Diamond News Archives

- Category: News Archives

- Hits: 806

Sorry about the blatant outright cliché in the title, but honestly, I just can’t think of a better way to describe the recent moves in US dollar implied volatility…

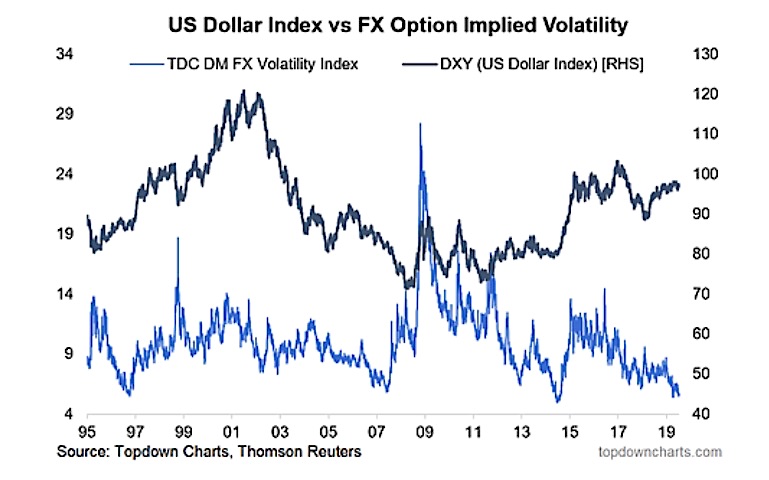

The chart below shows the US Dollar Index (CURRENCY: USD) versus our index for US dollar implied volatility, and the bottom line is that it has crunched down towards record lows in recent weeks.

This is quite rare, and something that has on a few occasions been a harbinger of a large move/turning point.

Specifically, the indicator takes an average of 1-month option implied volatility across 11 different developed market USD-XXX pairs. In other words, it gives an indication of the general level of implied volatility for the US dollar.

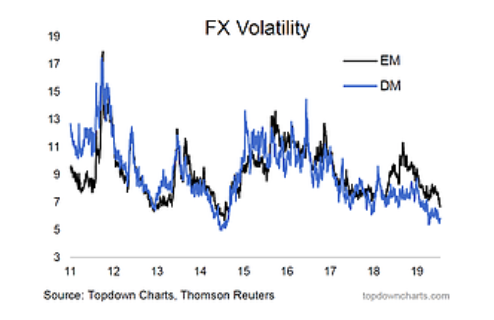

Just quickly, for those who might be interested, here’s the same kind of indicator, but for emerging markets (from the Global Cross Asset Market Monitor). It’s pretty much the same story for emerging markets: i.e. EMFX vs USD implied volatility has been crunching in too.

So what’s behind all this and why does it matter??

OK, so first of all, let’s look at how the US dollar has been trading…

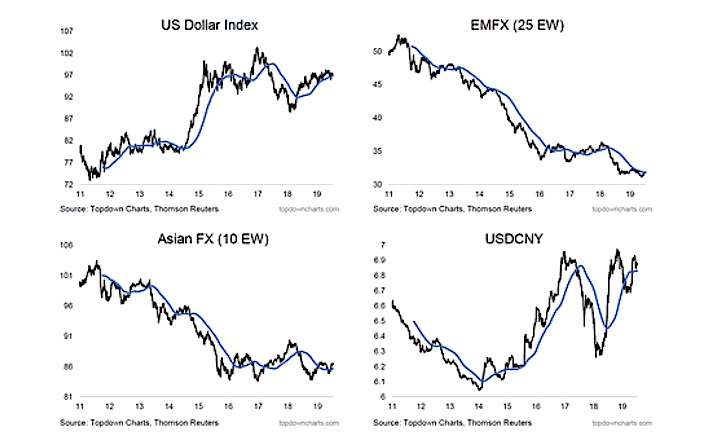

What’s the first thing you notice in the charts below?

If you said “nothing”, you’re basically on the money! The US dollar index (DXY) and my own equal weighted EMFX (emerging market currencies) index have been locked into a very tight trading range, with more than 1 false breakout showing up across those 4 key USD charts.

Implied volatility typically tracks closely with realized volatility – of which there is very little.

Historically this type of trading often precedes either a turning point, a large/violent move, or both....

- Category: News Archives

- Hits: 857

The first Israel Diamond Week in Shanghai, held July 16-18, ended "on a high note and is expected to become an annual event", the Israel Diamond Exchange (IDE) website reported..

Shanghai Diamond Exchange (SDE) President Qiang Lin hosted a delegation led by IDE President Yoram Dvash. More than 15 prominent Israeli diamond companies as well participated.

The event included an Israeli exhibition of diamonds in China, during which a memorandum of understanding for cooperation between the Chinese and Israeli Exchanges was signed at a festive ceremony. According to the IDE, SDE President Lin said that this is one of the most important events to be held at the SDE and that he was very happy to see such vitality and energy on their trade floor. Lin said that the event reminded him of the unique atmosphere that prevails on the IDE trade floor at the international diamond week in Israel and that he looks forward to further productive cooperation.

IDE President Dvash said: "In this situation, we must bring our Chinese partners closer with an aim to show the many advantages in working with members of the IDE, with emphasis on the benefits of the orderly regulatory environment in the country. Penetrating the Chinese market, as opposed to the American and European markets, is more complex and requires studying the target community and the challenges of local regulation. Precisely at complex interface points, the exchange is the only factor capable of opening trade relations to members and of becoming the coordinator between the Exchanges whilst providing services to its members".

Dvash also said that in Israel, the "Start-up Nation", many high-tech companies cooperate with Chinese companies, adding that the IDE believes in the...

- Category: News Archives

- Hits: 1662

HTTP/2 200 server: nginx date: Wed, 24 Jul 2019 20:00:04 GMT content-type: text/html; charset=UTF-8 content-length: 47129 vary: Accept-Encoding, Cookie cache-control: max-age=3600, public x-ua-compatible: IE=edge content-language: en x-content-type-options: nosniff x-frame-options: SAMEORIGIN expires: Sun, 19 Nov 1978 05:00:00 GMT last-modified: Wed, 24 Jul 2019 19:57:03 GMT etag: W/"1563998223" x-backend-server: drupal-69d5895487-vbqvf age: 180 varnish-cache: HIT x-cache-hits: 132 x-served-by: varnish-0 accept-ranges: bytes ...

Gundlach: Fed Will Be In "Panic Mode" When A Recession Hits | Zero Hedge s Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)

- Category: News Archives

- Hits: 847

Severalmaz, the Lomonosov mining and processing division of Alrosa, said that in the first half of this year, it had increased its production with 21 percent to more than 1.9 million carats of rough diamonds, 340,000 carats more than in the same period of 2018. In January-June, the Lomonosov mining and processing division mined 1.8 million tons of ore and processed almost 1.7 million tons.

More than 700 of rough diamonds larger than 10.8 carats (specials) were recovered. The largest of them were two gem-quality diamonds weighing 69 and 43 carats. The revenue of these individual stones can reach $200,000-300,000 per stone.

"In the first half of the year, we delivered good results in diamond mining due to the involvement of deeper horizons with higher diamond grades at both kimberlite pipes. The average diamond grade has increased by more than 25 percent to 1.13 carats per ton of ore compared to the first half of last year," commented Andrey Pismenny, CEO of Severalmaz. The share of Severalmaz's total output constitutes 10.9 percent of Alrosa's total production. ...

- Category: News Archives

- Hits: 1080

Central bankers across the world are set to fill up the proverbial punch bowl, but it may not juice stock markets much.

That’s according to a new strategy note from Deutsche Bank, which outlined what it expects major central banks around the world to do in the coming months.

| Central bank | Expected action |

| U.S. Federal Reserve | Three cuts in 2019 |

| European Central Bank | 10-basis-point cut in September and December, maybe more QE and “tiering” in September |

| Bank of Japan | On hold with no changes in target yields possibly into 2020 |

| Bank of England | No hikes until August 2020 |

| People’s Bank of China | To cut open market operations rate by 10 to 50 basis points, and one reserve requirement ratio cut |

| Emerging markets | Cuts coming in Russia, South Africa, Turkey, India, Indonesia, Philippines, Vietnam, Brazil and Chile |

Related: It’s the ECB’s turn to take a step toward further easing when it meets Thursday[1]

That should help limit slowing growth momentum, and Deutsche Bank sees world growth of around 3.2% this year. The monetary-policy actions, the Deutsche Bank strategists say, should allow for “cautious” near-term growth, as the central-bank easing counteracts political and trade headwinds.

Related: IMF cuts its global growth forecast again[2]

Equity markets already are pricing in a strong rebound in growth, limiting the potential for...