Diamond News Archives

- Category: News Archives

- Hits: 1166

(IDEX Online News) – Round diamonds saw relatively few changes in August. There were increases in 0.23-0.29 carat stones in E-I, VS2 of 2-3%, and in diamonds of 0.80-0.89 carats, D, VVS1-VS1, and I, SI1-SI3.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?> There were notable decreases in diamonds of 0.30-0.39 carats, D, I-F, VVS2, of 2-3%, and in several categories of 0.40-0.44 carat stones, 0.90-0.99 carats, M-N, IF-VVS1, of 3-4%, and especially in 2.00-2.99 carat diamonds of 2-3% in G-J, SI1+, as well as in a range of stones of 3.00 to 3.99 carats. Fancy diamonds also saw relatively few changes. There were some increases in the 0.70-0.79 carat category, F-I, VVS2-VS2 of 2-3%, and of 2-3% in I-J, IF-VVS1, in 0.90-0.99 carat diamonds, and a range of increases in the 3.00-3.99-carat range. Meanwhile, there were decreases of 2-3% in 0.30 to 0.39 carat stones in the D-H, VVS1-SI2 range; declines of 2-3% in 0.40-0.44 carat diamonds, E-F, IF-VS2; decreases of 2-3% in 0.70 to 0.79 carat stones, D-I, IF-VVS1; in some categories of 1.00-1.24 carat diamonds; in 1.50-1.99 carat stones, K-L, IF-VVS1; and 2.00-2.99 carat stones, G-J, IF. The following are some of the changes in this week's IDEX Online Diamond Price Report. To receive a free copy of the full IDEX Online Diamond Price Report, please email us at

(IDEX Online News) – Round diamonds saw relatively few changes in August. There were increases in 0.23-0.29 carat stones in E-I, VS2 of 2-3%, and in diamonds of 0.80-0.89 carats, D, VVS1-VS1, and I, SI1-SI3.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?> There were notable decreases in diamonds of 0.30-0.39 carats, D, I-F, VVS2, of 2-3%, and in several categories of 0.40-0.44 carat stones, 0.90-0.99 carats, M-N, IF-VVS1, of 3-4%, and especially in 2.00-2.99 carat diamonds of 2-3% in G-J, SI1+, as well as in a range of stones of 3.00 to 3.99 carats. Fancy diamonds also saw relatively few changes. There were some increases in the 0.70-0.79 carat category, F-I, VVS2-VS2 of 2-3%, and of 2-3% in I-J, IF-VVS1, in 0.90-0.99 carat diamonds, and a range of increases in the 3.00-3.99-carat range. Meanwhile, there were decreases of 2-3% in 0.30 to 0.39 carat stones in the D-H, VVS1-SI2 range; declines of 2-3% in 0.40-0.44 carat diamonds, E-F, IF-VS2; decreases of 2-3% in 0.70 to 0.79 carat stones, D-I, IF-VVS1; in some categories of 1.00-1.24 carat diamonds; in 1.50-1.99 carat stones, K-L, IF-VVS1; and 2.00-2.99 carat stones, G-J, IF. The following are some of the changes in this week's IDEX Online Diamond Price Report. To receive a free copy of the full IDEX Online Diamond Price Report, please email us at - Category: News Archives

- Hits: 1186

Gold moved higher overnight in a range of $1198.70 - $1209.15. After ticking down to its low during early Asian hours, gold climbed higher against weakness in the dollar (DX from 94.77 – 94.54).

The DX was pressured by strength in the yen (111.05 – 110.68, uptick in Japan’s Core CPI), the yuan (6.835 – 6.8245, stronger than expected Chinese PMI), and by a rebound in some emerging market currencies (Turkish lira from 6.785 – 6.49, Turkey waives a tax on lira savings, Russian rouble from 68.25 – 67.80).

Weaker global equities aided gold’s climb with the NIKKEI -0.1%, the SCI of 0.55, Eurozone shares were down from 0.5% to 1.1%, and S&P futures were -0.2%. Comments from Trump late yesterday rejecting an EU deal to scrap tariffs on cars, and threatening to pull out of the WTO along with weaker oil prices (WTI from $70.15 - $60.64) contributed to the softness in stocks.

Just before the NY open, reports emerged that US-Canadian talks had stalled, and a deal won’t be reached by today (the unofficial deadline), with a rumor that Trump said the US proposal is “going to so insulting that they’re not going to be able to make a deal”. S&P futures sold off (-7 to 2895) and the US 10-year bond yield sank to 2.8833%. The Canadian dollar tumbled (1.30 – 1.3071), and the DX shot up to 94.97. Gold sold off, but found support just in front of $1200.

Later in the morning, stronger than expected reports on the Chicago PMI (63.5 vs. exp. 63) and the University of Michigan Consumer Sentiment Index (96.2 vs. exp. 95.5) helped US stocks pare losses (S&P -7 to 2907), and pushed the 10-year yield up to 2.848%. The DX drove higher, also fueled...

- Category: News Archives

- Hits: 1316

WASHINGTON (Reuters) - U.S. federal regulators on Wednesday ordered BNP Paribas (BNPP.PA[1]) to pay a $90 million civil penalty after settling charges against BNP Paribas Securities Corp [BNPPSS.UL] for attempted manipulation of the ISDAfix benchmark.

A BNP Paribas logo is seen outside a bank office in Paris, France, August 6, 2018. REUTERS/Regis Duvignau/File Photo

Companies and investors use ISDAfix to price swaps transactions, commercial real estate mortgages and structured debt securities.

The Commodity Futures Trading Commission order found that BNP Paribas attempted to manipulate the benchmark to benefit its derivatives positions in instruments and that the conduct involved multiple traders and included supervisors, it said in a statement.

From 2007 to 2012, the CFTC said the bank attempted to manipulate the benchmark rate by deliberately trading to move it in a direction at the precise time it was being set. The CFTC also said the bank submitted false pricing reports to further sway the benchmark in a profitable direction.

“We accept the fine of $90m imposed by the CFTC and are pleased to have resolved this investigation regarding past conduct,” the bank said in a statement.

The CFTC said in its statement the bank cooperated with its investigation and pursued “significant remedial action” to address issues with its internal controls.

The BNP settlement is the latest in a series of settlements large banks have struck with regulators over the rigging of market benchmarks. The CFTC said Wednesday’s settlement with BNP was its seventh enforcement action relating to the U.S. dollar ISDAfix alone.

“We won’t stop until all wrongdoers are held accountable — no matter how broadly the misconduct stretches across the industry,” said...

- Category: News Archives

- Hits: 1127

By Rajendra Jadhav and Sumita Layek

MUMBAI/BENGALURU (Reuters) - Physical gold demand in India was moderate this week amid an improvement in retail purchases before the festival season despite an increase in domestic prices, while top consumer China saw a slight uptick in activity.

In the Indian market, gold futures were trading around 30,272 rupees per 10 grams on Friday, up about 3.7 percent from a more than seven-month low touched on Aug. 17.

The price gains came amid a plunge in the rupee, which fell to a record low against the dollar on Friday.

"Retail buying has picked up in the last few weeks except in Kerala. Demand will remain there for next few weeks unless prices shoot up further," said Aditya Pethe, a director at Waman Hari Pethe Jewellers.

India's top bullion consuming southern state of Kerala was hit by the worst flooding in a century this month, which killed hundreds and caused widespread damage.

Demand in the country is expected to pick up further in the festival season beginning in September, when buying gold is considered auspicious.

Dealers in India were charging a premium of up to $1 an ounce over official domestic prices this week, compared to a premium of $1.25 the last week.

But jewellers who had been aggressively replenishing stocks as prices fell in August were now slowing their purchases.

"Jewellers are cutting purchases ... They think the rupee could recover and local prices could fall again," said a Mumbai-based dealer with a private bank.

In China, premiums were around $6 to $7 an ounce this week, versus the $6 to $8 range last week, amid currency fluctuations, traders said.

"Jewellery wholesalers (in China) have begun stocking up physical inventories, while...

- Category: News Archives

- Hits: 1229

Bloomberg News

The price of the large yellow diamond alternately shrank and spiked by about a million dollars as it moved across the globe.

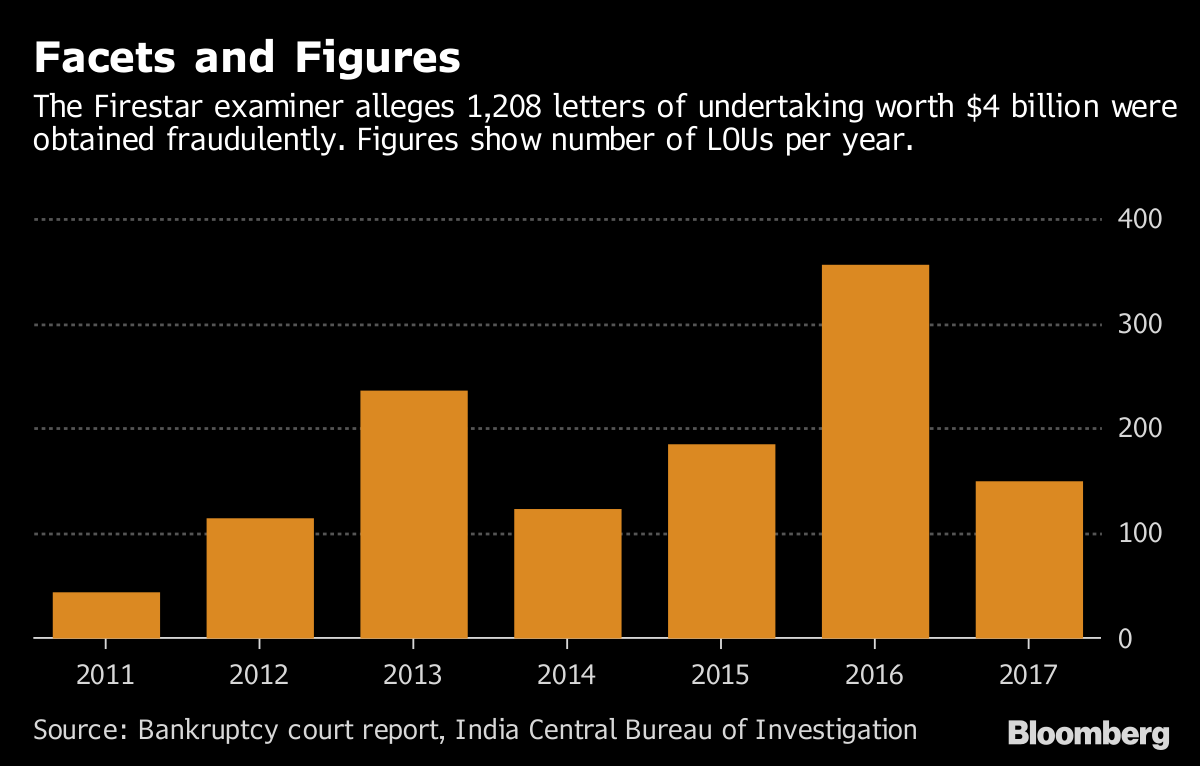

The three-carat gem was shipped at least four times between shadowy companies allegedly controlled by Indian billionaire Nirav Modi over about five weeks in 2011, according to a report by a U.S. bankruptcy examiner. The practice of round-tripping–trading a good repeatedly to give the appearance of distinct transactions–was central to the largest bank fraud in Indian history and ensuing criminal charges against celebrity jeweler Modi, according to the report filed Aug. 25.

The rapid-fire sales were described as part of a plan in which Modi and associates fraudulently borrowed approximately $4 billion over a period of years by manufacturing sham transactions purportedly to ‘import’ diamonds

and other gems into India using a web of more than 20 secretly controlled shell entities,” wrote John J. Carney, the examiner in the bankruptcy case of three U.S. jewelry companies indirectly owned by Modi.

The firms sought protection from creditors in February in New York as the celebrity jeweler’s empire unraveled. Authorities brought criminal charges against him and alleged accomplices, and Modi became an international fugitive. He’s denied doing anything wrong.

The “fancy vivid yellow orange cushion cut” diamond was first sold by Firestar Diamond Inc., a U.S. company indirectly owned by Modi, and shipped to Fancy Creations Company Ltd., a foreign shell company in Hong Kong also allegedly controlled by Modi, in August 2011, the report says. The price was almost $1.1 million.

The colorful stone was then shipped out two weeks later by Solar Export, a partnership formed by the Nirav Modi family trust, back to Firestar Diamond in the U.S., for closer to what...