Diamond News Archives

- Category: News Archives

- Hits: 1105

World-beating investments are made with sweaty palms, gritted teeth, and through a serious twinge of crippling nausea.

Looking at historical charts is both informative and misleading. Static in their stately, frozen-in-time way, past market crash chaos is presented in a frozen snapshot, absent the blood-in-the-streets, fight-or-flight mania that accompanied it.

Whether or not you are conscious of it, your brain is sizing up these charts and telling you one thing: “I could have seen it coming. It’s pretty obvious in retrospect. So this time, I’ll just wait for the bottom, then buy.”

A siren song. An utter fiction. A simple, rote impossibility.

Exact market bottoms are forged in a maelstrom of a thousand different entropic factors. For example, on the one hand, emotional investor fear-selling reaches a wild crescendo, while on the other, the unblinking and emotionless algorithms that trigger margin liquidation eviscerate over-leveraged portfolios at the lows.

We forget, so fast. At the time, our brains were screaming at us: “Whatever you do, do not buy! Everything has plummeted for days and will continue to plummet for days! Or weeks! OR MAYBE FOREVER!”

It’s not willful, it’s chemical. What’s one of the human behaviors that displays the most similar greed/fear chemical response in the brain (you know, the ones that push you to buy high and sell low) that investing does? The one that makes you heedless of risk, makes you throw good money after bad, and chase, chase, chase those already-in-the-past outsized risk-asset returns?

Cocaine use.[1]

I don’t need to convince you not to invest while you’re high. But it can be more difficult (and here’s where ‘willful’ comes in) to fully appreciate how it is in your best interest to do exactly the opposite of whatever your...

- Category: News Archives

- Hits: 1443

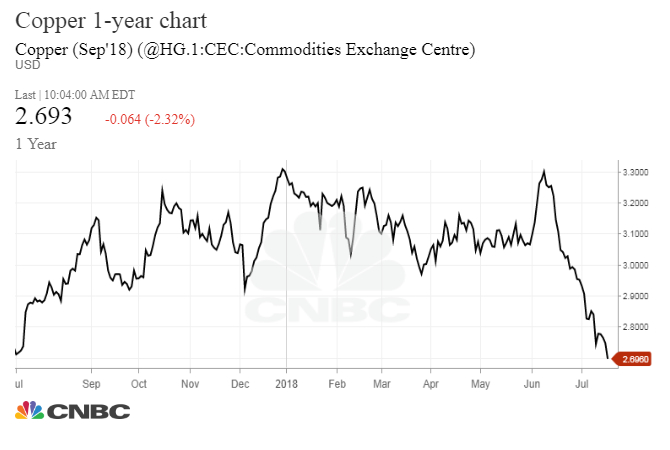

Copper prices[1] reached their lowest levels in a year on Thursday amid concerns that a global trade war could strain global supply chains and slow down the global economy.

The metal's futures for September delivery traded as low as $2.6735 per pound, their lowest since July 14, 2017, when it hit $2.663. Copper traded at $2.691 at around 9:50 a.m., down more than 2 percent.

"Dr. Copper," as it is sometimes referred to by economists and finance experts, is often seen as a leading indicator of future economic trends since it is used in a number of different sectors. Copper is used in home construction and consumer products, as well as manufacturing.

The U.S. has levied tariffs on steel and aluminum imports from China, the European Union and Mexico. The EU, China and Mexico have retaliated with tariffs of their own.

The U.S. has levied tariffs on steel and aluminum imports from China, the European Union and Mexico. The EU, China and Mexico have retaliated with tariffs of their own.

“Demand still looked very good, [but] as the year unfolded, trade tensions started to weigh on growth,” said Suki Cooper, precious metals analyst at Standard Chartered.

The metal was also approaching bear-market territory as it traded nearly 20 percent off its 52-week high. Copper shot up nearly 32 percent last year as investors bet on synchronized global economic growth around the world.

Analysts at Citi, however, think that copper is setting up to be a buy for investors. "The ongoing major sell-off, driven by escalating trade frictions between the US and China, is setting up a longer term buying opportunity. Here we look beyond the potential trade war to longer term copper market fundamentals and we find that current prices ... are nowhere near high enough to enable the market to clear," they said.

— CNBC's Gina Francolla, Patti Domm and Jeff Cox contributed to this report....

- Category: News Archives

- Hits: 1601

Oh, what a tangled web we weave when

first we practice to deceive!

– Walter Scott

When I taught in night school my professor insisted I attend a full-day conference on “Effective Teaching Methods”. The speaker list was full of well accredited academics.

When I taught in night school my professor insisted I attend a full-day conference on “Effective Teaching Methods”. The speaker list was full of well accredited academics.

The morning consisted of 3-4 speakers outlining their intellectual theories. They rambled on, under the illusion the audience was enthralled with their brilliance.

The afternoon speaker told a story of a father and young son at a graduation ceremony. The boy looked at the program and asked, “What does BS, MS and PhD mean after their names?”

Dad thought for a moment and said,

| “Son, everyone knows what BS is. Well, MS is just more of the same. At the top designation is PhD, meaning piled higher and deeper!” |

Most of us roared with laughter as we stood and applauded, while others nervously shifted around in their seats.

|

Help keep us on the air! We’re committed to keeping our weekly letters FREE. It’s humbling when readers suggested we add a donations button to help us offset the costs. It’s strictly voluntary – no pressure – no hassle! Click the DONATE button below for more information. And thank you all! PS: You do not have to sign up for PayPal to use your credit card. |

The investor’s challenge

Unfortunately, many investors must sort through too much BS that is attempting to deceive the public.

This week’s reading stack included eleven articles – like this...

- Category: News Archives

- Hits: 1488

Finding the right fit is as important as having the right budget when it comes to home ownership. The survey found that about half of millennials had regrets about the home itself.

One in five said they were frustrated by damages they found after moving in, while others said they discovered the house didn't end up working well for their family.

To avoid unexpected expenses, experts recommend getting a home inspection before finalizing the sale. "Especially if you're a first-time buyer or new to home ownership, you may not even know what to look for, so you definitely want to have the expert on your side," Hale says.

It can also help to nail down what you really need in a home. Make a list of your must-haves before you start looking and know what you're willing to compromise on, Hale says. It's currently a very competitive market, so chances are, you're going to have to make compromises.

In fact, about two-thirds of home buyers reported compromising on some sort of home characteristic, according to a survey from the National Association of Realtors[1].

"The more targeted your search is," Hale says, "the more chance you won't waste your time or get distracted by homes that ultimately aren't a good fit for you." Follow this advice, and you can avoid purchasing a home that you regret.

Don't miss: How an often overlooked part of owning a home can cost you an extra $6,000 or more a year [2]

Like this story? Subscribe to CNBC Make It on YouTube![3]...

- Category: News Archives

- Hits: 1700

Anglo American’s De Beers has bought Canada’s Peregrine Diamonds (TSE:PGD), the company behind the Chidliak mine in the Canadian territory of Nunavut, as the world’s largest roughs producer by value needs to replace its closing mines in the country.

The Cdn$107 million-deal ($87m) extends De Beer’s footprint in Canada’s frozen north beyond the Gahcho Kué joint-venture, which recently achieved full production.

The Chidliak resource, discovered in 2008, has an inferred resource of 22-million carats and needs about Cdn$455m to bring into production.

“With a strong outlook for consumer demand, we are seeking new opportunities to invest in our future supply potential and look forward to growing our portfolio in Canada,” De Beers CEO Bruce Cleaver said in the statement.

Canada produces approximately 10% of world’s overall diamond output by volume and about 15% by value.

More to come…

The post De Beers buys Canada’s Peregrine Diamonds for $81 million appeared first on MINING.com....