Diamond News Archives

- Category: News Archives

- Hits: 1323

Gold traded modestly higher last night in a range of $1266.80 - $1271.15. It faded some weakness in the red-hot dollar, with the DX slipping from 94.88 to 94.43.

The greenback was pressured by some initial strength in the yen (110.08 – 109.86, firmer CPI, PMI, All Industry Activity Index), a firmer euro ($1.16 -$1.1675, stronger German and Eurozone PMI’s), and continued strength in the pound ($1.3240 - $1.3314, yesterday’s tilt to the hawkish side by the BoE still resonating), along with some profit-taking after a strong week.

Mostly firmer global equities were a headwind for gold, with the NIKKEI off 0.8%, the SCI up 0.5%, European markets were up 0.4% to 0.8%, and S&P futures were +0.5% - with news that the 35 biggest US banks passed the first round of the Fed’s stress tests supportive of equities.

Firmer oil (WTI $65.70 - $66.60, rumors that OPEC was leaning to only a moderate output increase) was also a tailwind for stocks.

After the NY open, S&P futures rose (+16 to 2768) on news from OPEC that the output increase – while announced at 1M bpd, would be effectively only a rise of 600k bpd as many of the members were already at capacity, and took WTI over $68.

The US 10-year yield moved up to 2.928%, and the DX rebounded to 94.81. Gold retreated in response, but found support at the overnight low at $1266.80.

AT 10 AM, a worse than expected reading on US Markit Manufacturing PMI (54.6 vs. exp. 56.1) took US stocks lower (S&P +5 to 2755). A tweet from Trump threatening new tariffs on the EU also weighed on stocks:

Based on the Tariffs and Trade Barriers long placed on the U.S. and it great companies...

- Category: News Archives

- Hits: 1311

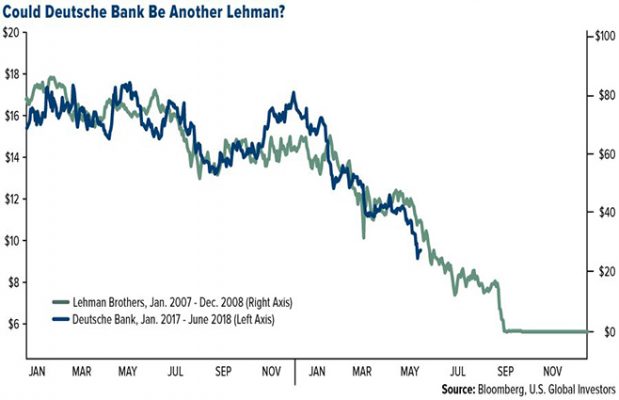

Deutsche Bank has been a global black swan for some time. Will it bring the global banking system down? All the more reason to have physical precious metals insurance in your hands. Not since Leman, this could get extremely ugly!

Deutsche Bank has almost triple those assets, $1.7 trillion, but its future is in question. The bank’s net income plummeted by 80 percent from its 2017 level.[1] The Federal Reserve has labeled Deutsche Bank’s US operation as troubled. And that might be an understatement.

The growing problems at Deutsche Bank, combined with unprecedented global debts, could spell economic and financial chaos

That is the reason gold is looking like an excellent investment against any future financial ripple effect. Deutsche Bank is suffering from a lack of faith for a reason. Gold could put investors’ minds at ease.

ORIGINAL SOURCE: Deutsche Bank could spell economic and financial chaos. Could this be why Germany has repatriated 583 tons of Gold?[2] by Tom Lewis of goldtelegraph.com[3] on 6/22/18...

References

- ^ 80 percent from its 2017 level. (global.handelsblatt.com)

- ^ Deutsche Bank could spell economic and financial chaos. Could this be why Germany has repatriated 583 tons of Gold? (www.goldtelegraph.com)

- ^ goldtelegraph.com (www.goldtelegraph.com)

- Category: News Archives

- Hits: 1175

The collection consists of 32 round diamonds, 0.3 carats each, named after the countries – participants of the World Cup. All diamonds are of high quality, D to F color and VVS2 to IF clarity, they were mined in Russia and cut by ALROSA's subdivision – DIAMONDS ALROSA, in keeping with the best traditions of the world-famous Russian cut.

Diamonds will be offered to natural persons and legal entities through the website www.diamondsofrussia.ru. If desired, the stone can be personalized with an engraving associated with the World Cup, or it can be given its own name. ALROSA will issue a special-design official certificate confirming characteristics of each diamond.

"Russia produces one-third of all rough diamonds in the world and is famous for its polished diamonds, which are yet another symbol of our country. We decided to provide the fans with the opportunity to take a tiny piece of Russia with them or to mark national teams and symbolic victories important for them not only with football anthems, but also with a unique diamond that will remain with them forever. The collections of stones have been selected so that they are affordable for a wide range of fans. Optionally, we can form sets from them," noted Pavel Vinikhin, Director of DIAMONDS ALROSA.

ALROSA today is the only diamond-mining company in the world with its own cutting subdivision, which allows guaranteeing absolute authenticity of a stone, its natural origin and mining in accordance with the highest standards of social and environmental responsibility. DIAMONDS ALROSA combine unique traditions of the Russian cut with the use of the up-to-date technologies, creating excellent quality diamonds – as for instance the Dynasty collection launched last year.

The post ALROSA launches football collection of diamonds on the occasion of the...

- Category: News Archives

- Hits: 1207

— Art Cashin in Cashin’s Comments

SUBSCRIBE TO THE DAILY FEATHER for only $25/month[1]

VIPs

VIPs

John Williams is now the second-most powerful leader inside the world’s most powerful central bank. If Jay Powell gets hit with the flu in a few months, it is Williams who directs interest rate policy. Williams has advocated for raising the inflation target off the 2% level they’ve failed to attain forever as it’s an ill-designed metric not meant to rise. Williams also advocated for further bond-buying (a.k.a. Quantitative Easing) and in the event all else fails, forward guidance. Williams’ SF Fed has extensively researched raising the inflation target to coerce a steepening in the yield curve. But is that even do-able? That also builds in higher inflation expectations across the term structure of interest rates, so long-end yields would rise. Raising the inflation target means the Fed doesn’t just tolerate higher prices, it tolerates higher costs and profits. But it falls flat in practice. If firms can’t raise prices, then either costs are cut, profits are squeezed, or companies’ balance sheets weaken due to the reduced cash or added leverage that stems from the higher-cost environment. The issue then becomes a credit problem. La plus ca change does not apply to the New York Federal Reserve’s John Williams. If you’re in the City, drop him a line. Today is his first day on the job since resigning his post as the President of the San Francisco Fed, where he’d been since 2002. New York

- Category: News Archives

- Hits: 1194

The European Union’s retaliatory tariffs on U.S. products came into force on Friday, the latest shots fired in what increasingly looks like a global trade war.

The EU, the world’s largest trading bloc, imposed levies on 2.8 billion euros ($3.3 billion) of American products in response to U.S. duties on its steel and aluminum exports that were justified on national security grounds.

“We did everything we could to avoid this situation, but now we have no choice but to respond,’’ said EU Trade Commissioner Cecilia Malmstrom. “It is frankly ridiculous that EU steel is considered a threat to U.S. national security. As longstanding allies of the U.S., we were disappointed, but not surprised.’’

The EU Strikes Back

Some 2.8 billion euros of U.S. goods are targeted in retaliatory tariff

Source: European Commission

The European reaction opens up another front in Washington’s battle to reshape its commercial relationship with the world. President Donald Trump has levies on $250 billion of Chinese goods in the pipeline and already placed duties on products from allies including Canada, Mexico and Japan.

The economic risks of tit-for-tat tariffs imposed by the world’s main trading blocs have created divisions among White House officials[1], with one faction seeking talks with China to take the heat out of the situation. Another group is determined to punish China, and the president himself, who was forced to reverse a high-profile immigration policy this week, has shown no signs of backing down.

Risk sentiment[2] benefited from signs that Washington may be seeking to calm tensions with China. European stocks rose, along with U.S. futures, while declines in Japanese and Hong Kong equities were offset by advances in their...