, two important sources of corundum. The gems vary in color from the deep and vibrant red ruby known traditionally in the trade as “Pigeon's Blood" to the lighter shades of pink (which are pink sapphire), Greenland Ruby said in a statement. Greenland Ruby executives, including CEO Magnus Kibsgaard and Vice President of Sales and Marketing Hayley Henning will be on hand...

(IDEX Online) – Greenland Ruby will be appearing at the JCK Show in Las Vegas, from June 1-4, and will each day be displaying a mini “iceberg” in which a real Greenlandic ruby has been frozen.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?> Visitors will be encouraged to guess the carat weight of the encased ruby for a chance to win the gem. Contestants can take 'selfies' in woolly hats with the iceberg, and post “from Greenland” with their guesses on Facebook or Instagram and then at 5pm each day, there will be an online announcement on Greenland Ruby’s social pages of the actual carat weight. The person with the closest guess wins the ruby! Hashtags for the event are: #greenlandrubyreveal, #greenlandruby, #notyourgrandmothersruby, and #responsiblerubies Greenland Ruby gems are mined at a remote mine site in Aappaluttoq, Greenland, 155 miles south of Nuuk, Greenland’s capital. The rubies, and pink sapphires, are embedded in corundum-bearing rock that geologists believe is in the oldest rock formation on earth. The output is processed at an ultra-modern, state-of-the-art cleaning and sorting operation adjacent to the mine. Ruby and pink sapphire from the region have been described as similar to the quality that is found in parts of Burma and in Mozambique, two important sources of corundum. The gems vary in color from the deep and vibrant red ruby known traditionally in the trade as “Pigeon's Blood" to the lighter shades of pink (which are pink sapphire), Greenland Ruby said in a statement. Greenland Ruby executives, including CEO Magnus Kibsgaard and Vice President of Sales and Marketing Hayley Henning will be on hand...

- Category: News Archives

- Hits: 1275

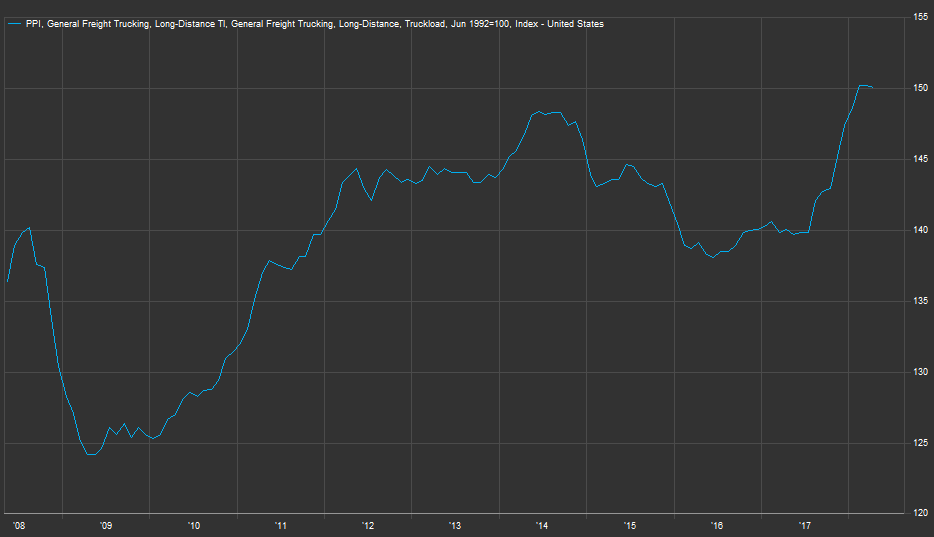

Now, the rapid increase in trucking demand is beginning to gather attention, with some corners of the financial markets wondering how long it will take until broader inflation gauges are impacted.

"When you have price pressure that is above and beyond what's normal, someone has to eat it," said Peter Boockvar, chief investment officer at Bleakley Advisory Group. "The truckers are obviously going to charge more for their services because they can, the buyers of that stuff who need the trucks are not going to eat the cost. They're going to do their best to pass it down."

While the most recent reading of the producer price index showed just a 2.6 percent gain over the past 12 months, the freight subindexes told a different story: truck transportation jumped 6 percent, rail was up 5.1 percent and air rose 3.9 percent. Overall, the general freight trucking component is just below the all-time high it hit in February.

General freight trucking component of the producer price index, from 2008-present.

Source: FactSet

"Demand is still exceeding capacity in most modes by a significant amount. In turn, pricing power has erupted in those modes to levels that spark overall inflationary concerns in the broader economy," Donald Broughton wrote in the most recent Cass Freight Index Report, a widely read industry publication.

While Broughton, founder and managing partner of Broughton Capital, said he believes technological improvements will offset long-term price pressures, he added that transportation indicators are showing noteworthy levels.

"April's 12.8% increase [in the Cass Freight Expenditures Index] clearly signals that capacity is tight, demand is strong, and shippers are willing to pay up for services to get goods picked up and delivered in modes throughout the transportation industry," he wrote. "We should...

- Category: News Archives

- Hits: 1209

LONDON, May 23 (Reuters) - Euro zone economic growth slowed much more sharply than expected this month, a business survey showed, which along with weaker inflation suggests a stiffer policy challenge for the European Central Bank ahead.

The ECB will end its asset purchase programme this year and hike interest rates in 2019, a Reuters poll found last month, although policymakers may be concerned to see inflation pressures easing alongside weakening growth.

While the expansion still remained relatively strong, growth slowed in both of the bloc’s two biggest economies, Germany and France. Forward-looking indicators also deteriorated, suggesting no imminent bounce-back.

IHS Markit’s Euro Zone Composite Flash Purchasing Managers’ Index (PMI), seen as a good guide to economic health, sank in May to an 18-month low of 54.1 from 55.1, below all forecasts in a Reuters poll which predicted a dip to 55.0.

“It is a gloomier-looking picture than we were seeing at the turn of the year,” said Chris Williamson, chief business economist at IHS Markit. “But let’s not get too carried away with the fact we are slowing — we still have reasonably robust PMI numbers.”

He said the PMI, alongside the April reading, pointed to second quarter growth of 0.4 percent, weaker than the 0.6 percent prediction in an April Reuters poll.

A composite output price index fell to an eight-month low of 53.0 from 53.4. Euro zone inflation slowed to 1.2 percent in April, official data showed last week, moving further away from the ECB’s 2 percent target ceiling.

Despite those easing...

- Category: News Archives

- Hits: 1284

- Category: News Archives

- Hits: 1631

President Donald Trump’s maximalist approach in recasting his nation’s trade relations may soon hit U.S. farmers and manufacturers, as America’s trade partners prepare retaliatory tariffs that could generate $3.45 billion in revenue.

In just the past week, the European Union[1] threatened $1.6 billion of additional levies in response to U.S. tariffs on metal imports; Russia prepared $537.6 of added duties; Turkey $266.6 million; Japan $264.3 million; and India $165.6 million, according to filings with the World Trade Organization[2]. China already imposed $611.5 million of additional retaliatory tariffs.

To read more about the EU’s trade conflict with the U.S., click here[3]

Citing national security concerns, the U.S. imposed import duties of 25 percent on steel and 10 percent on aluminum in March, giving regions including the EU, Mexico and Canada temporary exemptions while they negotiate alternate resolutions. While the EU has indicated a willingness to discuss means of resolving global steel overcapacity, European leaders have said they won’t begin negotiations until Trump has provided a permanent exemption on the metals tariffs.

“As a matter of principle, we will talk about everything with a friendly country that respects WTO rules,” French President Emmanuel Macron said immediately after the U.S. tariffs were enacted. “But, by the same principle, we won’t talk about anything while there’s a gun pointed at our head.”

Trade Tiff

Six nations have threatened $3.45 billion in retaliatory tariffs against the U.S.

WTO filings