Diamond News Archives

- Category: News Archives

- Hits: 1146

On current evidence, the short-term outlook for American foreign trade is not good for reasons of (a) different growth dynamics, (b) confrontational trade policies and (c) the political and security fallout exacerbated by intensifying trade disputes.

Barring an inflation-induced recession, of which more later, the U.S. aggregate demand components — household consumption, residential investments and business capital outlays — are underpinned by high employment, increasing inflation-adjusted after tax incomes, low credit costs and targeted fiscal incentives.

An anticipated economic growth in the area of 2.5 to 3.0 percent for the rest of this year would still be more than an entire percentage point above the estimated non-inflationary potential of the U.S. economy. That strong demand pressure will continue to spill over into the rest of the world, and will support America’s vigorous imports of foreign goods and services.

That’s music to European and Chinese ears.

The Europeans — more specifically, export-driven German businesses — are looking forward to increasing American sales at a time when the EU growth has topped out and expected to decelerate in the months ahead.

The Chinese could do things differently to reduce their unsustainably large dependence on U.S. markets. China can use more of its output to serve rapidly expanding domestic markets. It can also step up the geographical diversification of its export sales. Instead of that, China continues to flood American markets with its goods and services, pocketing a gigantic $375 billion surplus on American trades and apparently paying no attention to Washington’s warnings over the last two years.

But the time for warnings is over. Washington has now initiated a flurry of trade tariffs and sanctions affecting large segments of European and Chinese economies.

It seems that the Europeans, led by Germany, are relenting....

- Category: News Archives

- Hits: 1211

HTTP/1.1 200 OK Expires: Tue, 27 Apr 1971 19:44:06 EST X-Frame-Options: SAMEORIGIN Content-Type: text/html; charset=utf-8 Cache-Control: no-cache Strict-Transport-Security: max-age=31536000 X-Content-Type-Options: nosniff P3P: CP="This is not a P3P policy! See http://support.google.com/accounts/answer/151657?hl=en for more info." X-XSS-Protection: 1; mode=block; report=https://www.google.com/appserve/security-bugs/log/youtube Date: Mon, 09 Jul 2018 12:15:04 GMT Server: YouTube Frontend Proxy Set-Cookie: YSC=sEMhWTpRjTQ; path=/; domain=.youtube.com; httponly Set-Cookie: VISITOR_INFO1_LIVE=Orud158UwWA; path=/; domain=.youtube.com; expires=Sat, 05-Jan-2019 12:15:04 GMT; httponly Set-Cookie: PREF=f1=40000000; path=/; domain=.youtube.com; expires=Sun, 10-Mar-2019 00:08:04 GMT Set-Cookie: GPS=1; path=/; domain=.youtube.com; expires=Mon, 09-Jul-2018 12:45:04 GMT Alt-Svc: quic=":443"; ma=2592000; v="43,42,41,39,35" Accept-Ranges: none Vary: Accept-Encoding Transfer-Encoding: chunked

Daniel Lacalle on Why Central Banks are Trapped - YouTubeWatch Queue

Queue

__count__/__total__

Rating is available when the video has been rented.

This feature is not available right now. Please try again later.

Published on Jul 6, 2018

Daniel Lacalle joins Jeff Deist to discuss how and why central banks are trapped, stuck with ultra-low interest rates and expansionary policies that produce astonishingly little real growth. This is a hard-hitting and sober look at what rising interest rates will mean, why academics and bankers are so clueless about the monetary side of financial markets, and why Austrians need to offer real-world solutions instead of ideology....

- Category: News Archives

- Hits: 1225

Right when the soccer fever is at its peak with the last matches of the World Cup 2018 quickly approaching, Russian giant Alrosa (MCX:ALRS) unearthed a diamond shaped as a soccer ball.

The 0.50-carat stone was found at the company’s Karpinskaya-1 pipe, located in the northern Arkhangelsk Region and operated by the miner’s subsidiary Severalmaz.

"Nature creates different whimsical shapes, but it’s the first time that we came across a diamond looking just like a soccer ball,” the world’s top diamond producer by output said in a statement.

Alrosa will name the diamond after Igor Akinfeev, Russia’s goalkeeper.

Being one of the main sponsors of the sports event taking place in its own country, the diamond producer also launched a "football" collection of 32 special size rough diamonds, which represent each of the countries taking part in the tournament.

The rocks will be auctioned in Moscow and among them, there is a large rough diamond weighing 76.53 carats, whose name is being chosen by fans in an online contest.

The post Alrosa unearths diamond shaped as soccer ball appeared first on MINING.com....

- Category: News Archives

- Hits: 1316

Share this page with your friends:

Print[1]Please note: The Frank Talk articles listed below contain historical material. The data provided was current at the time of publication. For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance[2] page.

July 5, 2018

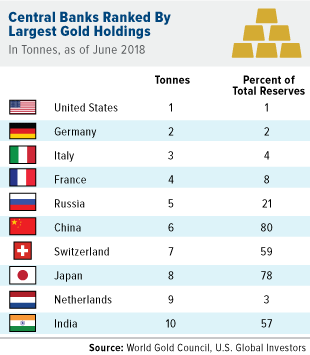

Beginning in 2010, central banks around the world turned from being net sellers of gold to net buyers of gold. Last year official sector activity rose 36 percent to 366 tonnes – a substantial increase from 2016.

|

The top 10 central banks with the largest gold reserves have remained mostly unchanged for the last few years. The United States holds the number one spot with over 8,000 tonnes of gold in its vaults – nearly as much as the next three countries combined. For six consecutive years the Russian Central Bank has been the largest purchaser of gold, increasing its holdings by 224 tonnes in 2017 and overtaking China to hold the fifth spot, according to the GFMS Gold Survey[3].

Not every central bank is a net buyer. For the second year in a row, Venezuela has been the largest seller of gold, with 25 tonnes sold last year to help pay off debt. However, gross official sector sales declined by 55 percent last year, to the lowest since 2014, indicating that central banks are happy to keep their reserves in gold, historically viewed as a safe-haven asset.

2018 could be another strong year for central bank gold demand. According to the World Gold Council[5] (WGC), demand in the first...

- Category: News Archives

- Hits: 1008

The International Institute of Diamond Grading & Research (IIDGR), part of De Beers Group, is pleased to announce that its ground-breaking synthetic diamond screening device, SYNTHdetect, has been shortlisted as a finalist for Industry Innovation of the Year in this year’s JNA Awards.

SYNTHdetect, launched last year, is the first synthetic diamond screening device to simultaneously test multiple stones in set jewellery and has the industry’s lowest referral rate at around 0.05 per cent. The device thereby significantly increases efficiency and reduces costs for retailers and manufacturers when it comes to ensuring they do not buy any undisclosed synthetic diamonds.

Jonathan Kendall, President, IIDGR, said: “We’re delighted that SYNTHdetect has been shortlisted in this year’s JNA Awards. SYNTHdetect was developed using IIDGR’s proprietary technology and it’s wonderful to see our scientists recognised for their innovation through this nomination. We are very proud of this device’s pioneering approach to screening for synthetic diamond content and continue to receive excellent feedback from our customers.”

The awards shortlisting process involved three rounds, including a visit by the judges to IIDGR’s lab in Surat, India, for a demonstration of SYNTHdetect in action.

Winners will be announced at the JNA Awards Ceremony and Gala Dinner on 16 September during the Hong Kong Jewellery & Gem Fair. The JNA Awards champion best business practices in the jewellery and gemstone community by recognising and promoting companies and individuals that demonstrate outstanding leadership, innovative thinking, and sustainable and socially responsible strategies, with a focus on their contribution in Asia, and whose ideas and actions have made a positive impact in the trade and communities.

About the International Institute of Diamond Grading & Research (a member of De Beers Group)

The International Institute of Diamond Grading & Research has been established...