Diamond News Archives

- Category: News Archives

- Hits: 910

The U.S. Federal Trade Commission, which investigates allegations of deceptive advertising, said on Tuesday that it has sent warning letters to eight companies to insist that they distinguish in advertisements between diamonds that come from mines and those made in laboratories.

The FTC said that it had found instances where the eight companies advertised diamond jewelry "without clearly and conspicuously disclosing that the diamonds are laboratory-created," according to the letter.

The agency declined to identify the recipients of the letters. An unredacted version of one of the letters seen by Reuters identified that recipient as Diamond Foundry, a California company that makes laboratory diamonds. The FTC said that it had found instances where eight companies advertised diamond jewelry "without clearly and conspicuously disclosing that the diamonds are laboratory-created"

Diamond Foundry declined to discuss whether the letter would lead to changes in its marketing. "We pride ourselves on being a lab grown diamond producer and this point of differentiation is what our success is built on," CEO Martin Roscheisen said in an emailed statement.

Analysts say increased production of laboratory-grown diamonds will lower the price of the stones.

The Diamond Producers Association (DPA), which represents mining companies like De Beers, Rio Tinto and Alrosa , welcomed the FTC insistence that companies distinguish between diamonds that are mined and those that are made in laboratories.

"The DPA has for several months expressed serious concerns about misleading marketing communication and unsubstantiated eco claims coming from many laboratory grown diamond marketers," said DPA Chief Executive Jean-Marc Lieberherr.

De Beers, a unit of Anglo American, said it was pleased by the move, adding the two kinds of diamonds were "distinct product categories."

De Beers has responded to pressure from lab diamonds by tearing up its decades-old...

- Category: News Archives

- Hits: 1086

Usually around the middle of February each year, the US Treasury Department releases an annual report of the federal government’s financial condition.

It’s called the Financial Report of the US Government… and it looks a lot like an annual report that you might see filed by a big company like Apple or Facebook.

Except that, unlike Apple and Facebook, the US government’s annual report is absolutely gruesome.

This year’s report is no exception, save for one humorous anecdote: they -just- released it. In other words, they’re a month and a half LATE (given that the report is typically released in mid-February).

I actually CALLED the Treasury Department myself in early March, asking when they would publish the report.

The bewildered individual on the other end of the line said that he had no earthly idea, given that the government had been shut down for so long earlier this year.

Anyhow, if you want to see the report for yourself, you can download it here[1].

But I thought I would take the liberty of providing a few highlights–

In Fiscal Year 2018, the government’s total net loss was $1.16 TRILLION.

Uncle Sam collected $3.4 trillion in tax revenue in FY18. But they spent over $4.5 trillion.

Of that $4.5 trillion spent, nearly HALF went to Social Security and Medicare. (They also spent a record $523 billion just on interest payments on the national debt!)

This is extraordinary given that the Social Security and Medicare trust funds are set to run out of money within the next 15 years.

In other words, despite spending almost HALF the federal budget on Social Security and Medicare, both programs are effectively insolvent.

As a...

- Category: News Archives

- Hits: 993

The American department store JCPenney is struggling to overcome its financial and organizational troubles and is closing 27 of its 860 stores in 2019.

In an interview published by TODAY Style, the department store's spokesperson, Carter C. English said: "As part of a standard annual review, the decision was made to close 18 stores across the country, including the three previously announced stores in early January." In addition, nine home and furniture stores will close this fall, bringing the total to 27.

JCPenney, an iconic American department store, was founded 116 years ago. It made the decision to close the 27 stores following decreasing sales. In 2018, sales plummeted 7.1 percent, resulting in a loss of $255 million for the fiscal year.

...

- Category: News Archives

- Hits: 902

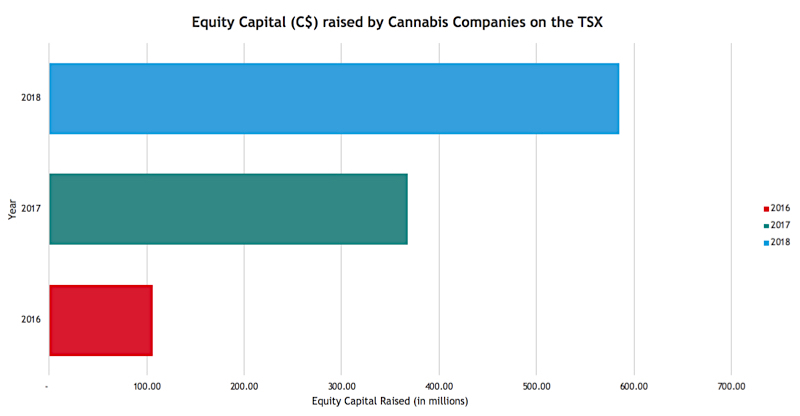

A burgeoning interest in Canada’s emerging cannabis sector, which spiked after recreational use of marijuana was legalized in October, is sucking investment capital away from the mining sector, and hitting juniors hardest, a new study shows.

According to BDO's Sherif Andrawes, investments in Canadian cannabis companies increased from C$43 million to C$770 million from the first half of 2016 to the same period in 2017, a massive surge year-on-year. In contrast, total mining companies listed on the Toronto Stock Exchange and TSX-V dropped 25% from 2017 to 2018.

The booming cannabis industry is sucking investment away from mining, and hitting juniors hardest

“Industry investors traditionally attracted to the junior mining space now have a secondary option. Valuations are higher and forecast demand for the product is being touted in the billions,” the report reads.

The analyst found that financing for juniors has decreased by 58% for those listed in the TSX and 23% for TSX-V from 2017-2018.

The main problem, Andrawes says, is that investing in mining exploration faces the risk of demand ultimately outstripping supply, with the consequent price spikes and market volatility. Forecast consumption of metals in a world driven by the electrification of industries will inevitably go up, the report notes. But without junior miners being able to secure the right capital, the industry “will forever be stuck in the boom-bust cycle,” BDO warns.

Source: BDO.

While spending in exploration has increased in the past two years, it has been focused on brownfield projects, also known as near-mine assets, located in areas where mineral deposits have been previously discovered.

Struggling to find investors

“Raising money is extremely difficult,” Patrick Downey, head of Canadian junior gold exploration company...

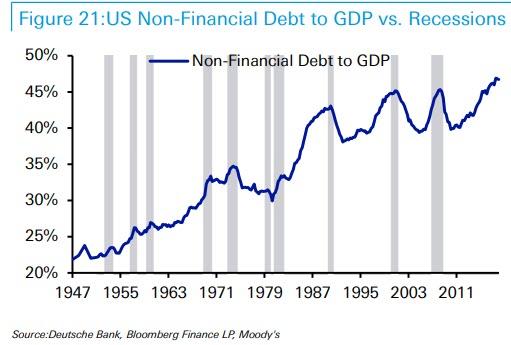

The Coming Credit Meltdown Will Be As Bad As The Great Depression And The Financial Crisis: Deutsche

- Category: News Archives

- Hits: 862

HTTP/2 200 server: nginx date: Tue, 02 Apr 2019 20:00:04 GMT content-type: text/html; charset=UTF-8 content-length: 63739 vary: Accept-Encoding, Cookie cache-control: max-age=3600, public x-ua-compatible: IE=edge content-language: en x-content-type-options: nosniff x-frame-options: SAMEORIGIN expires: Sun, 19 Nov 1978 05:00:00 GMT last-modified: Tue, 02 Apr 2019 20:00:01 GMT etag: W/"1554235201" x-backend-server: drupal-54c498cf8-wbxvg age: 3 varnish-cache: HIT x-cache-hits: 7 x-served-by: varnish-1 accept-ranges: bytes ...

The Coming Credit Meltdown Will Be As Bad As The Great Depression And The Financial Crisis: Deutsche | Zero Hedge Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)