Diamond News Archives

- Category: News Archives

- Hits: 1117

And of course all real estate is local, so certain markets are tipping faster than others. In San Diego, 20 percent of all listings had a price cut in June, up from 12 percent a year ago. In Seattle, which continues to be the hottest market in the nation, 12 percent of all listings had a cut, the largest share in nearly four years.

In Austin, Texas, also a very strong housing market thanks to a recent influx of technology jobs, more homes are seeing price cuts as well.

"We saw intense bidding on homes over the past few years, but that is calming down with more inventory in the area," said B Barnett, a real estate agent at Reilly Realtors in Austin. "Our inventory of homes is going up with new construction, and it is helping transfer power back to the buyer."

Barnett, who said about 60 percent of her clients are relocating into the Austin market, is still seeing multiple offers, but there are fewer bidding wars, meaning prices are no longer out of reach. Buyers, she said, are getting negotiating power back and some are even able to get repairs in the deal. For the past few years, in most hot markets, buyers had to take what they could get — no contingencies.

There are still some markets where prices gains are increasing, but those are markets that have seen smaller price growth in the past few years. San Antonio, Phoenix, Philadelphia and Houston had fewer listings with a price cut in June compared with a year ago.

Among the largest housing markets, San Jose, CA, Indianapolis, IN and Charlotte, NC could see price growth slow the most over the next year, according to Zillow....

- Category: News Archives

- Hits: 1166

(IDEX Online) – ALROSA, the world's leading rough diamond miner by volume, has tested a payment mechanism with foreign clients using the Russian currency. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

In the experiment, transactions were conducted with clients from China and India. If necessary, the company is ready to use this payment scheme in rubles in the future, the miner said.

The Chinese company paid for the goods purchased at the auction for special-size rough diamonds (+10.8 carats) held by ALROSA in Hong Kong in June. By agreement with the winner of one of the lots, the contract provided for the payment in Russian rubles instead of US dollars. Payment was made through the VTB bank branch in Shanghai.

Besides, ALROSA's long-term client from India paid for one of the scheduled diamond supplies under the contract in Russian rubles. In this case, the buyer transferred the amount in rubles from his account in another Russian bank.

According to Evgeny Agureev, Director of USO ALROSA, payment via foreign branches of Russian banks makes it possible to speed-up and simplify the payment process, as there is no more need to use correspondent accounts with other banks.

"The practice in the international rough diamond market provides for settlements in US dollars between sellers and buyers of rough diamonds. We have tested an alternative payment scheme to understand the possibility of its implementation and nuances to be taken into consideration. The experience is positive, so we will apply it on an as-needed basis," said Agureev.

He noted that ALROSA's Supervisory Board instructed the company's management to consider the...

- Category: News Archives

- Hits: 1198

GABORONE, Aug 15 (Reuters) – Sales at Botswana's state-owned Okavango Diamond Company (ODC) fell 16 percent in the first half of 2018 to $260 million, its managing director said, citing a high comparison base against last year's record growth.

Marcus ter Haar said the company sold 1.778 million carats in the first half of 2018 compared with 1.808 million carats in the same period last year.

"A favourable rough diamond market over this period has meant ODC has generated healthy sales for the first half of 2018 despite not being able to offer larger volumes to our customers compared to the same period in 2017," he said.

Ter Haar said customers from the United States and Far East largely drove demand in the six months through June.

Looking ahead, he said sales for the remainder of 2018 were unlikely to be as strong as in the first half due to an anticipated cyclical downturn in the market. Sales for the remainder of 2018 were unlikely to be as strong.

"Current indications suggest that a seasonal slowdown in the diamond market has now begun which will have somewhat of a dampening effect on the promising first half," he said.

ODC, which holds ten sales auctions each year, sells 15 percent of Debswana's production as Botswana develops its own price book through the independent window outside of De Beers' channels to gauge the market.

Debswana, a joint venture between Anglo American's De Beers and Botswana, recorded a 9 percent jump in production in the first half of 2018 to 12.08 million carats.

(Writing by Tiisetso Motsoeneng; Editing by Mark Potter)

The post First-half diamond sales down 16 percent at Botswana's Okavango appeared first on MINING.com....

- Category: News Archives

- Hits: 1428

Venezuela is set to begin using its "petro" cryptocurrency as an official accounting unit, according to the country's president.

ABC International reported[1] the development on Tuesday, citing a televised announcement by President Nicolas Maduro, who first unveiled the petro back in December[2]. As part of the change, the state oil and gas company Petróleos de Venezuela (PDVSA) will reportedly begin using the[3] petro as a mandatory accounting unit.

The moves come as Venezuela's government seeks to combat growing economic turmoil by relaxing its currency controls, according to an August 7 report from CNBC[4]. On August 20, for example, the government will seek to revalue its currency, the bolivar, and create a "sovereign bolivar."

In turn, the central bank will begin publishing the price of the sovereign bolivar as it relates to the petro "and the price of the petro according to international currencies," ABC reports. Similar moves will see the country's salary and pension systems tied to the petro's value.

Since its debut, the petro has proven to be highly controversial, drawing attacks[5] from opposition politicians within Venezuela as well as those in the U.S and abroad.

In March, the Trump administration barred[6] U.S. citizens from transacting in the petro as part of a series of new sanctions against the South American country.

Image via Shutterstock

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies[7]. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

...

- Category: News Archives

- Hits: 1168

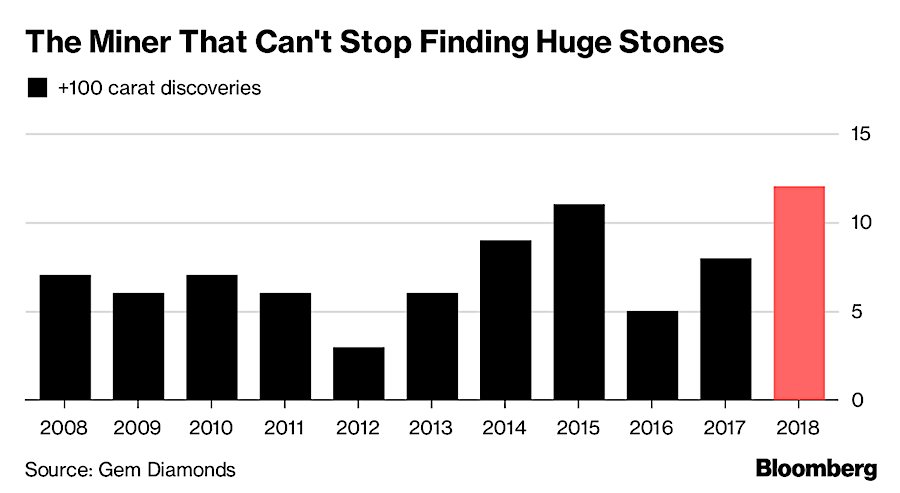

Africa-focused Gem Diamonds (LON:GEMD) must be getting used to recovering huge precious rocks from its flagship Letšeng mine in Lesotho, as it has just dug up another massive one.

The 138-carat, top white colour Type IIa diamond is 12th diamond over 100 carats the company finds this year, beating the 11 it dug up in 2015.

The largest diamond found this year is a 910-carat D colour type IIa diamond, about the size of two golf balls, which was named the “Lesotho Legend.” It became the second largest recovered in the past century and sold for $40 million at an auction in March.

Since acquiring Letšeng in 2006, Gem Diamonds has found now five of the 20 largest white gem quality diamonds ever recovered, which makes the mine the world’s highest dollar per carat kimberlite diamond operation.

At an average elevation of 3,100 metres (10,000 feet) above sea level, Letšeng is also one of the world’s highest diamond mines.

The biggest diamond ever found was the 3,106-carat Cullinan, dug near Pretoria, South Africa, in 1905. It was later cut into several stones, including the First Star of Africa and the Second Star of Africa, which are part of Britain's Crown Jewels held in the Tower of London.

Lucara’s 1,109-carat Lesedi La Rona was the second-biggest in record, while the 995-carat Excelsior and 969-carat Star of Sierra Leone were the third- and fourth-largest.

The post Gem Diamonds big discoveries reach a dozen appeared first on MINING.com....