If you know where to look, the markets are telling you that they understand we’re moving into a new phase of US-dollar decay.

With the most recent dovish statement by Jerome Powell, the wheels have been set in motion for a fresh cycle of rate cuts. Going so far as to say he would do what it takes to “sustain the expansion[1]”, I believe the Fed chair is preparing the market for a series of cuts that will send the Fed rate to 0%. This is the best possible news for America’s worst companies.

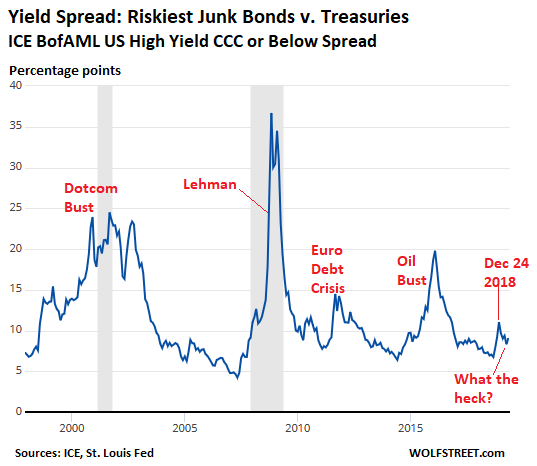

Junk bonds, the riskiest of all corporate bonds, should offer a significant percentage return to US Treasuries. As the chart below indicates, this is especially so when a recession comes into play.

It makes all the sense in the world when you learn that for the last 32 years, sub-investment-grade bonds, the junk rated CCC and lower, has defaulted at a spectacular 26.85% rate[2].

So we see that the spread between junk bonds and T-bills has soared during times of market crisis, maxing out at around 37% during the Lehman Brothers collapse.

So how is it that with 60% of National Association of Business Economics economists predicting US recession by 2020[3], a result that would be ordinarily be fatal to many if not most of the riskiest junk-bond-issuing companies, junk bonds on the whole are returning a mere 8% percent premium above the perceived global safe haven of US Treasuries?

Because while a free-market recession would indeed be fatal to heavily indebted, money-losing companies, a free market is not what we have. Even before he came out and told everyone it would happen[4], the bond...