Now, the rapid increase in trucking demand is beginning to gather attention, with some corners of the financial markets wondering how long it will take until broader inflation gauges are impacted.

"When you have price pressure that is above and beyond what's normal, someone has to eat it," said Peter Boockvar, chief investment officer at Bleakley Advisory Group. "The truckers are obviously going to charge more for their services because they can, the buyers of that stuff who need the trucks are not going to eat the cost. They're going to do their best to pass it down."

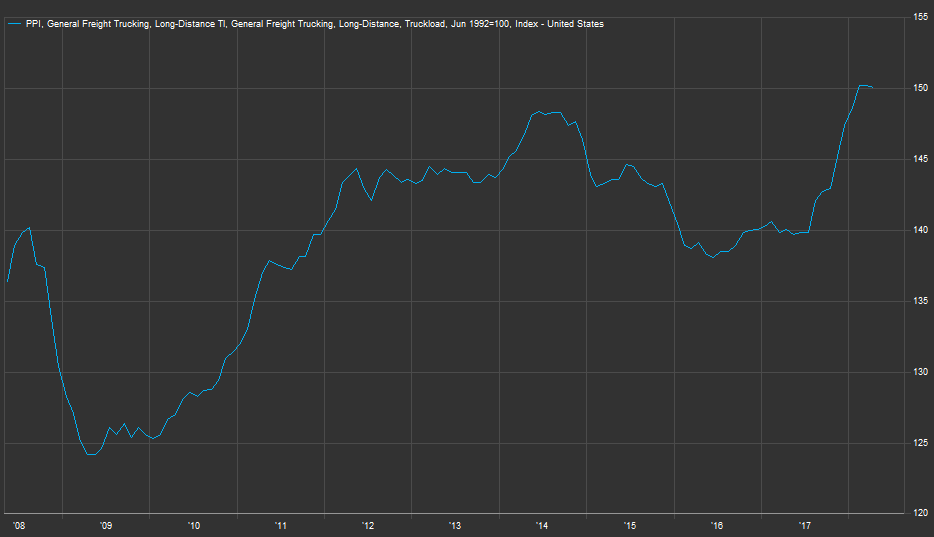

While the most recent reading of the producer price index showed just a 2.6 percent gain over the past 12 months, the freight subindexes told a different story: truck transportation jumped 6 percent, rail was up 5.1 percent and air rose 3.9 percent. Overall, the general freight trucking component is just below the all-time high it hit in February.

General freight trucking component of the producer price index, from 2008-present.

Source: FactSet

"Demand is still exceeding capacity in most modes by a significant amount. In turn, pricing power has erupted in those modes to levels that spark overall inflationary concerns in the broader economy," Donald Broughton wrote in the most recent Cass Freight Index Report, a widely read industry publication.

While Broughton, founder and managing partner of Broughton Capital, said he believes technological improvements will offset long-term price pressures, he added that transportation indicators are showing noteworthy levels.

"April's 12.8% increase [in the Cass Freight Expenditures Index] clearly signals that capacity is tight, demand is strong, and shippers are willing to pay up for services to get goods picked up and delivered in modes throughout the transportation industry," he wrote. "We should...