In 2002, Ben Affleck made headlines when he gave Jennifer Lopez a 6.1-carat pink diamond engagement ring worth a reported US$1.2 million. Now, US$1.2 million isn’t a small amount of money, but it practically sounds like Monopoly money when you hear what some coloured diamonds are fetching at auction these days. Jen Zoratti of the Winnipeg Free Press has the scoop!

Like the "Oppenheimer Blue," a 14.62-carat fancy vivid blue diamond that sold for US$57.5 million at Christie’s Magnificent Jewels auction in May. Or the "Orange," a 14.82-carat fancy vivid orange diamond that sold for US$35.5 million in 2013, also at a Christie’s auction.

During the past few years, there have been many trend reports about coloured diamonds as investment opportunities — if you can afford them.

Ultra-rare, ultra-pricey gems can rise in value 10 to 15 per cent annually, but you'll need deep pockets

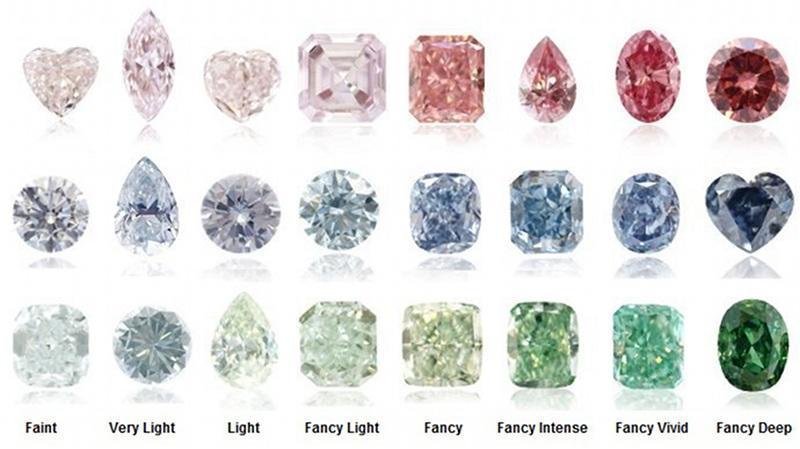

Coloured diamonds are attractive investments for a few reasons: they haven’t decreased in wholesale price since 1959, and they can increase in value 10 to 15 per cent each year. They are also incredibly rare: only 0.001 per cent of diamonds mined each year qualify as "fancy," and fewer still earn the distinction of "vivid", which is a highly saturated colour. (Fancy Vivid diamonds, such as the two that went for fortunes at Christie’s, are the rarest and most prized.)

Few mines on Earth produce coloured diamonds. Only one fancy blue diamond is mined per year; only 20 to 30 fancy reds are known to exist. So, in other words, in order for diamonds to be investment pieces, they have to be, by definition, exceptional. Unless they are flawless, white diamonds are not usually exceptional.

Grandmother’s heirloom white diamond wedding ring, while priceless in sentimental value, is not an investment. These are all facts I learned Thursday night at the Art of Buying Coloured Diamonds, a seminar and auction presented by Ritchies auctioneers, a Toronto-based house, and Gurevich Fine Art.

It was the first event of its kind in Winnipeg, designed to be a small sample auction — Ritchies auctions can have 200 to 300 people in attendance, as well as many telephone and absentee bidders — and informational evening. "We wanted to try something new," says Howard Gurevich, owner of the Exchange District gallery.

I was curious about what kind of fancy people would attend a wine-and-chocolate fancy diamond auction in Winnipeg. Only 10 people or so were in attendance, not including the two police officers there to protect the jewel cases glittering with about $5 million worth of diamonds.

Jonty Friedman is a fine jewelry specialist at Ritchies. Coloured diamonds are something of a sub-specialty for him. He says although coloured diamonds are having a moment fashion-wise — especially in Asia — people are not buying these diamonds to be worn.

"A lot of these buyers are foreign buyers, investors. A coloured diamond buyer is more of an investor than a jewelry buyer. It’s funny, you’ll see these pieces go into rings, but that’s just a way of more or less storing it, rather than keeping a loose stone in a parcel or something."

Part of what’s driving demand for fancy coloured diamonds is scarcity

The Argyle diamond mine, which is located in Australia and owned by Rio Tinto, produces 90 to 95 per cent of the world’s fancy pink diamonds. The mine is set to close in 2020, and Friedman says the value of certified Argyle fancy pinks is expected to soar after it closes. A fancy vivid pink, for example, could be worth US$3 million per carat by 2020.

Red diamonds are the rarest while yellow is the most common, making it attractive to entry-level investors who don’t have $50 million sitting around.

Friedman displays a seven-carat pale yellow diamond that would trade for US$10,000. The more intense the colour, the more money the diamond could fetch. He has another yellow diamond that is more saturated, but less sparkly (yes, these are technical terms). "You can see the inclusions, but it’ll still command stupid money. People are buying for the colour."

Diamonds, whether they are coloured or white, leave a lot of room for subjectivity in general, which is why appraisal is often described as an art, not strictly a science. Diamonds are evaluated by the four Cs — carat, clarity, colour and cut. With coloured diamonds, there are other variables, such as the rarity of the colour and the saturation of the hue.

Determining market value is also a challenge. After all, with coloured diamonds, it is possible to get a one-of-a-kind stone. You don’t need to be a billionaire to invest in coloured diamonds, but you do need to know what you’re doing — and it probably helps if you’re at least a millionaire.

The value of a coloured diamond bought for a few thousand dollars, such as the ones on display Thursday night, will rise at the same rate, says Kashif Khan, the director of Ritchies.

The big diamonds are usually sold via auction, so, unlike other kinds of investments, there are taxes and commission fees to consider. Investment-grade diamonds must be certified by the Gemological Institute of America, which will encrypt a stone with a microscopic report number.

Because there were so few attendees Thursday, the seminar and auction didn’t happen as planned. A few serious buyers spoke to Khan, including a man with a rare jade ring that Khan estimates is worth $250,000. Apparently, this man is interested in going to the Ritchies office in Toronto to look at a red diamond.

Investing in coloured diamonds is not a practical alternative to, say, an RRSP for most people. So Thursday night was mostly about looking at spectacular jewels and hearing the stories: such as a client of Khan’s who bought a red diamond in the 1970s for $50,000 and later sold it for $1.5 million.

Or the Toronto businessman who bought a 10-carat fancy intense orange-pink diamond for $2.3 million. When Khan went to deliver his purchase — among the biggest in Canada — the businessman discovered he had a seven-carat blue diamond in his safe. Khan says the blue diamond was worth $28 million. (Imagine being that rich: "Oh, this old thing? It’s just a rare blue diamond I forgot I had!")

"One of my biggest mistakes actually got solved in Winnipeg," Khan says. About six years ago, a man in Brazil contacted Khan and said he had a bunch of green diamonds. There is no official coloured diamond mine in Brazil, but Khan went to check it out. "We were literally in the jungle," he says.

Khan was presented with three or four intensely coloured green diamonds. That’s rare; green diamonds occur because of radiation, which doesn’t penetrate the carbon the same way as nitrogen, which results in yellow diamonds, or boron, which results in blue diamonds.

Khan bought them on the spot. When he came back to Canada, he sent them to be cut — and found out they were white inside. Once cut, their value plummeted. "It was a $100,000 deal and they were maybe worth $10,000." Khan’s story got out among industry insiders, and he received a call from a geologist in Winnipeg. The geologist didn’t care; he loved the idea of having an irradiated diamond that size. Khan ended up making money.

Sometimes, value is in the eye of the beholder. "There isn’t another one," Khan says. "If you say, ‘I want a rough green diamond of this size,’ there isn’t another one."

(Originally appeared in the Winnipeg Free Press)