Diamond News Archives

- Category: News Archives

- Hits: 1443

HTTP/1.1 200 OK Server: Apache/2.4.6 (CentOS) PHP/7.0.15 X-Powered-By: PHP/7.0.15 Content-Type: text/html; charset=utf-8 X-Aicache-OS: 10.17.1.61:80 Cache-Control: max-age=15 Expires: Mon, 02 Jul 2018 12:15:19 GMT Date: Mon, 02 Jul 2018 12:15:04 GMT Transfer-Encoding: chunked Connection: keep-alive Connection: Transfer-Encoding Set-Cookie: region=USA; expires=Sun, 30-Sep-2018 12:15:04 GMT; path=/; domain=.cnbc.com Vary: User-Agent

EU warns of new tariffs worth $300 billion if Trump targets automakers

Guenter Schiffmann | Bloomberg | Getty Images

A worker performs the final check of a BMW 3-series automobile on the production line, March 11, 2009.

The United States could get a new round of retaliatory tariffs worth as much as $300 billion, if it moves ahead with new duties on European cars, the Financial Times[1] reported.

In a written statement to the U.S. Department of Commerce, seen by the news publication, the EU set out clear plans to respond to potential U.S. duties on European cars. According to the newspaper, European leaders[2] are getting more convinced that President Donald Trump will put new tariffs on European cars.

The written submission sent by the EU also highlighted that European-owned car brands represented more than a quarter of U.S. car production. It added that this was mainly focused on exportation and any tariffs would fragment markets, raise prices for the American consumer and potentially lead to job losses.

Speaking to Fox News over the weekend, Trump said that the EU is “possibly as bad as China, just smaller” when speaking on trade deficits with other countries. He added: “It is terrible what they do to us.”

Read the full Financial Times article here[3]....

- Category: News Archives

- Hits: 1276

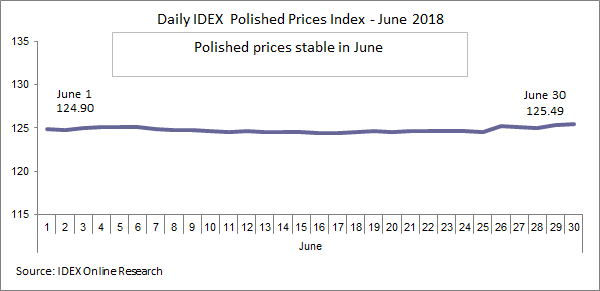

(IDEX Online News) – The IDEX polished diamond price index was stable in June, rising very slightly during the month.

The Index began the month at 124.90 and ended at 125.49.

Outlook

Diamond trading was robust during June, as seen by the ongoing robust demand for goods reported by De Beers and ALROSA.

De Beers sold a provisional $575 million of rough at its fifth sight of this year, making more than $2.5 billion of sales in the first six months of this year.

Bruce Cleaver, CEO, De Beers Group, said: "Sentiment in the diamond industry’s midstream is positive following the JCK Las Vegas trade show at the start of the month, and we continued to see good demand for our rough diamonds across the product range.”

Meanwhile, ALROSA also reported continuing strong sales, with sales of $2.26 billion of rough in the January to May period.

The Russian miner also reported a 7% jump in diamond jewelry sales in the first quarter of this year.

For the full IDEX Online Research article, click here

[1]...

- Category: News Archives

- Hits: 1691

(IDEX Online News) – Round diamonds saw a small number of changes in smaller stones of half a carat and less in June. There were decreases of 1-3% in diamonds of 0.90-0.99 carats, I-J, IF-VVS1, and also in 4.00-4.99 carats, D-F, VS2, while 5.00-5.99 carat stones, F-H, VS2, saw declines of 1-3%. Increases were noticeable in diamonds of 3.00-3.99 carats, G-I, VVS2-VS1, of 3%. Fancy diamonds also saw relatively few changes, particularly in the very smallest categories. There were decreases of 2-6% in stones of 0.30 to 0.39 carats, F-I, VVS2-SI1; and declines of 2-4% in 0.90-0.99 carat diamonds, H-J, SI3-I1. Meanwhile, there were increases in the 1.50-1.99 carat category, L-M , IF-VS1 of 2-3%; and in 4.00-4.99 carat diamonds, D, IF-VS2 and I1-I2 clarities. The following are some of the changes in this week's IDEX Online Diamond Price Report. To receive a free copy of the full IDEX Online Diamond Price Report, please email us at

(IDEX Online News) – Round diamonds saw a small number of changes in smaller stones of half a carat and less in June. There were decreases of 1-3% in diamonds of 0.90-0.99 carats, I-J, IF-VVS1, and also in 4.00-4.99 carats, D-F, VS2, while 5.00-5.99 carat stones, F-H, VS2, saw declines of 1-3%. Increases were noticeable in diamonds of 3.00-3.99 carats, G-I, VVS2-VS1, of 3%. Fancy diamonds also saw relatively few changes, particularly in the very smallest categories. There were decreases of 2-6% in stones of 0.30 to 0.39 carats, F-I, VVS2-SI1; and declines of 2-4% in 0.90-0.99 carat diamonds, H-J, SI3-I1. Meanwhile, there were increases in the 1.50-1.99 carat category, L-M , IF-VS1 of 2-3%; and in 4.00-4.99 carat diamonds, D, IF-VS2 and I1-I2 clarities. The following are some of the changes in this week's IDEX Online Diamond Price Report. To receive a free copy of the full IDEX Online Diamond Price Report, please email us at - Category: News Archives

- Hits: 2549

Tord M. (aka Graddhy) Commodities TA+Cycles on Twitter: "$GOLD, weekly Looking at the two dotted, exactly the same length, purple lines it is no surprise from this chart either that we get a major low right here. The two Vs are at exactly the same distance from the centre. Symmetry - the charts often loves it.

- Category: News Archives

- Hits: 1378

Ronald-Peter Stöferle discusses why recessions can be good for precious metals. They are monitoring various leading inflation indicators which they say have reached a maximum. They document this in their report which you can find here. https://ingoldwetrust.report[1]

There is massive inflation beginning to show up, and they detail that in the report. This year they have identified three significant changes.

Globally central bank monetary policy seems to be growing hawkish as they tighten policy. This year the Fed will reduce their balance sheet by 430 billion. The liquidity that we all got used to is ending and people are at risk of underestimating the effects of this tightening.

Secondly, de-dollarization continues with countries like Russia having sold a lot of treasuries and continue to accumulate gold. The Petro-Yuan is now a major factor that helps countries to circumvent the US Dollar.

Lastly, there is a technological shift with new technology such as bitcoin and cryptocurrencies. He feels that they are just competition for gold and could become a potent tool for improving the usability of gold....

References

- ^ https://ingoldwetrust.report (www.youtube.com)