Diamond News Archives

- Category: News Archives

- Hits: 1322

We casually refer to “the stock market” all the time. And whatever the Dow Jones, the S&P 500, and the Nasdaq are doing is generally accepted as how “the market” is doing.

But there are about 3,600 publicly traded stocks between then NYSE and the Nasdaq. Drilling deeper into market internals tells us what the market is really made of, the true structure and state of its underlying integrity, as opposed to the cursory snapshot that the indices provide.

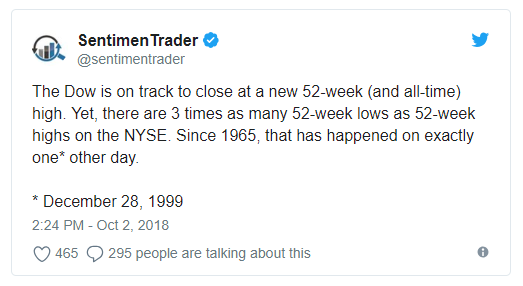

So how well is a market really doing when three times as many stocks are trading at their lowest levels in a year as compared to those trading at 52-week highs?

There have been two days since 1965 have seen 3x as many NYSE stocks at year-lows than at year-highs while the Dow traded at an all-time high.

The only other time prior to October 3, 2018?

December 28, 1999. The Dow was just days prior to hitting 11,722 on January 10, 2000, which would mark its long-term top. It would bottom at 8,062 on September 21, 2001. A 32% decline. The Nasdaq lost over 60% of its value during that same period, and would decline 78% from its all-time high.

And now this oddity has occurred again. And one of the major forces driving it is the massive rise in index investing:

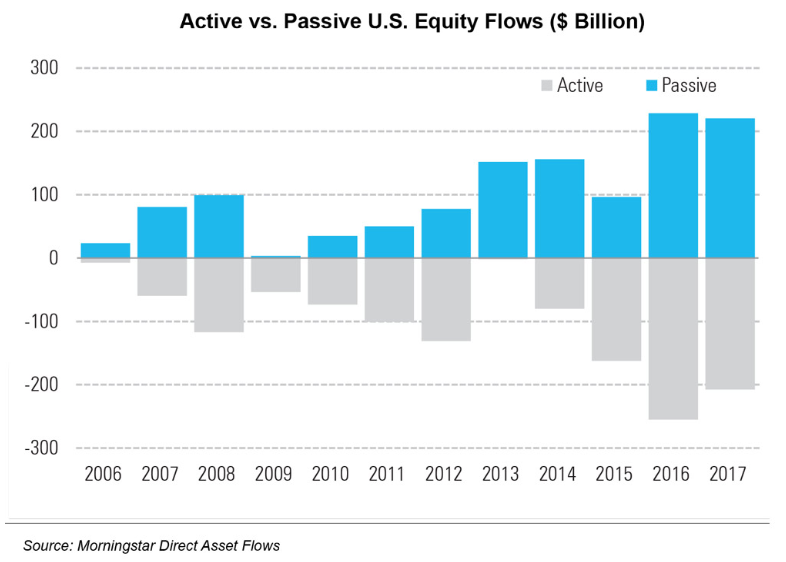

As investors started to realize that they were getting fleeced paying for active management of mutual funds that routinely underperformed super-low-fee index funds, there was a sea change in individual investor behavior, as seen in the above chart.

The mechanics of that are important. Take the huge inflows that have moved into S&P 500 Index funds. That means that 500 individual stocks have seen blind, persistent...

- Category: News Archives

- Hits: 1299

(IDEX Online) – The Bharat Diamond Bourse (BDB) is gearing up for the opening of the second edition of the Bharat Diamond Week on Monday. The October 8-10 polished diamond fair will be opened by Mr Andrei Zhiltsov, Consul General of the Russian Federation in Mumbai, and Mr Evgeny Agureev, Director of ALROSA's United Selling Organisation.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

"We are delighted that the Consul General and Mr Agureev," have graciously agreed to join us for the ceremonial opening of the diamond show," said BDB Vice-President Mehul Shah, who heads the Bharat Diamond Week project. "ALROSA is an extremely important supplier of rough goods to the Indian diamond industry, which is by far the world's largest diamond manufacturing centre."

BDB President Anoop Mehta said: "It is not by chance that the second edition of the Bharat Diamond Week is to be opened by these important gentlemen. India is the largest purchaser of Russian goods which are critical for Indian manufacturers. We have excellent relations with Russia, and especially with ALROSA which recognises the importance of the Indian diamond market."

He added that the finishing touches were being put to the diamond fair where 120 Indian polished diamonds companies will be exhibiting a wide range of goods in all shapes, colours and sizes. The BDB has provided 100 free flight tickets for selected buyers to create more sales opportunities for the exhibitors. The buyers who have been selected are from Turkey, Thailand and India. The bourse will also be providing 150 rooms for international buyers at a hotel close to the BDB. More than 750 visitors from India and overseas have already registered for the show....

- Category: News Archives

- Hits: 1164

(IDEX Online) – The Diamond Producers Association (DPA), an international alliance of the world's leading diamond mining companies, has launched its integrated marketing campaign ‘Real is Rare’ in India in the Telugu language.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

The ‘Real is Rare’ campaign focuses on celebrating the precious moments which mark the journey of a relationship between a couple. Following comprehensive research, DPA arrived at a key insight – while couples tend to celebrate anniversaries and birthdays as milestones, there are other unrecognized moments of bonding and intimacy that form the foundation of their relationship.

These moments are unique and rare to each couple and deserve to be acknowledged. Taking inspiration from these real stories, DPA’s “Real is Rare. Real is A Diamond” campaign offers a compelling narrative by recreating such relatable moments between a couple.

Featuring Telugu cinema actor and winner of Bigg Boss Telugu season one, Siva Balaji, and his wife Madhumita, the commercial presents love as being a true partnership, marking the real promise a couple makes to each other. For maximum impact, the commercial will be promoted across TV, social and digital platforms.

Commenting on the campaign launch Richa Singh, Managing Director, Diamond Producers Association, India, said: “There are certain defining moments in every relationship that make a couple’s journey unique. Through our “Real is Rare” campaign, we want diamonds symbolize the successful transformation of this partnership. We are happy to associate with Siva Balaji and Madhumita who have beautifully captured the essence of rare and real life moments.”

Recently, DPA also collaborated with renowned actor and VJ Rio Raj and his wife Shruti...

- Category: News Archives

- Hits: 1162

Rio Tinto has revealed its 2018 Argyle Pink Diamonds Tender in New York to collectors, connoiseurs and those in search of the incomparable, including the Argyle Muse , the largest purplish red diamond ever offered at Tender.

, the largest purplish red diamond ever offered at Tender.

Rio Tinto's Argyle mine is the world's only consistent source of rare pink, red and violet diamonds and the 2018 Argyle Pink Diamonds Tender is named 'Magnificent Argyle' in honour of Argyle's role in charting the history of the world's most coveted diamonds.

Rio Tinto Copper & Diamonds chief executive Arnaud Soirat said "I am delighted to be in New York, the epicentre for rare fancy coloured diamond collectors and a key market for Rio Tinto's Argyle diamonds.

"This is our 34th Argyle Pink Diamonds Tender and the potency of colours in this collection is a testament to the extraordinary Argyle ore body – rare fancy coloured diamonds, created and limited by nature.

"The combination of strong demand and extremely limited world supply continues to support significant value appreciation for these stunning diamonds."

The 63 diamonds in the 2018 Argyle Pink Diamonds Tender weigh a total of 51.48 carats – including five Fancy Red diamonds, two Purplish Red diamonds and three Violet diamonds.

The collection comprises six 'hero' diamonds selected for their unique beauty and named to ensure there is a permanent record of their contribution to the history of the world's most important diamonds....

- Lot 1: Argyle Muse

, 2.28 carat oval shaped Fancy Purplish Red diamond

, 2.28 carat oval shaped Fancy Purplish Red diamond - Lot 2: Argyle Alpha

, 3.14 carat emerald shaped Fancy Vivid Purplish Pink diamond

, 3.14 carat emerald shaped Fancy Vivid Purplish Pink diamond - Lot 3: Argyle Maestro

, 1.29 carat square radiant shaped Fancy Vivid Purplish Pink diamond

, 1.29 carat square radiant shaped Fancy Vivid Purplish Pink diamond - Lot 4: Argyle Alchemy

, 1.57 carat princess

, 1.57 carat princess

- Category: News Archives

- Hits: 1327

The President. The Senate. The House. Their silence on the issue tells you all you need to know.

Forget any semblance of fiscal responsibility. Washington has completely given up on bare-bones fiscal sanity.

What would you call a ceiling that has been that demolished four times? Surrounded by the assorted rubble, you wouldn’t feel the raindrops on your head, see the storm clouds gathering, and think “Hmm, what’s wrong with the ceiling?” You’d think, “Damn. There’s nothing there.”

And there isn’t. Between the absurdist mock-constraint of a debt “ceiling” that everyone knows can be ignored and the overheated faux-panic about “government shutdowns” (which don’t seem to affect much of anything, even when they happen), there is literally nothing stopping politicians from debt spending at will except, well, their will.

Since the Tea Party came to a quiet and undistinguished end, paying any attention to government spending has gone far out of fashion.

And why not? We have a president who, after promising to not just balance the budget, but pay off the entire existing US debt balance[1], is on pace to add more debt in just four years than even Obama did in eight[2]. And Obama added an eye-watering $8.5T!

This is not a partisan issue. Without looking at the dates along the x-axis, see if you can tell the difference in fiscal policy between the Obama administration and the Trump administration:

No difference. It doesn’t matter what politicians say, because they all do the same thing. Spend money they don’t have in a desperate attempt to make halfway good on promises some previous president made. Their non-solution solution is always the same. Their answer to bad debt is more...