Diamond News Archives

- Category: News Archives

- Hits: 1821

JPMorgan inherited an enormous short against silver when they absorbed the collapsing Bear Stears (who had initially made the bet) in the 2008 crisis.

Necessity is the mother of invention, and often, fraud. By continuing to short the stock on paper while simultaneously physically buying it, JPM managed to cover that short on the cheap and accumulate the single greatest stockpile of physical silver ever amassed in the history of the world.

It was such an airtight scheme that JPM has never, ever lost money shorting silver. Illegal? Sure. But when the largest and most prominent names in global finance all stand to gain millions and regulatory authorities are bought and paid for, who’s going to stop them?

The silver lining in all of this is that the most powerful bank in the world now owns more silver than any other entity ever has. Sooner or later you can bet they’re going to let the price of silver run higher. As high as they possibly can. And until they do, you can bet alongside them, to profit from the same trade, at bargain basement prices.

With the COMEX silver fraud, the list of those keeping the real facts in the dark is a mile long. Pitted against the insiders intent on keeping the COMEX silver fraud in the dark are mining companies and silver investors, the vast majority of which don’t have a clue about the fraud.

In this group are those who denied the silver manipulation early on and can’t face up to admitting they were wrong even as compelling new data proving fraud roll in. The surest proof of the COMEX silver manipulation fraud is the refusal of the insiders to openly discuss it.

The CFTC refuses to answer...

- Category: News Archives

- Hits: 1397

Witness the charts below that show how the current statistical “recovery”, benefiting the very few by inflating the price of risk assets, has come at the expense of the very many.

Almost nobody is a mental health facility because there is no funding for mental health facilities[1]. The poor and mentally ill are homeless or locked up. Most cruelly, the seriously mentally ill are locked in solitary confinement because they are unable to peaceably exist in general population[2]. Often in for-profit prisons[3], who make money for as long as they are detained, and who are legally allowed to detain them for as long as they deem them to be a threat to society, even after their actual sentence is served[4]. Indefinitely, even.

Even excepting the fact that almost 1 in 1,000 Americans is institutionalized, over half are functionally broke, with less than $1,000 in savings, unable to withstand any sort of moderate unsuspected cost, be it car repair, medical emergency, or otherwise.

Aggregate statistics and averages are so misleading as to be meaningless. Most Americans are in desperate straits, living paycheck to paycheck at best, and suffering day-to-day more often than government-cited numbers at all suggest.

The common suggestion, which we agree with, is to have at least 6 months of expenses in savings in case of an emergency. This stat that 39% have no savings lines up perfectly with the stat we discussed in a previous article which showed 41% of Americans don’t have the cash to deal with a surprise expense of $400.

You can’t deal with that type of expense without money in a savings account. This stat is more dire than the $400 Fed survey...

- Category: News Archives

- Hits: 1058

HTTP/1.1 200 OK Server: nginx/1.13.5 Date: Fri, 01 Jun 2018 16:15:03 GMT Content-Type: text/html; charset=UTF-8 Content-Length: 224281 Connection: keep-alive Vary: Accept-Encoding, Cookie Cache-Control: max-age=3600, public X-UA-Compatible: IE=edge Content-language: en X-Content-Type-Options: nosniff X-Frame-Options: SAMEORIGIN Expires: Sun, 19 Nov 1978 05:00:00 GMT Last-Modified: Fri, 01 Jun 2018 16:15:02 GMT ETag: W/"1527869702" X-Backend-Server: drupal-55f5c48f6d-fs8bs Age: 0 Varnish-Cache: HIT X-Cache-Hits: 2 X-Served-By: varnish-1 Accept-Ranges: bytes ...

Record 95.9 Million Americans Are No Longer In The Labor Force | Zero Hedge Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)

- Category: News Archives

- Hits: 1291

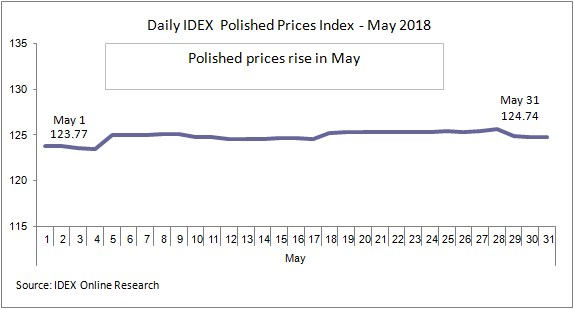

(IDEX Online News) – The IDEX polished diamond price index rose in May after a flat performance in April. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?> The Index began the month at 123.77 and ended at 124.74. <?xml:namespace prefix = "v" ns = "urn:schemas-microsoft-com:vml" /?>

(IDEX Online News) – The IDEX polished diamond price index rose in May after a flat performance in April. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?> The Index began the month at 123.77 and ended at 124.74. <?xml:namespace prefix = "v" ns = "urn:schemas-microsoft-com:vml" /?>  Outlook Trading was strong during May, and that appeared to be backed up by the ongoing robust demand for goods seen at sales by De Beers and ALROSA. De Beers reportedly raised prices at its May sales cycle where a provisional $550 million of rough was sold, making more than $2 billion of sales in the first five months of this year. Sales reported by ALROSA were at a similar level. Meanwhile, a report by De Beers pointed to a record high for global diamond jewelry sales in 2017 of $82 billion. Sales in the United States were the main driver for the increase, with a 4% rise on the year. Among the standout news items of the month was the decision by De Beers to launch a lab-grown diamond jewelry line which caused a widespread industry debate on the possible ramifications. For the full IDEX Online Research article, click here[1] References ^ here (www.idexonline.com) ...

Outlook Trading was strong during May, and that appeared to be backed up by the ongoing robust demand for goods seen at sales by De Beers and ALROSA. De Beers reportedly raised prices at its May sales cycle where a provisional $550 million of rough was sold, making more than $2 billion of sales in the first five months of this year. Sales reported by ALROSA were at a similar level. Meanwhile, a report by De Beers pointed to a record high for global diamond jewelry sales in 2017 of $82 billion. Sales in the United States were the main driver for the increase, with a 4% rise on the year. Among the standout news items of the month was the decision by De Beers to launch a lab-grown diamond jewelry line which caused a widespread industry debate on the possible ramifications. For the full IDEX Online Research article, click here[1] References ^ here (www.idexonline.com) ...

- Category: News Archives

- Hits: 1166

If you’ve never seen an out-and-out cattle stampede in person, it’s difficult to convey the power and the dynamics that drive it. But I’ll try.

First, you get a general sense of restlessness in the herd. The cattle snort, get jumpy, sway their heads…they’re nervous, and none of them are really sure why, except the rest of them seem to be nervous too. Which makes them all more nervous. Which makes them more agitated.

Then little pockets of cattle will start to lurch, move quickly, but not much, in one direction. They all get skittish, trying to figure out if this is really going to happen or not. The noise increases. You can almost feel the heat rise as the stress levels rise.

Then it breaks one way or the other. They all settle down, or one animal panic and really makes a break for it. Then, usually, it’s on. The other animals don’t know why this one decided to sprint in a mad dash in one direction, but they might not have time to think. It might be a predator. So more follow, and then all hell breaks loose.

They all go charging, thousands of tons unthinking panic, in one direction. Then they eventually stop. The reason they all stampeded, 99% of the time, is simple mass psychology. Plain primal fear. Driven by perception and nothing more.

It may be Italy, it may be something else. But the market is in the sidelong-glancing nervous phase right now. Something will spook someone enough that we see a gap-down plunge. Where will it stop, driven by algorithms blindly following? Anyone’s guess.

There could be bigger upside the more investors realize the full and global implications of Italy’s political turmoil.

Italian government...