Diamond News Archives

- Category: News Archives

- Hits: 841

HTTP/2 200 content-type: text/html; charset=utf-8 server: nginx/1.12.2 x-powered-by: Express x-request-id: 6af88fdc-e7cc-496b-a10d-1f3c60e41974 access-control-allow-origin: * x-aicache-os: 172.31.14.242:81 x-aicache-os: 34.234.2.131:80 cache-control: max-age=15 expires: Tue, 09 Jul 2019 20:00:19 GMT date: Tue, 09 Jul 2019 20:00:04 GMT set-cookie: region=USA; expires=Mon, 07-Oct-2019 20:00:04 GMT; path=/; domain=.cnbc.com vary: User-Agent ...

Fed chief will be 'Walking a tightrope over Niagara Falls'- Category: News Archives

- Hits: 893

- Category: News Archives

- Hits: 893

If you know where to look, the markets are telling you that they understand we’re moving into a new phase of US-dollar decay.

With the most recent dovish statement by Jerome Powell, the wheels have been set in motion for a fresh cycle of rate cuts. Going so far as to say he would do what it takes to “sustain the expansion[1]”, I believe the Fed chair is preparing the market for a series of cuts that will send the Fed rate to 0%. This is the best possible news for America’s worst companies.

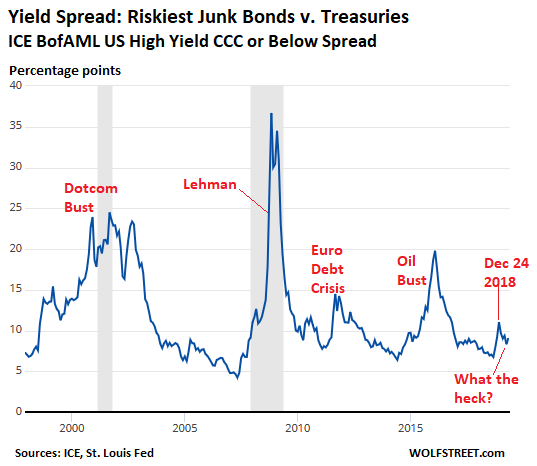

Junk bonds, the riskiest of all corporate bonds, should offer a significant percentage return to US Treasuries. As the chart below indicates, this is especially so when a recession comes into play.

It makes all the sense in the world when you learn that for the last 32 years, sub-investment-grade bonds, the junk rated CCC and lower, has defaulted at a spectacular 26.85% rate[2].

So we see that the spread between junk bonds and T-bills has soared during times of market crisis, maxing out at around 37% during the Lehman Brothers collapse.

So how is it that with 60% of National Association of Business Economics economists predicting US recession by 2020[3], a result that would be ordinarily be fatal to many if not most of the riskiest junk-bond-issuing companies, junk bonds on the whole are returning a mere 8% percent premium above the perceived global safe haven of US Treasuries?

Because while a free-market recession would indeed be fatal to heavily indebted, money-losing companies, a free market is not what we have. Even before he came out and told everyone it would happen[4], the bond...

- Category: News Archives

- Hits: 883

We’ve mentioned before that Jeff is occasionally asked to prepare reports for institutional investors. This summary of gold’s performance in the second quarter of 2019 was sent to various advisors and brokers. We thought we’d share with you what some institutional investors are reading. - Alexander Trigaux, Editor

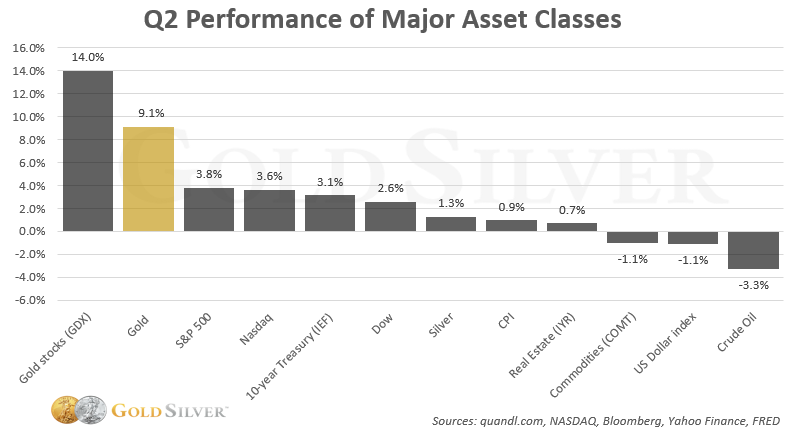

This report briefly examines the performance of gold and other major asset classes during the second quarter of 2019, along with YTD performances. We also highlight the conditions that could specifically impact the gold market going forward.

Q2-2019: Gold Price Breakout

Gold began the second quarter at $1,295 per ounce. The price was flat in April and May, then spiked in June due to the Fed‘s increasingly dovish stance, the conflict with Iran, and the ongoing US/China trade war. Gold ended the quarter up 8.8%.

Here is the performance of gold and other major assets classes in the second quarter (April through June).

Gold outperformed all major investment categories in Q2, including stocks, bonds, real estate, and commodities. Unsurprisingly, gold mining equities also had a strong second quarter. In contrast, the US dollar and an index benchmarked to a broad basket of commodities each fell 1.1%.

Here’s how the same investments have performed year-to-date.

Gold is up 9.9% for the year, besting commodities, Treasuries, and the US dollar. Common stocks remain in a bull market.

The gold price as measured in other currencies paints an even more striking picture. Notice where each ranked historically at the end of the second quarter.

In total, gold is now at or near all-time highs in 72 currencies. To put the importance of this in perspective, the US represents only 4% of the world’s population.

Unsurprisingly, gold’s volatility also spiked. The...

- Category: News Archives

- Hits: 803

ISTANBUL

The Swedish Central[1] Bank[2] and the Bank[3] of England carry out researches on whether they should start issuing Central[4] Bank[5] Digital Cash (CBDC) and compete with bank credit as a means of payment.

International Movement for[6] Monetary Reform-IMMR that operates in more than 30 countries gathered international[7] experts, central banks, researchers and banks to discuss the projects and proposals for[8] a sustainable money system as well as design of digital currencies on June 15.

Miguel Fernandez Ordonez- Former governor of Banco de España; Carl Andreas Claussen Senior Advisor, Central[9] bank of Sweden and Martijn van der Linden Professor of New Finance at The Hague University of Applied Science discussed the topic.

Dr. Artuğ Çetin, who also attended the conference explained the studies of European Central[10] Banks. "The system is producing Money and offering it as credit because today’s system is not working anymore. Today money volume is equal to credit volume. We’re only producing money by getting into debt. This is the main problem that creates financial crisis. This money system is overvaluing the prices of the assets. The overvalued assets create different crises: mortgage crisis, share crisis etc. Turkey is one of the potential countries that can change its money system and make its own money more valuable, especially in today’s situation as Turkey is in debt and its money lost value,” he said.

Europe, Central Bank, Economy, international movement for monetary reform[11][12][13][14]...