Diamond News Archives

- Category: News Archives

- Hits: 1289

What do we all have to fear from a collapse of Deutsche Bank? A shorter list would count what we don’t have to fear from a collapse of Deutsche Bank.

Now comes news that the Fed has privately placed the bank on a list of ‘troubled’ lenders, meaning that DB has had to run decision-making through the Fed for at least the past year. A process that, until now and despite being a publicly traded company using the capital of untold numbers of investors, has been shrouded in total secrecy.

The bottom line is this: Deutsche Bank is unequivocally too big to fail. No matter how catastrophic their bad bets have been, no matter how criminal their behavior, they will be bailed out on the backs of global taxpayers.

A potential death star smack dab in the middle of global finance, this diagram sums up the systemic risk posed by DB and its 2x-larger-than-world-GDP derivatives book:

Deutsche Bank (DB - Get Report) shares fell sharply Thursday after the Wall Street Journal reported that the Federal Reserve has deemed the German lender's U.S. operations as "troubled" in a previously written assessment that hasn't been made public.

The assessment effectively meant that the bank, Germany's largest, has had to clear many operational decisions through Fed officials in either Washington or New York for at least the past year, the WSJ noted, citing sources familiar with the matter. Reports of the Fed assessment follow Deutsche Bank's planned reduction of its U.S. equity and bond market trading divisions and significant jobs cuts under Christian Sewing as the new CEO attempts to reverse years of losses and a loss of investor faith in one of Europe's most important lenders.

Deutsche Bank shares were marked...

- Category: News Archives

- Hits: 1198

Canada-listed Fura Gems (TSX-V:FUR), a new gemstone mining and marketing company headed by the former COO of Gemfields (LON:GEM), is changing its brand identity, including logo, tagline and social media.

The company, which began operations a year ago, said the move seeks to strengthen its communication with key stake holders and consumers.

The new logo, it said, was inspired by the Fura and Tena mountains of Colombia, while the colours represent the gemstones Fura mines — vivid green Colombian emeralds and intense red Mozambique rubies.

The new logo. (Image courtesy of Fura Gems via Instagram.)

Fura’s assets are all located in areas known for holding coloured gemstones deposits, including operating mines currently undercapitalized and that need to be modernized.

A good example of those assets, Fura Gems chief executive officer Dev Shetty told MINING.com earlier this year, is the company’s Coscuez emerald mine in Colombia, which it grabbed from Gemfields in October.

Located in the mountainous department of Boyacá, Coscuez is probably one of the best-known emerald deposits in the world, said Shetty, adding it’s known to have produced over 95% of Colombia’s emerald supply in the 1970s.

Fura kicked off initial production at the operation in March, yielding 1,720 carats of emeralds, including 826 carats of top quality ones. The output was obtained through a bulk-sampling program carried out within eight weeks of the completing the acquisition of the mine

In Mozambique, the company hold four licences in the area known as “the ruby belt” and it believes is in position to start mining those assets “very soon.”

The post Emeralds and rubies producer Fura Gems changes look appeared first on MINING.com....

- Category: News Archives

- Hits: 1093

The inflation numbers are out for April and the numbers show that the Core Personal Consumption Expenditure Deflator remained the same as March at 2.0% YoY. Although increasing, “inflation” remains tepid since The Great Recession ended (mostly under the 2% Fed inflation target).

While inflation remains tepid, things are anything but “business as usual” at Sears. Sears’ stock price never quite recovered from The Great Recession and, like many big box retailers, has been “Bezos’d”.

(Bloomberg) Sears Holdings Corp. kicked off another fiscal year with declining sales from a dwindling number of stores, and more closings are on the way.

The operator of Sears and Kmart stores posted a first-quarter loss of $3.93 a diluted share. Revenue fell due to fewer stores and a 12 percent drop in comparable-store sales. The Hoffman Estates, Illinois-based retailer said Thursday that it has identified 100 unprofitable stores, and 72 of them will begin store-closing sales in the near future. It will announce the locations to close by midday.

Shares fell as much as 13 percent before the start of regular trading. The shares have lost 10 percent this year through Wednesday’s close.

...

Related

- Category: News Archives

- Hits: 1558

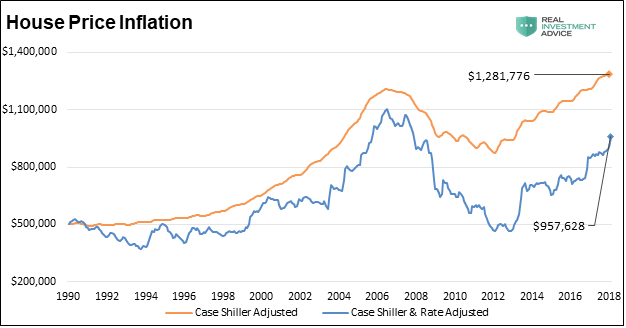

Millennials have shown significantly less interest in owning homes than past generations. Baby boomers are currently seeking to downside in their retirement years, selling the houses in which they raised families.

Mortgage rates are at a five-year high[1]. Predatory bank lenders are scraping the bottom of the subprime barrel[2] in an attempt to force huge loans on the least qualified buyers so they can buy Lamborghinis.

The housing market is primed for a fall. Just one of many asset classes that have been inflated by the Fed and risen to irrational levels in the Everything Bubble.

The Fed has raised interest rates six times since the end of 2015. Their forward guidance from recent Federal Open Market Committee (FOMC) meeting statements and minutes tells of their plans on continuing to do so throughout this year and next. Additionally, the Fed owns over one-quarter of all residential mortgage-backed securities (MBS) through QE purchases.

Their stated plan is to reduce their ownership of those securities over the next several quarters. If the Fed continues on their expected path with regard to rates and balance sheet, it creates a significant market adjustment in terms of supply and demand dynamics and further implies that mortgage rates should rise.

The consequences of higher mortgage rates will not only affect buyers and sellers of housing but also make borrowing on the equity in homes more expensive.

From a macro perspective, consider that housing contributes 15-18% to GDP, according to the National Association of Home Builders (NAHB). While we do not expect higher rates to devastate the housing market, we do think a period of price declines and economic weakness could accompany higher rates.

ORIGINAL SOURCE: The Headwind Facing Housing...

- Category: News Archives

- Hits: 1300

HTTP/1.1 200 OK cache-control: no-cache, no-store, must-revalidate, pre-check=0, post-check=0 content-length: 183659 content-type: text/html;charset=utf-8 date: Thu, 31 May 2018 12:15:07 GMT expires: Tue, 31 Mar 1981 05:00:00 GMT last-modified: Thu, 31 May 2018 12:15:07 GMT pragma: no-cache server: tsa_b set-cookie: fm=0; Expires=Thu, 31 May 2018 12:14:58 GMT; Path=/; Domain=.twitter.com; Secure; HTTPOnly set-cookie: _twitter_sess=BAh7CSIKZmxhc2hJQzonQWN0aW9uQ29udHJvbGxlcjo6Rmxhc2g6OkZsYXNo%250ASGFzaHsABjoKQHVzZWR7ADoPY3JlYXRlZF9hdGwrCPd9H7ZjAToMY3NyZl9p%250AZCIlZjA2YmQ5NWQxMmE5MjUxNWE1YTYyM2UwNjE3ZmYxMDE6B2lkIiUzNTM0%250AOTI3NmFmNDQ4YzczN2Q2NGQ4YjFmODI2NzgyZQ%253D%253D--1ba4ca118c4ac2179048f7e496e75d3bb7eecf35; Path=/; Domain=.twitter.com; Secure; HTTPOnly set-cookie: personalization_id="v1_HOsF8ww0d+FAO799hsGcuw=="; Expires=Sat, 30 May 2020 12:15:07 GMT; Path=/; Domain=.twitter.com set-cookie: guest_id=v1%3A152776890725282393; Expires=Sat, 30 May 2020 12:15:07 GMT; Path=/; Domain=.twitter.com set-cookie: external_referer=8e8t2xd8A2w%3D|0|S38otfNfzYt86Dak8Eqj76tqscUAnK6LsOQsnL6lsSZiPZzJFfYNVQ%3D%3D; Expires=Thu, 07 Jun 2018 12:15:07 GMT; Path=/; Domain=.twitter.com set-cookie: ct0=3ba686a590586c99a1d6c905633cf311; Expires=Thu, 31 May 2018 18:15:07 GMT; Path=/; Domain=.twitter.com; Secure status: 200 OK strict-transport-security: max-age=631138519 x-connection-hash: ae3e194cf571f17d6220f7fded786038 x-content-type-options: nosniff x-frame-options: SAMEORIGIN x-response-time: 103 x-transaction: 0087a08d00eab9ce x-twitter-response-tags: BouncerCompliant x-ua-compatible: IE=edge,chrome=1 x-xss-protection: 1; mode=block; report=https://twitter.com/i/xss_report

WSJ Central Banks on Twitter: "Only the currencies of Argentina, Brazil, Russia and Turkey have done worse than the rupee since the beginning of 2018 https://t.co/tkCCcHpbpG" Skip to content[1]-

Tweet with a location

You can add location information to your Tweets, such as your city or precise location, from the web and via third-party applications. You always have the option to delete your Tweet location history. Learn more[2]

...