Caterpillar (NYSE:CAT), the world's No.1 heavy machinery maker, boosted Tuesday its 2018 profits forecast after beating estimates for first-quarter earnings on strong global demand for its equipment.

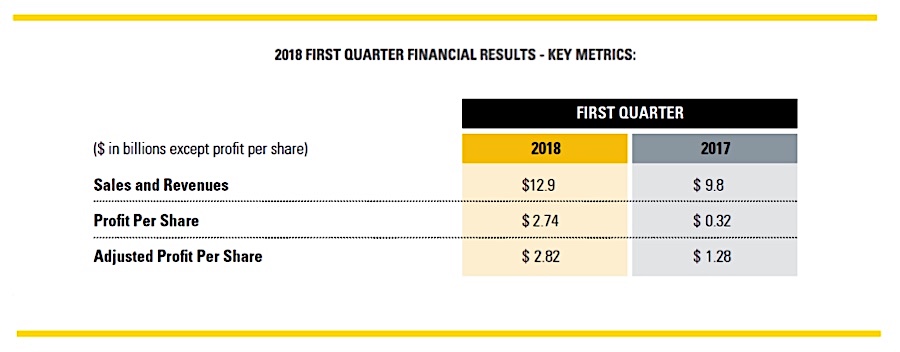

For the three months ended on March 31, the Deerfield, Illinois-based firm, which is considered a reliable bellwether of global economic activity, reported a net profit of $2.74 per share, above most analysts' consensus forecast of $2.04 per share.

It cited better-than-expected sales volume as the main driver of its improved full-year guidance.

The firm, which saw continued strength for construction in North America and infrastructure in China in the first quarter of the year, boosted its 2018 profit outlook by $2 a share over the previous quarter, to a range of $10.25 to $11.25 per share.

Caterpillar cited better-than-expected sales volume as the main driver of its improved full-year guidance, which assumes continued global economic growth. But the company warned that any potential impacts from geopolitical risks and trade restrictions had not been included in the outlook.

Increased volume also drove CAT’s total sales up 38% from the year-earlier quarter, to $5.7 billion.

Despite the positive results, shares in the company dropped more than 4% and they’ve had lost $6.5 by noon trading at $147.05 at 12:30 ET.

Taken from CAT Quarterly Highlights.

"The combination of strength in many of our end markets and our team's continued focus on operational excellence — including strong cost control — helped us deliver improved margins and a record first-quarter profit," chief executive Jim Umpleby said in a statement.

The heavy-duty equipment manufacturer added 10,900 jobs from a year earlier, bringing its worldwide total to 118,800 and it repurchased $500 million of common stock in the first...