Share this page with your friends:

Print[1]Please note: The Frank Talk articles listed below contain historical material. The data provided was current at the time of publication. For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance[2] page.

July 5, 2018

Beginning in 2010, central banks around the world turned from being net sellers of gold to net buyers of gold. Last year official sector activity rose 36 percent to 366 tonnes – a substantial increase from 2016.

|

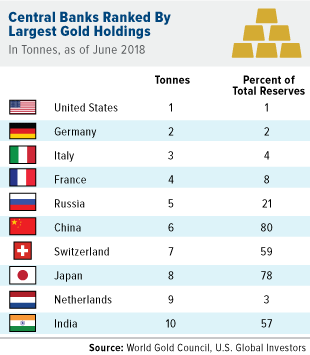

The top 10 central banks with the largest gold reserves have remained mostly unchanged for the last few years. The United States holds the number one spot with over 8,000 tonnes of gold in its vaults – nearly as much as the next three countries combined. For six consecutive years the Russian Central Bank has been the largest purchaser of gold, increasing its holdings by 224 tonnes in 2017 and overtaking China to hold the fifth spot, according to the GFMS Gold Survey[3].

Not every central bank is a net buyer. For the second year in a row, Venezuela has been the largest seller of gold, with 25 tonnes sold last year to help pay off debt. However, gross official sector sales declined by 55 percent last year, to the lowest since 2014, indicating that central banks are happy to keep their reserves in gold, historically viewed as a safe-haven asset.

2018 could be another strong year for central bank gold demand. According to the World Gold Council[5] (WGC), demand in the first...