Diamond News Archives

- Category: News Archives

- Hits: 1189

Federal Reserve Chairman Jerome Powell is testing the economy’s room to run. It’s a strategy that contains both big benefits and risks for ordinary Americans and is causing excitement, tinged with caution, inside the central bank.

Take Fed treatment of one of its bedrock conceptual benchmarks, a rate of unemployment that keeps inflation stable. In June, they estimated that level at 4.5 percent. Unemployment in May was 3.8 percent. Yet with no sign of price pressures, policy makers plan to let the labor market run even hotter, with the jobless rate projected at 3.5 percent over the next two years.

Powell, a Trump administration appointee, shares his predecessor Janet Yellen’s appreciation that labor-market slack may be greater than estimated. He’s combined that with a sense that the range of uncertainty around guidepost estimates that govern monetary policy are highly uncertain tools.

For Powell, the first non-economist to hold the job in more than three decades, conceptual benchmarks can’t fully describe the complexity of the U.S. economy. So in this first five months, he’s brought a subtle but important change to the chairmanship at a key juncture in the business cycle: trust evidence as much as economic models.

“Let’s be guided by what’s going on and what the real economy’s telling us,” Powell said on the sidelines of a June 20 central bank conference in Sintra, Portugal, at which he also repeated the case for gradual interest-rate increases. “And let’s also admit that our understanding of what the location” of full employment is must be “informed by reality and what’s actually happening.”

A hot labor market has tremendous benefits for U.S. workers, millions of whom were locked out of jobs during the post-crisis recovery because of age or racial...

- Category: News Archives

- Hits: 1254

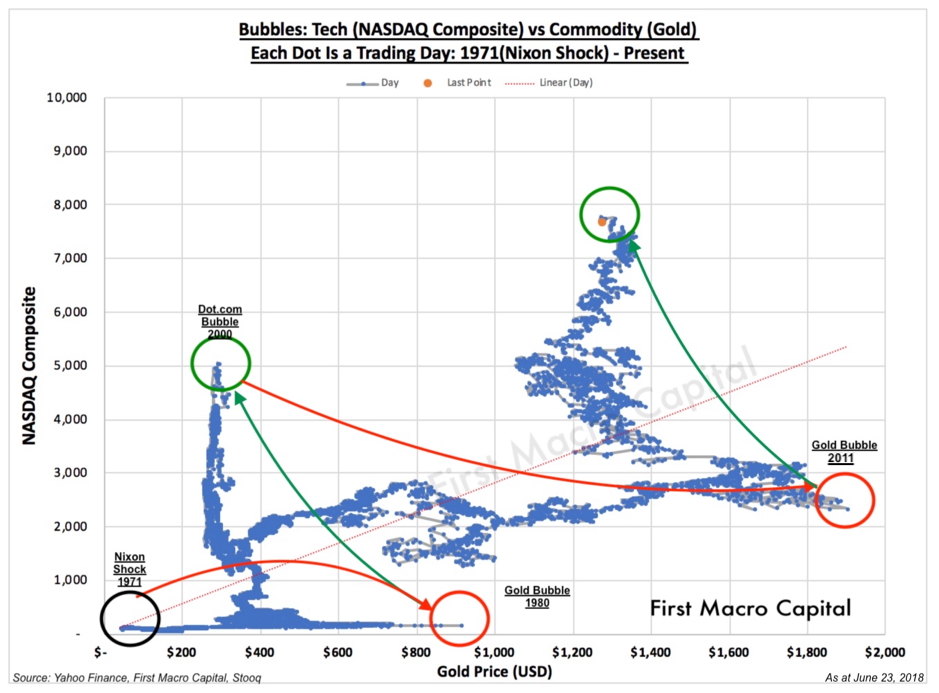

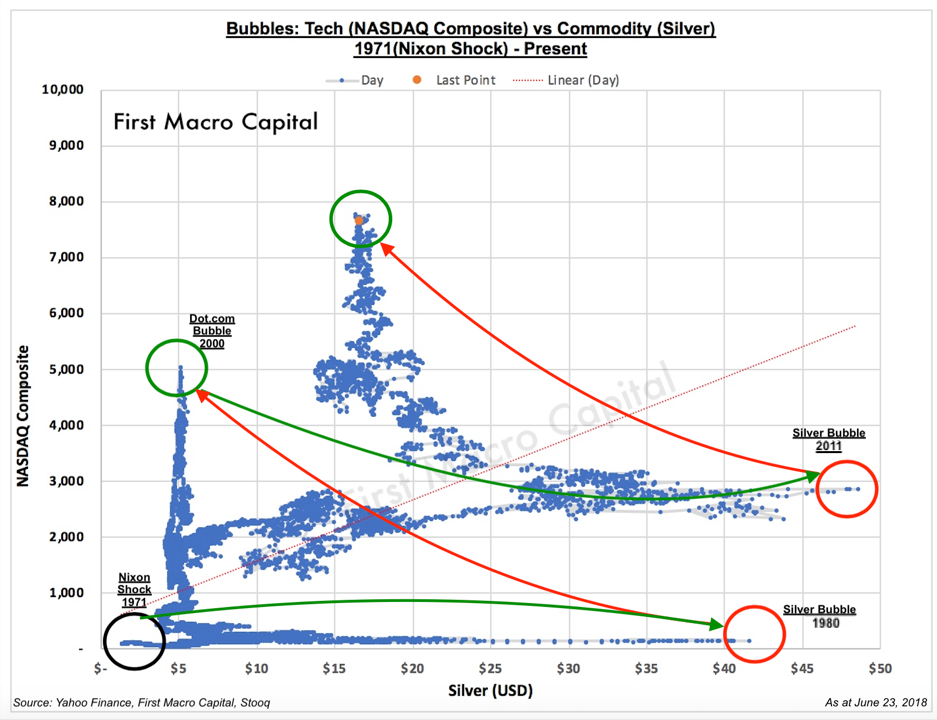

The cyclical nature of commodities and equities goes back at least until the 1970’s. When commodities are doing well, equities are performing poorly. Then the cycle flips and investors pile into equities, eventually making them expensive and commodities like gold and silver become cheap. But what do you get when you take the extremes of both equities and commodities? The extreme side of equities, technology stocks (NASDAQ Composite) being driven by lines of code you can’t touch. On the opposite end of commodities, you get tangible precious metals, silver and in particular gold. Tech investors versus gold and silver couldn’t be more different. Their history of being at a tug-of-war has rarely been discussed until now.

When we look at the NASDAQ Composite (NASDAQ) in relation to gold and silver in US dollars, going back to 1971, when the Nixon shock occurred. You get a striking relationship that confirms the cyclical nature between the commodities and equities. This was four years before Paul Allen and Bill Gates read the famous popular mechanics issue highlighting the world’s first microcomputer kit. That magazine propelled the creation of Microsoft. The 1970’s were a period of rising commodity prices, high inflation, a stagnant economy, and multiple recessions.

The Pendulum of Gold and Silver vs. NASDAQ Composite

1) 1971 – 1980: Commodities went on an epic bull run, increasing by more than twenty-five times, clearly outperforming the NASDAQ. By 1980, the NASDAQ was incredibly cheap relative to gold and silver.

2) 1980 – 2000: From 1980 onward capital flowed out of gold and silver and the overall commodities complex. as interest rates lowered, and confidence in the public sector was renewed. Equities were the cheap asset class in relation to commodities....

- Category: News Archives

- Hits: 1212

The ranks of hedge fund managers expecting impending market chaos are growing.

Greg Coffey, the former star manager at Moore Capital Management who started trading at his own firm this year, is comparing the turmoil in May to the end of dotcom bubble in 2000. Horseman Capital Management’s Russell Clark, one of the most bearish hedge fund managers in Europe, invoked memories of the financial crisis of 2008 in a letter to clients.

The two managers, among the best-known in Europe, join a growing chorus of investors predicting an end to the decade-old rally in asset prices, as central banks move to normalize policies and the rise of populism threatens trade across the globe. Billionaire George Soros in May warned[1] of a looming financial crisis and an existential threat to the European Union. Crispin Odey has for years expected a market crash and lost money betting on it.

“The ghosts of 2000 are upon us,” Coffey wrote in a May investors letter for his Kirkoswald Capital Partners. “Make no mistake, this is the current investment environment we are in, and will be through 2018.”

Officials for Horseman and Kirkoswald declined to comment.

Painful Years

Betting on a crash -- one of the key abilities hedge funds have over traditional investment funds -- has been a painful strategy for years as central banks across the globe bought assets to prop up markets. Odey’s European Inc. hedge fund lost almost 50 percent in 2016 and a further 22 percent last year.

“Since the global financial crisis, the number of doomsayers has risen exponentially,” said Philippe Ferreira, a Paris-based senior cross-asset strategist at Lyxor Asset Management, which oversees about 73 billion euros ($85 billion) in so-called alternative and active strategies. “But...

- Category: News Archives

- Hits: 1070

- Category: News Archives

- Hits: 1025

HTTP/1.1 200 OK Server: nginx/1.13.5 Date: Wed, 27 Jun 2018 14:15:04 GMT Content-Type: text/html; charset=UTF-8 Content-Length: 88292 Connection: keep-alive Vary: Accept-Encoding, Cookie Cache-Control: max-age=3600, public X-UA-Compatible: IE=edge Content-language: en X-Content-Type-Options: nosniff X-Frame-Options: SAMEORIGIN Expires: Sun, 19 Nov 1978 05:00:00 GMT Last-Modified: Wed, 27 Jun 2018 14:15:03 GMT ETag: W/"1530108903" X-Backend-Server: drupal-69955bbf6d-7m8n5 Age: 0 Varnish-Cache: HIT X-Cache-Hits: 1 X-Served-By: varnish-1 Accept-Ranges: bytes ...

Core Durable Goods Slump In May As Capital Spending Proxy Disappoints | Zero Hedge Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)