We’ve mentioned before that Jeff is occasionally asked to prepare reports for institutional investors. This summary of gold’s performance in the second quarter of 2019 was sent to various advisors and brokers. We thought we’d share with you what some institutional investors are reading. - Alexander Trigaux, Editor

This report briefly examines the performance of gold and other major asset classes during the second quarter of 2019, along with YTD performances. We also highlight the conditions that could specifically impact the gold market going forward.

Q2-2019: Gold Price Breakout

Gold began the second quarter at $1,295 per ounce. The price was flat in April and May, then spiked in June due to the Fed‘s increasingly dovish stance, the conflict with Iran, and the ongoing US/China trade war. Gold ended the quarter up 8.8%.

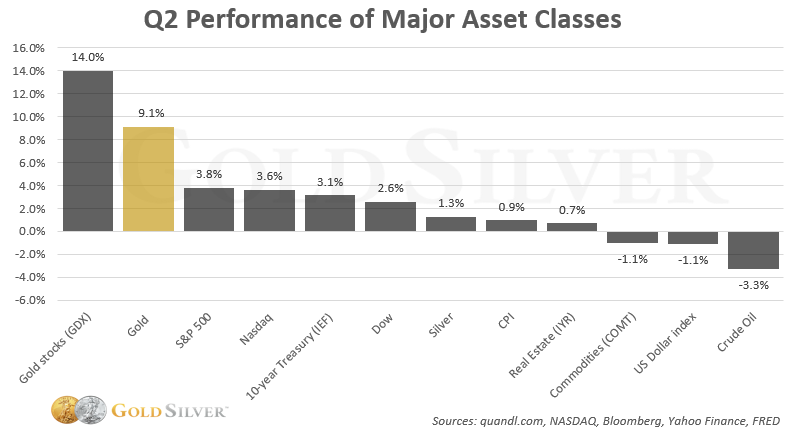

Here is the performance of gold and other major assets classes in the second quarter (April through June).

Gold outperformed all major investment categories in Q2, including stocks, bonds, real estate, and commodities. Unsurprisingly, gold mining equities also had a strong second quarter. In contrast, the US dollar and an index benchmarked to a broad basket of commodities each fell 1.1%.

Here’s how the same investments have performed year-to-date.

Gold is up 9.9% for the year, besting commodities, Treasuries, and the US dollar. Common stocks remain in a bull market.

The gold price as measured in other currencies paints an even more striking picture. Notice where each ranked historically at the end of the second quarter.

In total, gold is now at or near all-time highs in 72 currencies. To put the importance of this in perspective, the US represents only 4% of the world’s population.

Unsurprisingly, gold’s volatility also spiked. The...