Diamond News Archives

- Category: News Archives

- Hits: 867

The De Beers Group published the following announcement on Friday August 16:

"De Beers Group is shocked and saddened by the sudden death of Albert Milton, Managing Director, Debswana, the 50/50 joint venture between the Government of the Republic of Botswana and De Beers Group.

Albert became unwell in Johannesburg on Thursday evening. He was admitted to hospital but died early this (Friday) morning.

We extend our deepest condolences to Albert's family, relatives and friends. Our thoughts are with them at this most difficult time.

Albert was appointed Managing Director of Debswana and to the De Beers Group Executive Committee in December 2018. He joined Debswana in 1992 and held various positions throughout his career across the company's mining operations and in leadership positions. He was appointed General Manager of Jwaneng Mine in 2013 and held posts as Project Manager at Venetia Mine in South Africa and as General Manager at Morupule Coal Mine in Botswana from 2008 to 2013.

Lynette Armstrong, Chief Financial Officer, Debswana, is serving as Acting Managing Director at Debswana with immediate effect. A further announcement regarding arrangements for a memorial for Albert will be made in due course."...

- Category: News Archives

- Hits: 919

Gold softened last night, retreating in a range of $1506 - $1528. It briefly broke support at $1510 (up trendline from 8/1 $1401 low, double top – 8/7 and 8/8 highs), but once again, decent dip buying took the market back to the $1510 level. The yellow metal was pressured by a bounce in the US 10-year bond yield (1.497% - 1.569%, 2-10 year spread out to +4bp from the inversion two days prior, yesterday’s strong US data helping to lessen recession fears), and mostly firmer global equities. While the NIKKEI was off 0.2%, the SCI rose 0.3%, European shares were up from 0.6% to 1%, and S&P futures were up 1% (strong earnings report last night from Nvidia). Gold was also weighed from an increase in the US dollar (DX to 98.31, 2-week highs), which was lifted by a further decline in the euro ($1.1113 - $1.1073, 2-week low). The common currency was under pressure from a weaker report on the Eurozone Trade Balance, with yesterday’s dovish comments from the ECB’s Olli Rehn still resonating, and with the German 10-year bund yield making yet another all-time low (-0.727%).

At 8:30 AM, a miss on US Housing Starts (1.190M vs. exp. 1.270M) was largely offset by a stronger than anticipated report on Building Permits 1.336M vs. exp. 1.270M). At 10 AM, a much weaker than expected reading the University of Michigan Consumer Sentiment (92.1 vs. exp. 97) tugged US stocks lower (S&P +19 to 2867), with a decline in oil (WTI to $54.24, OPEC’s monthly report cut its forecast for oil demand growth in 2019, indicates mkt in surplus in 2020) contributing to the move. The US 10-year yield was brought down to 1.542%, the DX fell to 98.17, and gold climbed to $1516.

Later...

- Category: News Archives

- Hits: 861

Yahoo News reported that China is taking on the world's diamond miners, using sophisticated technology to offer increasingly cheap and real-looking knockoffs that threaten to upend the lucrative fine jewelry market.

The technological disruption seen in medicine, autos, banking and countless other sectors is spilling over into diamonds, where an oligopoly of just four miners controls more than 60 per cent of production, according to consultancy Bain & Company.

It is happening as China taps the know-how it developed in becoming the world's biggest maker of synthetic diamonds used primarily in the industrial cutting tools market.

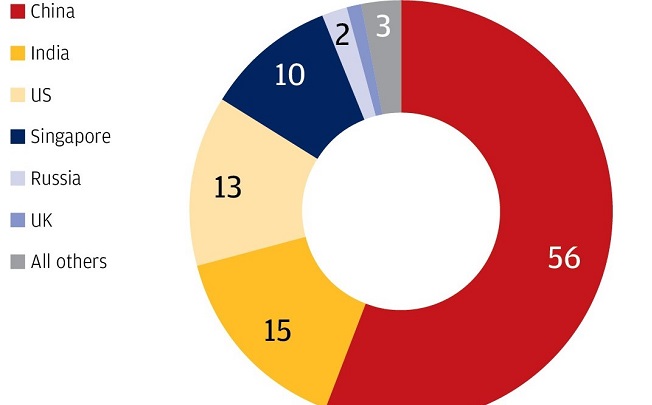

By doing so, China now makes 56 per cent of the world's gem-quality synthetic diamonds, far outpacing second-placed India.

While synthetic diamonds right now only account for 3.5 per cent of the world's diamond jewelry, the share could grow to six per cent in four years, and even more later, says Yahoo News interviewed Paul Zimnisky, a New York-based independent diamond sector analyst who said that during the past "few years Chinese producers had been upgrading existing equipment to produce larger, better-quality synthetic diamonds for use as jewelry. China already has the infrastructure in place which allows for high production scalability of higher-quality synthetic diamonds, as existing high-pressure high-temperature equipment is upgraded," Zimnisky said.

Five years ago, a "fake" diamond cost about 10 percent less than the real thing. Now the discount is about 50 percent. And within five years, Zimnisky estimated, it could be 90 percent.

"Technology has progressed rapidly, not only are the lab-grown diamond producers able to produce bigger stones … but also better clarity and color," Georgette Boele, senior precious metals and diamonds analyst at Holland-based bank ABN AMRO, wrote in...

- Category: News Archives

- Hits: 851

Organized by the Continental Buying Group and Preferred Jewelers International, the new Diplomat show will be held right after Labor Day on September 4, 5, and 6. at the newly renovated Diplomat Hotel and Resort in Hollywood Florida,

in a statement, the organizers said that "As we head into the critical fourth quarter, [we will be] offering great opportunities for retailers to fill up their cases for the fourth quarter with merchandise that will produce higher margins."

The show will be organizing networking events - breakfast, lunch, cocktails - and a choice of educational seminars. All these events are scheduled such that both suppliers and retailers can attend everything together.

The educational seminars will include: ...

- The President and CEO of the Jewelers Vigilance Committee, Tiffany Stevens along with Debbie Azar from GSI will be speaking about synthetics, lab grown diamonds, mined diamonds, and what your responsibility is as a supplier or retailer, to yourself and the consumer.

- Keith Elzia from Enterprise Content Solutions. This charismatic presenter spent 18 years as Executive Vice President at IBM. Keith will be going into astonishing detail about A.I. (artificial intelligence) and how it will help your business and help you acquire new customers.

- Angela Gage from Solupay will be explaining in detail on how they can assist with website payment options and provide fraud prevention products to facilitate all elements of your business while providing the best pricing model and services.

- Bottomline Marketing will be closing this educational seminar with an interactive and fun presentation on the ever-changing world of social media and how important it is for your business.

- Category: News Archives

- Hits: 823

HTTP/2 200 server: nginx date: Mon, 12 Aug 2019 20:00:04 GMT content-type: text/html; charset=UTF-8 content-length: 43019 vary: Accept-Encoding, Cookie cache-control: max-age=3600, public x-ua-compatible: IE=edge content-language: en x-content-type-options: nosniff x-frame-options: SAMEORIGIN expires: Sun, 19 Nov 1978 05:00:00 GMT last-modified: Mon, 12 Aug 2019 19:56:09 GMT etag: W/"1565639769" x-backend-server: drupal-5c68f4bd49-rvh8d age: 234 varnish-cache: HIT x-cache-hits: 120 x-served-by: varnish-1 accept-ranges: bytes ...

Gold Spiked, Stocks Crash As Long-Bond Yields Near Record Lows | Zero Hedge s Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)