Diamond News Archives

- Category: News Archives

- Hits: 890

Petra Diamonds commented on the release of its share price performance for the financial year of 2019, saying it delivered "solid set of operational results for 2019," with improved safety, a production of 3.87 million carats - in line with guidance - and lower capital expenditure of $81.7 million, down from US$129.6 million in 2018

Petra generated $17 million of free cashflow in the second half of the year, after paying the interest on a bond of $23.6 million and repaying $20 million. "In other words, operating free cashflow for the second half of FY 2019 was over $60 million. This is a significant achievement given the current challenging market conditions in rough diamonds," Petra wrote in a statement.

Also, the update introduced Project 2022, an initiative that will identify and drive efficiencies and improvements across all aspects of the business to enable the miner to deliver an initial target of $150-200 million free cashflow over a three-year period.

"Project 2022 will focus on enhancing cashflow generation and reducing net debt to provide optionality to address the refinancing of the bond. The company is not considering raising equity to refinance the bond."

"Therefore the initial target of $150-$200 million of net free cashflow in the years 2020-2022 has potential upside in additional cash generation from improved rough diamond prices, a weakening in the Rand beyond the assumptions above and the continued recovery of exceptional diamonds from Cullinan," the statement said .

Petra said it has cash resources of $90 million together with a $70.4 million revolving credit facility and $35.2 million in working capital facilities. The firm emphasized that the miner "has the third largest global diamond resource - [reserves] in excess of 250...

- Category: News Archives

- Hits: 886

Ten years ago, at the peak of the global financial crisis, the Board of Trustees which oversees Social Security in the United States issued a stark warning:

They projected that Social Security’s enormous trust funds would completely run out of money in 2039.

Naturally nobody paid attention. Back in 2009 the economy in shambles, so focusing on a future economic crisis that was more than three decades away was a low priority.

And for the past decade, the US government has continued to ignore its Social Security problem.

But it’s become much worse.

Ten years later, the Board of Trustees now projects that Social Security’s primary trust fund will run out money in 2034.

That’s five years earlier than they projected back in 2009. And it’s only 15 years away.

Now, 15 years might seem like a long time. But take a minute to grasp the magnitude of this problem:

According to the US government’s own estimates, Social Security and Medicare combined are underfunded by $100 TRILLION.

$100 trillion is literally more than FIVE TIMES the size of the entire US economy. And this giant fiscal chasm is actually growing.

The big problem for Social Security is that tax revenue is no longer enough.

Every worker who is legally employed in the United States currently pays roughly 15% of his/her wages each month to help fund Social Security and pay benefits to retirees.

But there are now so many people receiving Social Security benefits that all the payroll tax revenue is no longer enough.

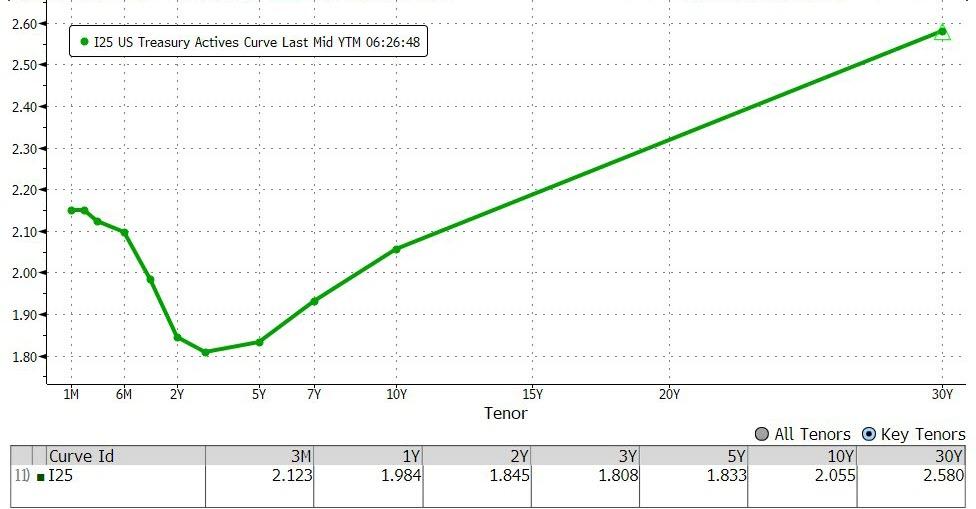

Social Security also derives a portion of the income it needs to pay benefits from the investment returns on its $3 trillion worth of assets.

Problem is– Social Security is...

- Category: News Archives

- Hits: 816

HTTP/2 200 server: nginx date: Tue, 30 Jul 2019 16:00:03 GMT content-type: text/html; charset=UTF-8 content-length: 59120 vary: Accept-Encoding, Cookie cache-control: max-age=3600, public x-ua-compatible: IE=edge content-language: en x-content-type-options: nosniff x-frame-options: SAMEORIGIN expires: Sun, 19 Nov 1978 05:00:00 GMT last-modified: Tue, 30 Jul 2019 15:55:01 GMT etag: W/"1564502101" x-backend-server: drupal-f8897688-wwlxt age: 302 varnish-cache: HIT x-cache-hits: 781 x-served-by: varnish-1 accept-ranges: bytes ...

Whalen Warns Of "Imminent Insolvency Of Large Industrial Nations" | Zero Hedge s Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)

- Category: News Archives

- Hits: 866

De Beers Group published the results of what it calls its "sixth sales cycle" of 2019.

The value of this month's sight stood at $250 million, a drop of more than 60 percent compared to the sixth sight of 2018 ($533). The miner reported that its fifth sight, of last month, had generated $391 million, compared to $581 million in June 2018.

To date, De Beers' rough sales in 2019 reached $2. 63 billion.

With four more sights to go in August, September, November and December, it is obvious De Beers rough sales will not come close to the sales number ($5.39 billion) of 2018, as it will continue to allow clients to defer their sights, in light of the current oversupply of rough in the pipeline, the lack of liquidity, the demand of Indian banks to restitute existing loans and the stated unwillingness of banks to extend new loans for rough purchases.

Bruce Cleaver, CEO, De Beers Group, said: "With ongoing macroeconomic uncertainty, retailers managing inventory levels, and polished diamond inventories in the midstream continuing to be higher than normal, De Beers Group provided customers with additional flexibility to defer some of their rough diamond allocations to later in the year. As a result, we saw a reduction in sales during the sixth cycle of 2019.

...

- Category: News Archives

- Hits: 782

HTTP/2 200 server: nginx date: Mon, 29 Jul 2019 20:00:04 GMT content-type: text/html; charset=UTF-8 content-length: 57679 vary: Accept-Encoding, Cookie cache-control: max-age=3600, public x-ua-compatible: IE=edge content-language: en x-content-type-options: nosniff x-frame-options: SAMEORIGIN expires: Sun, 19 Nov 1978 05:00:00 GMT last-modified: Mon, 29 Jul 2019 19:52:01 GMT etag: W/"1564429921" x-backend-server: drupal-f8897688-sszx6 age: 482 varnish-cache: HIT x-cache-hits: 879 x-served-by: varnish-0 accept-ranges: bytes ...

Did Steve Liesman Just Expose The 'Existential' Reason For A Fed Cut This Week? | Zero Hedge s Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)