Diamond News Archives

- Category: News Archives

- Hits: 877

HTTP/2 200 server: nginx date: Fri, 26 Apr 2019 16:00:03 GMT content-type: text/html; charset=UTF-8 content-length: 54281 vary: Accept-Encoding, Cookie cache-control: max-age=3600, public x-ua-compatible: IE=edge content-language: en x-content-type-options: nosniff x-frame-options: SAMEORIGIN expires: Sun, 19 Nov 1978 05:00:00 GMT last-modified: Fri, 26 Apr 2019 16:00:02 GMT etag: W/"1556294402" x-backend-server: drupal-c7d5497d5-h5lf2 age: 1 varnish-cache: HIT x-cache-hits: 3 x-served-by: varnish-1 accept-ranges: bytes ...

Q1 GDP Smashes Expectations, Soars 3.2%, But The Real Story Is Below The Surface | Zero Hedge Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)

- Category: News Archives

- Hits: 938

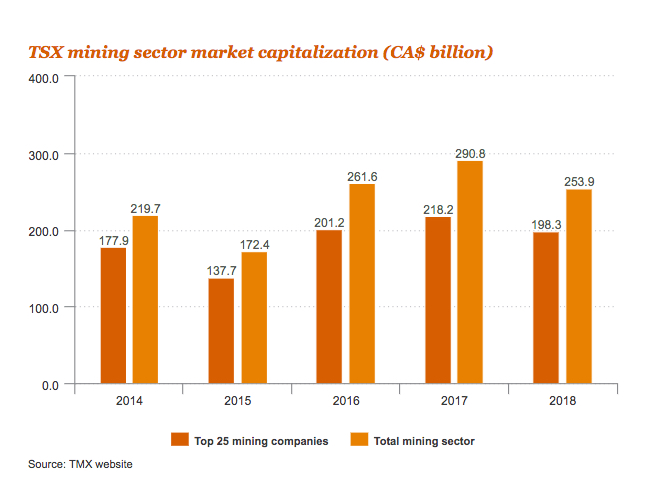

Despite unfavourable market conditions, the mining industry is staging a comeback thanks to highly publicized multi-billion mergers and acquisitions targeting mostly the gold sector.

The aggregate valuation of all miners listed on the Toronto Stock Exchange (TSX) declined by 12.7% in 2018, to $253.9 billion, compared with a 10.8% decrease in the market capitalization of the entire TSX market, says PwC in its Canadian Mine report published Thursday.

Liquidity also fell for the second year in a row, with the volume and value of TSX mining shares trading down by 21% and 20%, respectively.

Taken from: Canadian Mine 2019: Shifting Ground.

Performance was hampered by a downward shift in most commodity prices, following a strong showing in 2017, the report reads:

Spot prices for base and precious metals decreased across the board. Zinc tumbled 25%, copper 17% and nickel 6%. Even cobalt and lithium prices, which have registered strong gains over the past five years, suffered double-digit declines in 2018.

However, Dean Braunsteiner, PwC Canada National Mining Leader, believes 2018 marked a turning point for the mining industry.

“While recent mergers were a sign of a wave of consolidation that will help companies better compete for capital, we can expect even more M&A activity in the near future,” Braunsteiner says. “That creates a cascading effect of further deals as companies sell off non-core assets, which brings new opportunities for management teams to build the next big Canadian mining company.”

After years of speculation around how the sector could regain power, followed by a period of internal restructuring, companies are now focusing on opportunities, PwC Canadian Mine report states.

Growth was heavily powered by potash and gold. Nutrien overshadowed the top...

- Category: News Archives

- Hits: 967

The following is an excerpt from a recent weekly market comment featured in The Felder Report PREMIUM[1].

“Somehow we need to go to an economy that is using its resources, operating at full employment, but doing so in a way that isn’t reliant on bubbles.” –Janet Yellen

This quote, uttered before she became Fed chair, is worth studying for at least a couple of reasons. First, because it demonstrates just how easy it is to see the problem from a distance and also how difficult it becomes to address once you become deeply involved with it. And second, because it underscores the limitations of monetary policy and the fact that central bankers, even though they are cognizant of these limitations, continue to try to defy them.

As my friend Dr. John Hussman adroitly discussed last week, “Extraordinary monetary policy has one function, and it is to amplify yield-seeking speculation when investors are inclined to speculate. That and that alone, is how quantitative easing has impacted the economy in recent years.”

'Extraordinary monetary policy has one function, and it is to amplify yield-seeking speculation when investors are inclined to speculate. That and that alone, is how quantitative easing has impacted the economy in recent years.' –@hussmanjp https://t.co/ygTi3QudiB pic.twitter.com/B9vC5uBz9K[2][3][4]

— Jesse Felder (@jessefelder) April 8, 2019[5]

The Fed influences the financial markets by controlling short-term interest rates, via the Fed Funds rate, and the supply of risk-free securities, via Quantitative Easing. When they took the former to zero for the better part of a decade it inspired investors to reach for yield they could no longer get from a savings account or something similar....

- Category: News Archives

- Hits: 804

Russian state-controlled miner Alrosa, the world's biggest producer of rough diamonds in terms of carats, expects a drop in its sales in 2019 due to weaker demand for polished diamonds from China, a senior company official told Reuters.

"We will not reach last year's sales number," Evgeniy Agureev, director of sales for Alrosa, said late on Wednesday.

The company's sales in 2018 rose 6 percent from the previous year to $4.5 billion but the trend has changed, he said.

Alrosa's sales in the first quarter fell 38 percent from a year earlier to $988 million, Agureev said, and in the second quarter sales are likely to hold near the first-quarter level.

The trade war between the U.S. and China has been cutting into polished diamond sales in China, said Agureev, who was in India this week to meet customers.

China is the world's second-biggest diamond market after the United States.

The trade war between the U.S. and China has been cutting into polished diamond sales in China

Demand for polished diamonds during China's Lunar New Year was also subdued and sales in 2019 are likely to be lower than a year ago, Agureev said.

Retail sales growth overall during the Lunar New Year holidays slipped to its lowest since at least 2011.

Leading diamond miners, however, have been cutting production, and that will help support rough prices during the rest of the year, he said.

India's diamond industry, which cuts and polishes 90 percent of the gems sold globally, curtailed rough diamond purchases in the first quarter of 2019 to make balance sheet adjustments before the closing of their financial years, Agureev said.

India's financial year runs from April to March.

Indian diamond companies could...

- Category: News Archives

- Hits: 830

I wrote to silver last week, and she answered back. I'd like to share our correspondence with you…

Dear Silver,

I’m a big fan. You offer so many important benefits to an investor, and at such a low price. You’re a permanent store of value. You’re nobody else’s liability, so I know when I buy you, I’m not relying on anyone else to live up to their end of the bargain in a crisis. You are available in sizes that make you affordable for everyone and have been used as money for thousands of years.

You’re the history and you’re the future. Which is why it’s amazing to me you’re so unappreciated in the present.

I’m incredibly excited that I get the opportunity to acquire all your powerful attributes at a 70% discount from your record high, set this day 8 years ago, especially when all the reasons I bought you at $40 are even more relevant today than back then. I fully understand the explosive potential you hold, but I have to admit, the wait can sometimes be frustrating.

Is your price weakness almost over, or is it here to stay?

Jeff Clark, devoted silver investor

Here's her polite response:

Dear Mr. Clark,

I understand your frustration. The past eight years have not been fun.

But I have good news for you and your fellow investors. Things will soon change – and when they do I can assure you that you will be very happy with me.

There are five things I would like you to know…

#1: I Am MONEY, No Matter What

Buy me in physical form and you get benefits most other assets don’t offer....

- I