A burgeoning interest in Canada’s emerging cannabis sector, which spiked after recreational use of marijuana was legalized in October, is sucking investment capital away from the mining sector, and hitting juniors hardest, a new study shows.

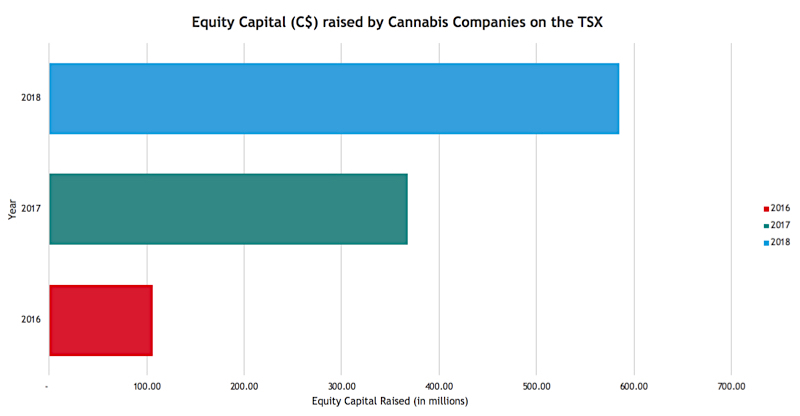

According to BDO's Sherif Andrawes, investments in Canadian cannabis companies increased from C$43 million to C$770 million from the first half of 2016 to the same period in 2017, a massive surge year-on-year. In contrast, total mining companies listed on the Toronto Stock Exchange and TSX-V dropped 25% from 2017 to 2018.

The booming cannabis industry is sucking investment away from mining, and hitting juniors hardest

“Industry investors traditionally attracted to the junior mining space now have a secondary option. Valuations are higher and forecast demand for the product is being touted in the billions,” the report reads.

The analyst found that financing for juniors has decreased by 58% for those listed in the TSX and 23% for TSX-V from 2017-2018.

The main problem, Andrawes says, is that investing in mining exploration faces the risk of demand ultimately outstripping supply, with the consequent price spikes and market volatility. Forecast consumption of metals in a world driven by the electrification of industries will inevitably go up, the report notes. But without junior miners being able to secure the right capital, the industry “will forever be stuck in the boom-bust cycle,” BDO warns.

Source: BDO.

While spending in exploration has increased in the past two years, it has been focused on brownfield projects, also known as near-mine assets, located in areas where mineral deposits have been previously discovered.

Struggling to find investors

“Raising money is extremely difficult,” Patrick Downey, head of Canadian junior gold exploration company...