Diamond News Archives

- Category: News Archives

- Hits: 1122

Throughout the Hidden Secrets of Money series, Mike Maloney has taken you on a detailed tour of monetary history and shown how politicians and central bankers have made the same crucial mistakes time and time again.

Yet despite these centuries of compelling evidence about what not to do, the parallels between past policy errors that resulted in world-changing fiscal and social upheaval, and present-day political trends, are perhaps more striking than ever.

Join us Monday, October 29th at 8PM Eastern/5PM Pacific for the premiere of Episode 9 of Hidden Secrets of Money.

Then Tuesday, October 30th at 8PM Eastern/5PM Pacific, join us for the premiere of HSOM Episode 10.

Mike will be live-answering your questions both nights!

To be automatically notified when new content and episodes are added, play the video above, then click the 'SUBSCRIBE' button in the lower right corner of the video screen. And be sure to check out GoldSilver's YouTube page[1] for more HSOM content.

...

References

- ^ GoldSilver's YouTube page (youtube.com)

- Category: News Archives

- Hits: 1109

(IDEX Online) – De Beers reported that rough diamond production for Q3 decreased 5% to 8.7 million carats due to planned volume reductions in Botswana (Debswana) and South Africa (DBCM).<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

In Botswana, production declined 6% to 5.7 million carats due to the planned processing of lower grade material at Jwaneng. Production at Orapa remained in line with Q3 2017 at 2.6 million carats.

In Namibia production was flat at 460,000 carats.

In South Africa production decreased 14% to 1.3 million carats due to a planned shutdown at Venetia to upgrade the processing plant ahead of the transition from open cut to underground operations.

Production increased 5% to 1.2 million carats, driven by higher grades at Victor, which is approaching the end of its life. Gahcho Kué production was in line with Q3 2017.

Rough sales volumes were 5.0 million carats (4.6 million carats on a consolidated basis) from two sales cycles in Q3 2018, compared with 6.9 million carats (6.5 million carats on a consolidated basis) from two sales cycles in Q3 2017. Rough sales volumes were down as a result of sightholders being given the opportunity during the seventh Sight of 2018 to re-phase the allocation of some smaller, lower value rough diamonds. Rough sales revenues were broadly in line with Q3 2017.

Full Year Guidance

Full year production guidance remains at 34 to 36 million carats but is expected to be at the higher end of the range....

- Category: News Archives

- Hits: 1282

Today, economy watchers were treated to more of the same from the housing market. That is, more weak numbers suggesting we may have seen the peak in housing activity for the cycle. This fits with our earlier analysis[1] that higher lending rates – a function of both long-term government bond yields and short-term funding costs for banks – are starting to permeate one of the most cyclical areas of the economy. It is the consequence of monetary policy tightening, which as we know produces its intended effects with “long and variable lags”.

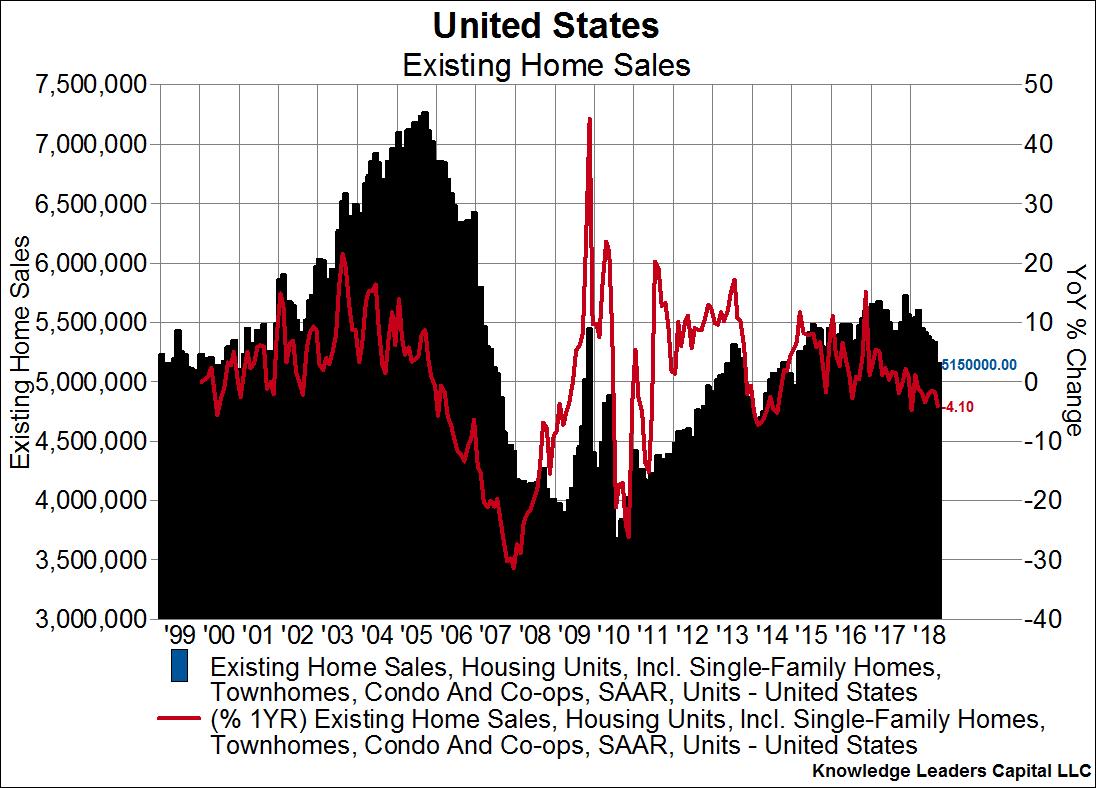

The metric of interest today is existing home sales. The reading came in at 5.15m units, which was well below the estimated 5.3m units and 4.1% below year ago levels. As the chart below shows, existing home sales have been falling all year long, and year-over-year growth rates have been mostly negative since September, 2017.

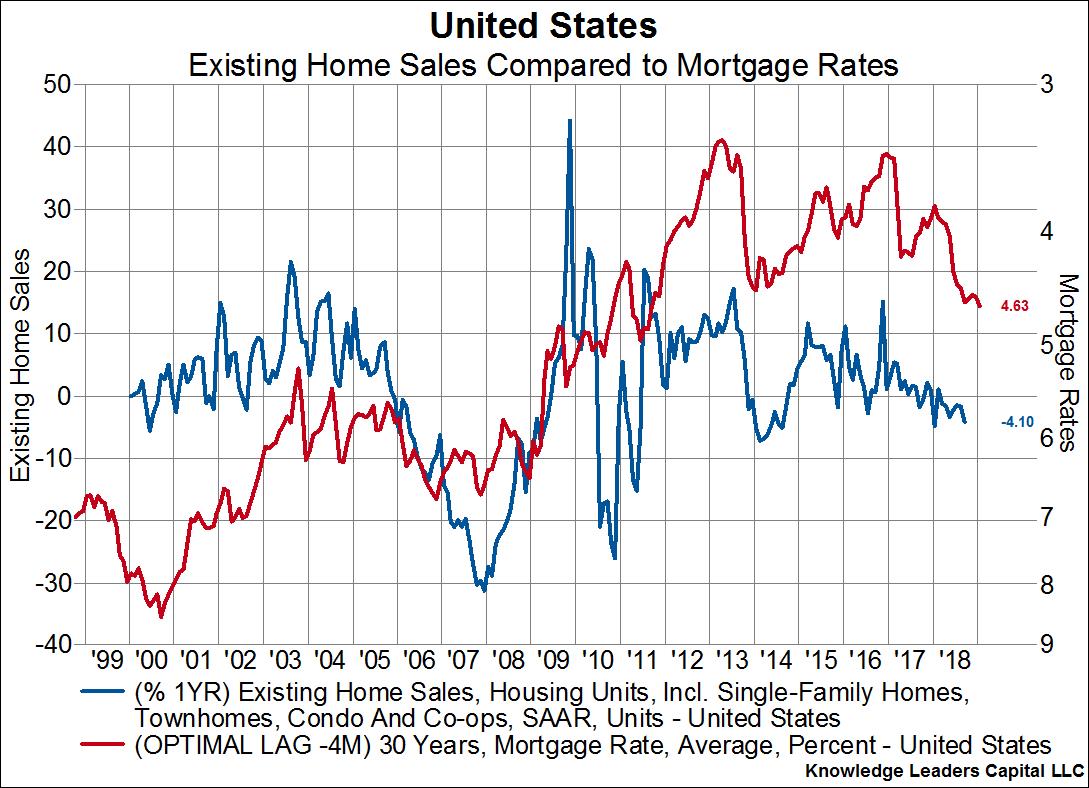

What’s more is that we should expect continued slowing in housing going forward. As the next chart below shows, mortgage rates (the red line on the right, inverted axis) lead the growth rate of existing home sales (blue line on the left axis) by four months.

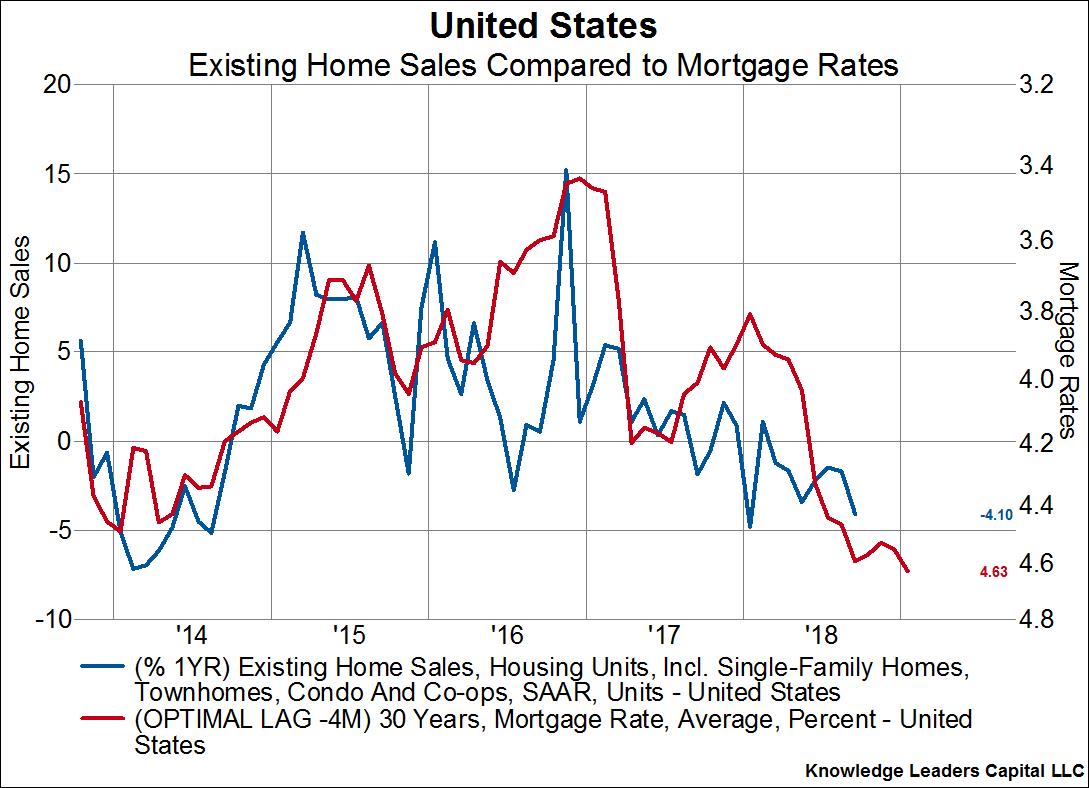

Here is a closeup showing the same relationship over just the last five years. Higher mortgage rates are telegraphing a 7% year-over-year drop in existing home sales by January 2019.

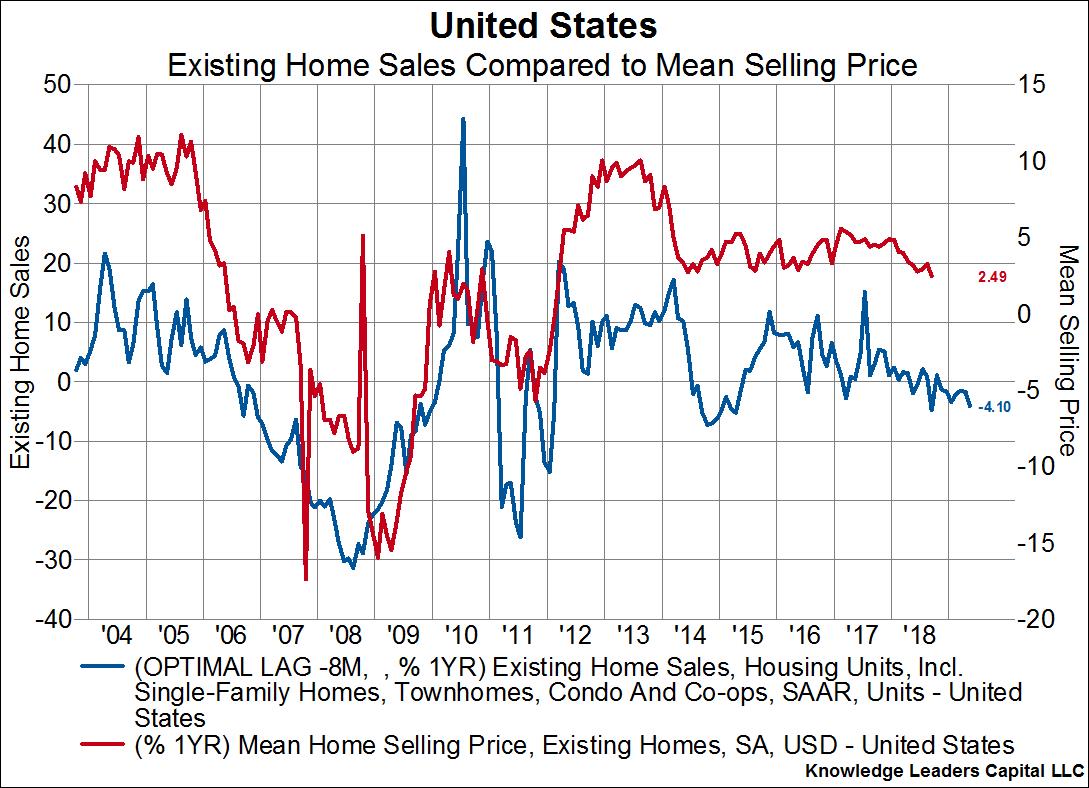

The slowdown in home sales is likely to put pressure on prices. The below chart overlays the mean home selling price (red line, right axis) on top of existing home sales (blue line, left axis). Existing sales lead the selling price by eight months, and are telegraphing the slowest year-over-year growth in home prices since early 2012 when prices were on an upswing.

...

- Category: News Archives

- Hits: 1318

South Africa’s Petra Diamonds (LON:PDL) increased sales by more than a fifth in the first quarter of its financial year, as higher production, better quality stones and a weakening of the rand offset a slump in the price of the precious rocks it mines.

Revenue rose 22 percent in the quarter to $80.2 million from $65.8 million a year prior, despite diamond prices being 5 percent lower when compared to the same period of 2017.

Petra said is still in discussions with the Tanzanian government, which seized last year a diamond parcel from it Williamson mine of about 71,000 carats.

Diamond production increased 21 percent to 1.1 million carats from 883,803 carats the year prior. The improvement was mainly due to a 25 percent run-of-mine production jump across its operations to 1 million from 815,571 carats.

The superior performance marks a turnaround for Petra, which hasn’t been an investor’s favourite this year. In May, in fact, it had to raise £133 million via a discounted share sale and last month its chief executive John Dippenaar announced he was leaving the company.

Petra, which owns the iconic Cullinan mine, where the world’s biggest-ever diamond was found in 1905, said net debt also rose in the three months to September— 3.5 percent to $538.9 million from $520.7 million three months earlier, in line with its expectations.

The company, which expects to be cash flow positive for financial 2019, said is still in discussions with Tanzania, where the government seized last year a diamond parcel from it Williamson mine of about 71,000 carats.

The move, part of the country’s ongoing probe into alleged wrongdoing in the diamond and tanzanite sectors, has been costly for Petra, as it shares lost around half of their value...

- Category: News Archives

- Hits: 1022

HTTP/1.1 200 OK Date: Mon, 22 Oct 2018 16:00:05 GMT Content-Type: text/html; charset=UTF-8 Transfer-Encoding: chunked Connection: keep-alive Set-Cookie: AWSALB=wOzzxm/ElcmryO0yWBXsj2jU+3wEVY73mIud72dgffgTsXWUZEp8ImQqUR0s8NNhCpyLL2fF8qgzU+TCDCsJqcAjr/tI1xePnKAi+vIwui4nfYpvDMs3DmOihQyU; Expires=Mon, 29 Oct 2018 16:00:05 GMT; Path=/ Server: Apache/2.4.34 (Amazon) OpenSSL/1.0.2k-fips PHP/5.6.37 X-Powered-By: PHP/5.6.37 Set-Cookie: ss=ktmfae7d3ugn0msp6bala43r41; path=/ Expires: Thu, 19 Nov 1981 08:52:00 GMT Cache-Control: no-store, no-cache, must-revalidate, post-check=0, pre-check=0 Pragma: no-cache Cache-Control: no-cache Set-Cookie: XSRF-TOKEN=eyJpdiI6IlRcL1MxZG4zYkJ3eGZmZm5DSElGMlhnPT0iLCJ2YWx1ZSI6ImFQSkpZclpiRlBGRGtQc2FzTVFpYlNZd05LYWJ6RWQyekFMYzdFVSsxY3lpXC9aXC9FdG1NQzllM29aOUFIZVR2R0VxWDBtT0MyTURlNXoyVlVoNXl6ZUE9PSIsIm1hYyI6IjI2ZmY5MzkzZDgzYzlhYTRkMDBiNGJlNzU2YTVhMzEzNDhjY2FkMGE4MGQ5YmIyZjk4M2E3MWE2Y2ZiNjMzMDIifQ%3D%3D; expires=Mon, 22-Oct-2018 18:00:05 GMT; Max-Age=7200; path=/ Set-Cookie: laravel_session=eyJpdiI6IlBRQTRhZVlpRG5DRUI4NFNnaGZnQmc9PSIsInZhbHVlIjoic3hQZmdWUkw2WkVyeHlKeU5HRjllbk1vMlBwRHN0dUVHd09aRU15aUI2b2pDaFlheHRoNEF6WWhDMEdqbFNBVEdvd2xnY1hEaDR4bTRZdkdnU2hVN3c9PSIsIm1hYyI6IjYxN2E2MDdkN2U5ZjM2ZTRlZTIwYjg4ZTRmMDZkNzg0ZDNiNzkxY2NmOTc5YTExN2I3OGVhNDg3Y2JjMjgyMTkifQ%3D%3D; expires=Mon, 22-Oct-2018 18:00:05 GMT; Max-Age=7200; path=/; httponly Vary: Accept-Encoding

DiMartino Booth: Powell Intent on Maintaining True Fed Independence - GoldSilver.com