Despite unfavourable market conditions, the mining industry is staging a comeback thanks to highly publicized multi-billion mergers and acquisitions targeting mostly the gold sector.

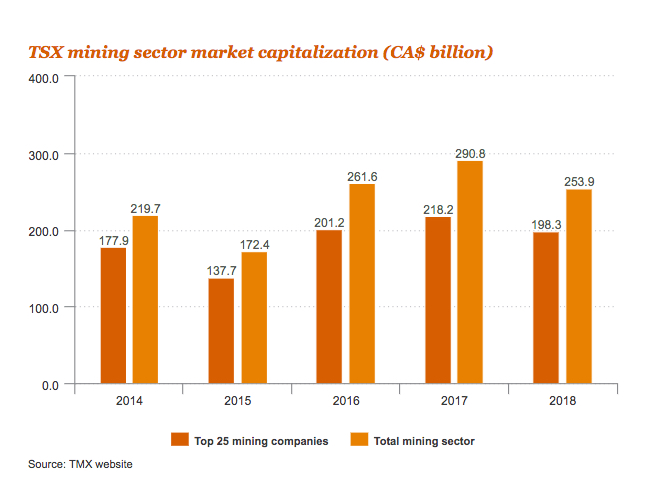

The aggregate valuation of all miners listed on the Toronto Stock Exchange (TSX) declined by 12.7% in 2018, to $253.9 billion, compared with a 10.8% decrease in the market capitalization of the entire TSX market, says PwC in its Canadian Mine report published Thursday.

Liquidity also fell for the second year in a row, with the volume and value of TSX mining shares trading down by 21% and 20%, respectively.

Taken from: Canadian Mine 2019: Shifting Ground.

Performance was hampered by a downward shift in most commodity prices, following a strong showing in 2017, the report reads:

Spot prices for base and precious metals decreased across the board. Zinc tumbled 25%, copper 17% and nickel 6%. Even cobalt and lithium prices, which have registered strong gains over the past five years, suffered double-digit declines in 2018.

However, Dean Braunsteiner, PwC Canada National Mining Leader, believes 2018 marked a turning point for the mining industry.

“While recent mergers were a sign of a wave of consolidation that will help companies better compete for capital, we can expect even more M&A activity in the near future,” Braunsteiner says. “That creates a cascading effect of further deals as companies sell off non-core assets, which brings new opportunities for management teams to build the next big Canadian mining company.”

After years of speculation around how the sector could regain power, followed by a period of internal restructuring, companies are now focusing on opportunities, PwC Canadian Mine report states.

Growth was heavily powered by potash and gold. Nutrien overshadowed the top...