Diamond News Archives

- Category: News Archives

- Hits: 1172

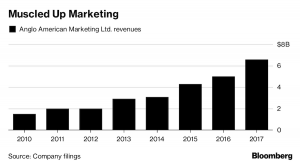

Anglo American Plc has quietly become a commodities trader.

In just five years, the century-old miner assembled marketing operations that now sell more metals than the company produces. Yet the trading business gets barely a mention at presentations by Anglo executives or in analyst reports, taking a back seat to mines that produce everything from copper and platinum to diamonds.

Anglo’s move into trading goes against a long-standing industry maxim: miners don’t trade. For much of the last two decades, investors wanted producers’ shares to track soaring metals prices and resisted anything that might get in the way. The orthodoxy was challenged when Glencore Plc broke into the big leagues of global mining with the acquisition of Xstrata in 2013, roughly when Anglo started building its trading unit.

Trading its own production allows Anglo to save money and get insight into metals markets, said Peter Whitcutt, the company’s head of marketing. It’s built a network that stretches from the mine gates of platinum in South Africa to copper high in the Andean mountains, funneling almost everything it digs up through a central hub in Singapore.

From there, it made sense to buy and sell minerals produced by others as well, and the company could even go a step further and start taking financial bets, in addition to trading the physical metal, he said.

“We have great customer relationships and we can move product around the world. Why wouldn’t we put other people’s material through our system?” Whitcutt said in an interview. “As we become more comfortable with it institutionally, it may be that the best way we can express a view is financially rather than physically.”

The Numbers:

Last year, $6.6 billion of commodities flowed through Anglo’s main marketing...

- Category: News Archives

- Hits: 1244

(IDEX Online) – The Bharat Diamond Bourse (BDB) in Mumbai says more than 300 visitors from India and overseas have already registered for the second edition of the Bharat Diamond Week at the bourse, to take place from October 8-10. Hundreds more buyers are expected to register in the countdown to the expanded polished diamond fair. The inaugural show, held from April 23-25, was attended by more than 1,000 visitors from India and across the world who did business with 100 Indian exhibitors of polished goods.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

In addition, the BDB is providing flight tickets to selected buyers to create more sales opportunities for the 100 Indian polished diamonds companies who will be exhibiting at the show. The buyers who have been selected are from Turkey, Thailand and India. The bourse will also be providing 150 rooms for international buyers at a hotel close to the showgrounds.

Bharat Diamond Bourse Vice-President Mehul Shah, who heads the Bharat Diamond Week project, said: “As part of our strategy for creating a show that will provide many more sales opportunities for our diamond manufacturing and exporting firms, we have carefully chosen major buyers who we want to see at the Bharat Diamond Week. We want them to become acquainted with our exhibitors, and with the Indian diamond industry in general. That is why we decided to bring 50 select buyers here."

BDB President Anoop Mehta said: "Registration for the show is moving ahead strongly, and we expect to see a larger number of visitors/buyers than at the first edition. For any foreign firms that have not been to India before, I would say this...

- Category: News Archives

- Hits: 1245

De Beers, the world’s top diamond producer by value, has unveiled a new device to detect whether that bling ion your piece of jewellery is or not a man-made stone, in an effort to bring greatest transparency to the synthetics market.

The SYNTHdetect XL, and an advanced version of a screening device De Beers launched last year, has a larger base unit that allows multiple volumes of jewellery to be screened simultaneously.

The technology allows users to scan larger necklaces, multiple solitaire rings and multiple bracelets, while retaining the ease of use of the original device, said Jonathan Kendal, President of The International Institute of Diamond Grading & Research (IIDGR), a division of De Beers Group.

The world’s top diamond producer by value has led industry efforts to both verify the authenticity of diamonds and ensure they are not from conflict zones.

Anglo American’s De Beers has led industry efforts to both verify the authenticity of diamonds and ensure they are not from conflict zones where gems may be used to finance violence.

Earlier this year, it announced it had successfully tracked 100 high-value diamonds from miner to retailer using its end-to-end blockchain system Tracr. The event was the first time a diamond’s journey had been digitally-tracked along the supply chain.

Shortly after, the company announced a shocking decision to start selling jewellery containing synthetic diamonds rather than mined ones, for the first time in its 130-year history.

The pivotal shift for the world’s No.1 diamond producer, which vowed never to sell synthetic stones, was followed by another unusual move. Last week, De Beers let customers delay acquiring smaller stones, which took a toll on its sales.

Based on the miner’s own analysis, consumer demand...

- Category: News Archives

- Hits: 1181

Anglo American’s De Beers said Thursday it had completed the acquisition of Peregrine Diamonds, the company behind the Chidliak project in the Canadian territory of Nunavut, as the world’s largest roughs producer by value needs to replace its closing mines in the country.

The C$107 million-deal ($82m), announced in July, extends De Beer’s footprint in Canada’s frozen north beyond the Gahcho Kué joint-venture, which recently achieved full production.

Diamond giant has gained the Chidliak diamond project in Canada, which hosts at least 74 kimberlites, eight of which are potentially economic.

The Chidliak resource, discovered in 2008, is located on Baffin Island about 120km from Iqaluit, the capital of Nunavut. The asset hosts at least 74 kimberlites (eight of which are potentially economic) and has an inferred resource of 22-million carats, but needs about Cdn$455m to come online.

“We are very pleased to complete the addition of the Chidliak resource to De Beers Group’s world-leading diamond resource portfolio, and to extend our presence in Canada,” chief executive Bruce Cleave said in the statement.

Based on studies by Peregrine, Chidliak would take 2.2 years to pay back its capital and have pre-tax cash flow of Cdn$2bn over its 13-year life of mine.

Peregrine Diamonds was founded by Eric Friedland, brother of mining legend Robert Friedland, who was involved in the development of assets such the Oyu Tolgoi copper mine in Mongolia and Voisey’s Bay nickel mine in Canada.

Canada produces about 10% of world’s overall diamond output by volume and about 15% by value. The country has historically provided De Beers leverage when it negotiates sales rights with host governments in southern Africa, especially Botswana, where the diamond giant has its two largest mines.

The post...

- Category: News Archives

- Hits: 1219

(IDEX Online) – ALROSA, the world's largest diamond mining company, sold 166 gem-quality lots of special size large diamonds (weighing over 10.8 carats) with a total weight of 2,611 carats in Israel for $15.6 million.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

Firms from Russia, Israel, Belgium, India, Hong Kong, UAE and the US participated in the auction. 45 companies were recognized as winners in different auction positions.

“The auction ended with good results – the starting price was exceeded by 1.5 times," said Evgeny Agureev, the Member of the Executive committee, Director of the USO ALROSA. "This indicates a stable demand for our products not only in Israel, where the auction took place, but also in other major diamond trade centers. In 2018, ALROSA held five auctions in Israeli to sell large-size rough diamonds, having already raised about $70 million,” he added.

Under Russian law, diamonds of special sizes – weighing over 10.8 carats – can only be sold at auctions. ALROSA is going to hold one more auction in the Israel in November 2018....