Diamond News Archives

- Category: News Archives

- Hits: 1891

The U.S. Internal Revenue Service’s online filing system was malfunctioning on Tuesday -- the day tax returns are due for most taxpayers.

“Currently, certain IRS systems are experiencing technical difficulties,” the IRS said in a statement. “Taxpayers should continue filing their tax returns as they normally would.”

Every year the IRS processes more than 120 million tax returns that arrive by mid-April and spits back some $300 billion in refunds. Tax Day is on April 17 this year, since April 15 was a Sunday and April 16 was a holiday in Washington.

The IRS is currently unable to accept information transmitted from software providers, David Kautter, acting commissioner of the IRS, said after testifying at a congressional hearing on Tuesday. He said taxpayers won’t be penalized because of the issue.

“On my way over here this morning, I was told a number of systems are down at the moment,” Kautter said during the hearing. The problem was discovered in the early morning hours between 1 a.m. and 3 a.m., according to Kautter.

The IRS is unsure whether a hardware or software issue is to blame, or if it was a cybersecurity issue -- but indications are that the problem is internal, Kautter said.

Alert Message

An alert message pops up when users select "Bank Account (Direct Pay)" on the agency’s website; it says the service is currently unavailable. The same message appears when choosing to apply for a payment plan or view account information.

Kautter added that taxpayers won’t be punished for the IRS’s issues. “If we can’t solve it today, we’ll figure out a solution,” Kautter said. “Taxpayers would not be penalized because of a technical problem the IRS is having.”

Tom Nemet, an accountant in Hamden, Connecticut,...

- Category: News Archives

- Hits: 2055

Debt is the problem. It’s not a free lunch, and far from having learned any lessons from the 2008 meltdown, we’ve added 42% more global debt to the hyper-overextended levels of a decade ago.

Never mind that none of the systemic causes of the 2008 crash have been remedied; everything deemed too big to fail is far larger now than it was then, and there is now an additional $70 trillion in worldwide leveraged stress on that same ramshackle scaffolding.

Central banks can prop it up for a while. And when they can’t? The biggest crash yet.

Like other benchmark interest rates, when the Libor is low, it means that loans are inexpensive, and vice versa. As with the U.S. Fed Funds Rate, Libor rates were cut to record low levels during the 2008-2009 financial crisis in order to encourage more borrowing and concomitant economic growth.

Unfortunately, economic booms that are created via central bank manipulation of borrowing costs are typically temporary bubble booms rather than sustainable, organic economic booms. When central banks raise borrowing costs as an economic cycle matures, the growth-driving bubbles pop, leading to a bear market, financial crisis, and recession.

Similar to the U.S. Fed Funds Rate, Libor has been rising for the last several years as central banks raise interest rates. While rising interest rates haven’t popped the major global bubbles just yet, it’s just a matter of time before they start to bite.

While most economists and financial journalists view the rising Libor as part of a normal business cycle, I’m quite alarmed due to my awareness of just how much our global economic recovery and boom is predicated on ultra-low interest rates.

With global debt up...

- Category: News Archives

- Hits: 1833

Investors need to prepare for downside as the end of the economic cycle is near and U.S. markets are priced for best-case scenarios, Morgan Stanley says.

While fiscal stimulus is supportive of growth in the near term, the benefits are already likely “in the price” and increase potential downside for markets at the end of the cycle, Morgan Stanley strategists including Michael Zezas, Matthew Hornbach and Andrew Sheets wrote in a note Tuesday. They also said U.S. stock valuations peaked before the tax bill was enacted with a cyclical top for equities later this year, while peak margins and rate of change on organic earnings growth coming by late 2018 or early 2019.

“There’s less reason to behave like it’s ‘morning in America’ than ‘Happy Hour in America,”’ the report said. Markets are “closer to the end of the day than the beginning.”

The report said the fiscal expansion factor supports a range-bound path for stocks, as well as a flatter U.S. Treasury yield curve with a lower yield bias.

“We advocate a focus on sector and stock-specific alpha as these late-cycle dynamics portend narrowing markets and a cyclical top for equities later this year, in our view,” the strategists said. “In Treasuries, we see the curve continuing to flatten on Fed hikes, and yield downside as the year progresses and the economic outlook becomes more mixed.”...

- Category: News Archives

- Hits: 2128

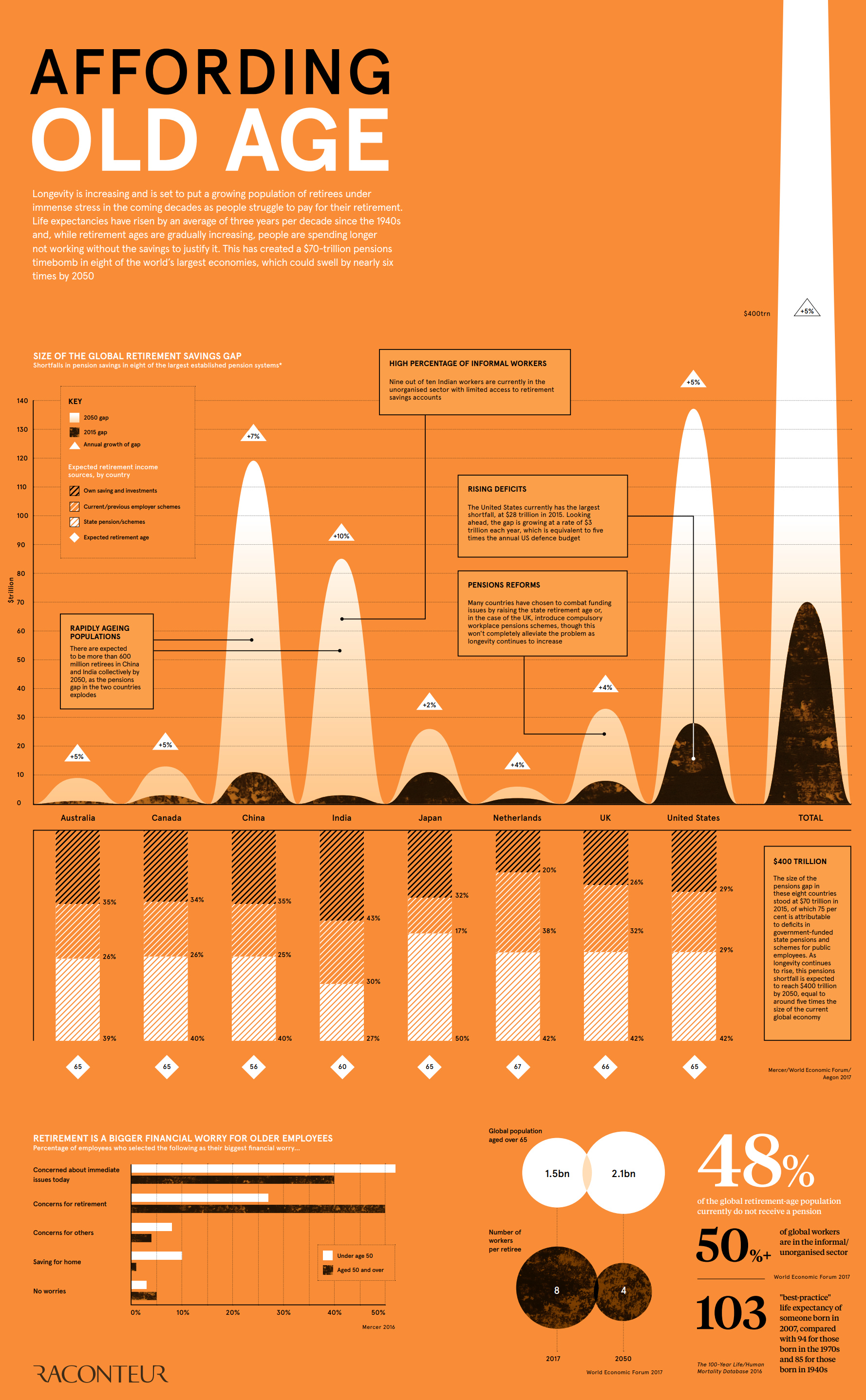

View the high resolution version of today’s graphic by clicking here.

[1]

Are governments making promises about pensions that they might not be able to keep?

According to an analysis by the World Economic Forum (WEF), there was a combined retirement savings gap in excess of $70 trillion in 2015, spread between eight major economies..

The WEF says the deficit is growing by $28 billion every 24 hours – and if nothing is done to slow the growth rate, the deficit will reach $400 trillion by 2050, or about five times the size of the global economy today.

The group of economies studied: Canada, Australia, Netherlands, Japan, India, China, the United Kingdom, and the United States.

MIND THE GAP

Today’s infographic comes to us from Raconteur, and it illuminates a growing problem attached to an aging population (and those that will be supporting it).

Since social security programs were initially developed, the circumstances around work and retirement have shifted considerably. Life expectancy has risen by three years per decade since the 1940s, and older people are having increasingly long life spans. With the retirement age hardly changing in most economies, this longevity means that people are spending longer not working without the savings to justify it.

This problem is amplified by the size of generations and fertility rates. The population of retirees globally is expected to grow from 1.5 billion to 2.1 billion between 2017-2050, while the number of workers for each retiree is expected to halve from eight to four over the same timeframe.

The WEF has made clear that the situation is not trivial, likening the scenario to “financial climate change”:

The anticipated increase in longevity and resulting ageing populations is the financial equivalent of...

- Category: News Archives

- Hits: 1763

(IDEX Online) – Leo Schachter said that Rosy Blue has become a minority investor in its business. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?> The transaction is expected to close soon, and will mark a culmination of over 30 years of a trading relationship built between the two groups, the Leo Schachter firm said in a statement. "Leo Schachter will continue to operate independently under the Schachter family’s majority ownership, by its principals and the leadership of the current executive team. "Leo Schachter and Rosy Blue will seek to create operational efficiencies by tapping into each other’s vast processing and administrative infrastructure around the globe with a view to delivering even better value to our respective clientele." Elliot Tannenbaum, Principal at Leo Schachter, noted that "From its inception in the diamond business 65 years ago, our two families have been blessed in identifying enduring partnerships where hard work, merged with diverse talents and ways of thinking, have produced excellent results. We feel that the relationship and collaboration which we have enjoyed with the Rosy Blue family for over two generations will produce a unique and innovative platform for the demands of today's diamond industry." Amit Bhansali, Managing Director of Rosy Blue NV said, “Rosy Blue has enjoyed a very long and trusting relationship with Leo Schachter thanks to our shared values built on hard work and integrity. The forward-thinking and responsible nature of Elliot and his team will be a great benefit to Rosy Blue as we navigate the evolving market.” ...

(IDEX Online) – Leo Schachter said that Rosy Blue has become a minority investor in its business. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?> The transaction is expected to close soon, and will mark a culmination of over 30 years of a trading relationship built between the two groups, the Leo Schachter firm said in a statement. "Leo Schachter will continue to operate independently under the Schachter family’s majority ownership, by its principals and the leadership of the current executive team. "Leo Schachter and Rosy Blue will seek to create operational efficiencies by tapping into each other’s vast processing and administrative infrastructure around the globe with a view to delivering even better value to our respective clientele." Elliot Tannenbaum, Principal at Leo Schachter, noted that "From its inception in the diamond business 65 years ago, our two families have been blessed in identifying enduring partnerships where hard work, merged with diverse talents and ways of thinking, have produced excellent results. We feel that the relationship and collaboration which we have enjoyed with the Rosy Blue family for over two generations will produce a unique and innovative platform for the demands of today's diamond industry." Amit Bhansali, Managing Director of Rosy Blue NV said, “Rosy Blue has enjoyed a very long and trusting relationship with Leo Schachter thanks to our shared values built on hard work and integrity. The forward-thinking and responsible nature of Elliot and his team will be a great benefit to Rosy Blue as we navigate the evolving market.” ...