Diamond News Archives

- Category: News Archives

- Hits: 1974

It is not surprising to hear Mario Draghi making noises about the economy not being as strong as he would prefer to see it.

His wild buying spree of garbage assets has resulted in markets propped up by…his wild buying spree of garbage assets. Were he to stop, well…he can’t stop. Nobody would buy the toxic trash he was buying then, and they certainly won’t buy it now, so he needs to position markets for perpetual QE.

In the past few weeks we have reported on the economic weakness in Europe[1]. The Citi Economic Surprise index for Europe is extremely negative[2] showing reports are missing economists’ expectations.

The ECB’s Mario Draghi responded to this recent weakness by stating[3] growth may have peaked for the cycle. This is a reasonable assessment, but it’s more than an economic forecast. Every statement by central bankers has monetary policy implications.

This could mean more dovish policy. This is an interesting predicament because the ECB has interest rates in the negatives and QE hasn’t even ended yet. The ECB will wait until July[4] to decide the fate of QE.

Policy is still extremely dovish with the goal of normalization in the next few years. Peak growth at the beginning of this process is a disaster. The biggest problem is normalization has gone too slow.

It would be interesting to see what policy would be put in place if Europe were to fall into a recession in 2019.

The stock market is acting very unusually because the S&P 500 has been range bound while the earnings growth in Q1 is in the high teens as we mentioned in Are Markets Priced For Perfection?...

- Category: News Archives

- Hits: 1917

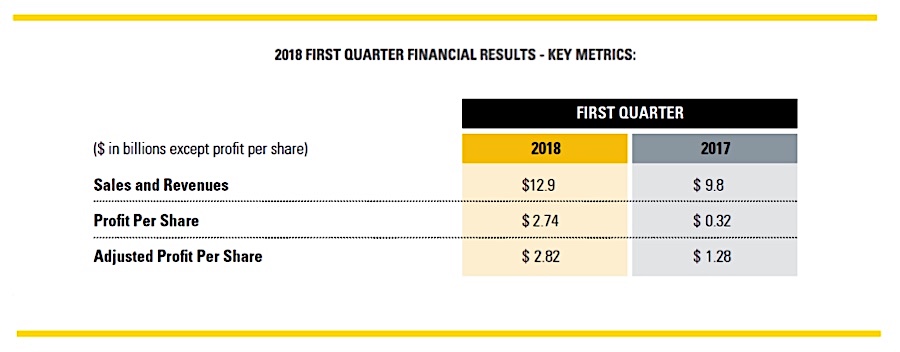

Caterpillar (NYSE:CAT), the world's No.1 heavy machinery maker, boosted Tuesday its 2018 profits forecast after beating estimates for first-quarter earnings on strong global demand for its equipment.

For the three months ended on March 31, the Deerfield, Illinois-based firm, which is considered a reliable bellwether of global economic activity, reported a net profit of $2.74 per share, above most analysts' consensus forecast of $2.04 per share.

It cited better-than-expected sales volume as the main driver of its improved full-year guidance.

The firm, which saw continued strength for construction in North America and infrastructure in China in the first quarter of the year, boosted its 2018 profit outlook by $2 a share over the previous quarter, to a range of $10.25 to $11.25 per share.

Caterpillar cited better-than-expected sales volume as the main driver of its improved full-year guidance, which assumes continued global economic growth. But the company warned that any potential impacts from geopolitical risks and trade restrictions had not been included in the outlook.

Increased volume also drove CAT’s total sales up 38% from the year-earlier quarter, to $5.7 billion.

Despite the positive results, shares in the company dropped more than 4% and they’ve had lost $6.5 by noon trading at $147.05 at 12:30 ET.

Taken from CAT Quarterly Highlights.

"The combination of strength in many of our end markets and our team's continued focus on operational excellence — including strong cost control — helped us deliver improved margins and a record first-quarter profit," chief executive Jim Umpleby said in a statement.

The heavy-duty equipment manufacturer added 10,900 jobs from a year earlier, bringing its worldwide total to 118,800 and it repurchased $500 million of common stock in the first...

- Category: News Archives

- Hits: 2115

HTTP/1.1 200 OK Server: nginx Date: Tue, 24 Apr 2018 18:15:03 GMT Content-Type: text/html; charset=UTF-8 Transfer-Encoding: chunked Connection: keep-alive Strict-Transport-Security: max-age=86400 Vary: Accept-Encoding Last-Modified: Tue, 24 Apr 2018 18:12:36 GMT Cache-Control: max-age=153, must-revalidate X-nananana: Batcache Vary: Cookie X-hacker: If you're reading this, you should visit automattic.com/jobs and apply to join the fun, mention this header. X-Pingback: https://confoundedinterest.net/xmlrpc.php Link: ; rel=shortlink X-ac: 3.ewr _dca Treasury 10-year Yield Breaks 3%, Then Subsides (How Long Before Inversion?) – Confounded Interest ...

But the 2-year note continues its rise towards 3%.

But the 2-year note continues its rise towards 3%.  How long before curve inversion?[16] Like this: Like Loading... Related

How long before curve inversion?[16] Like this: Like Loading... Related - Category: News Archives

- Hits: 1755

U.S. stocks fell on Tuesday, with major indexes retreating from early highs as a rise in bond yields provided another reason for caution at a time when the first-quarter earnings season is failing to excite investors, despite some strong reads from corporate America.

While the earnings season remained in full swing, with results from a number of major firms, the tone was generally negative, with several bellwether stocks slumping despite posting numbers that were ahead of analyst forecasts.

What are markets doing?

The Dow Jones Industrial Average DJIA, -0.75%[1] dipped 130 points to 24,317, a decline of 0.2%. The S&P 500 index SPX, -0.44%[2] fell 2 points to 2,668, a loss of 0.1%. The Nasdaq Composite Index COMP, -0.80%[3] declined by 32 points, or 0.5%, to 7,097.

If the Dow closes in negative territory, that will mark its fifth straight negative session, its longest such streak since March 2017. The Nasdaq is threatening its fourth straight down day, its longest streak since February.

Financial stocks were among the strongest performers of the day[4], with the industry up 1%. While rising bond yields are seen as a headwind to the overall market because they push up borrowing costs for American corporations, banks generally benefit as higher yields and interest rates...

- Category: News Archives

- Hits: 2263

Anglo American (LON:AAL) won’t resume production at its massive Minas Rio in Brazil until the fourth quarter of 2018 due to two pipeline leaks that forced it to halt operations in March, and which will cause the miner an annual group earnings (EBITDA) loss of $300 to $400 million.

The announcement is the last of a string of difficulties Anglo has faced with the mine, which was expected to produce 16 million tonnes of iron ore this year, but that will now generate just 3 million tonnes.

The delayed restart of Minas Rio comes at a time when several iron ore producers have issued downward revisions to production guidance, tightening the market.

The operation is Anglo American’s biggest development project, and its bet on the future of iron ore, but so far it only accounts for a small percentage of its overall profits as it is still in ramp-up phase, which has taken longer than expected.

Minas Rio has suffered repeated delays and is on hold pending an investigation into two leaks in a month in the more than 500-km pipeline that helps to deliver its iron ore to export markets, which has already cost Anglo $58 million in fines.

Anglo’s series of unfortunate events

The world's number four diversified miner bought the iron ore project in Southeaster Brazil during the commodity prices boom of 2007-2008, paying local ex-billionaire Eike Batista $5.5 billion for it. It had to then spent another $8.4 billion, more than twice what was originally projected, to bring Minas Rio to production in 2014.

The deal soon soured as rising global iron ore output overwhelmed demand, causing prices to tumble 80% from their 2011 peak. The miner also saw itself forced to write down...