Today, economy watchers were treated to more of the same from the housing market. That is, more weak numbers suggesting we may have seen the peak in housing activity for the cycle. This fits with our earlier analysis[1] that higher lending rates – a function of both long-term government bond yields and short-term funding costs for banks – are starting to permeate one of the most cyclical areas of the economy. It is the consequence of monetary policy tightening, which as we know produces its intended effects with “long and variable lags”.

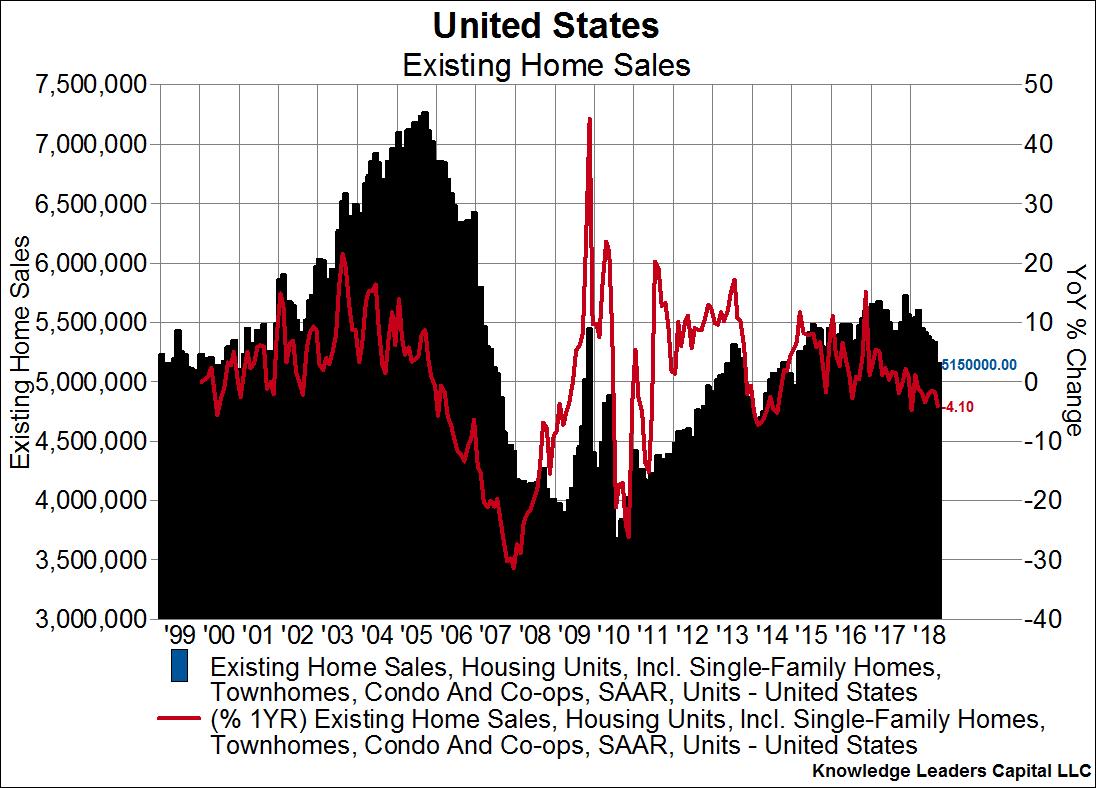

The metric of interest today is existing home sales. The reading came in at 5.15m units, which was well below the estimated 5.3m units and 4.1% below year ago levels. As the chart below shows, existing home sales have been falling all year long, and year-over-year growth rates have been mostly negative since September, 2017.

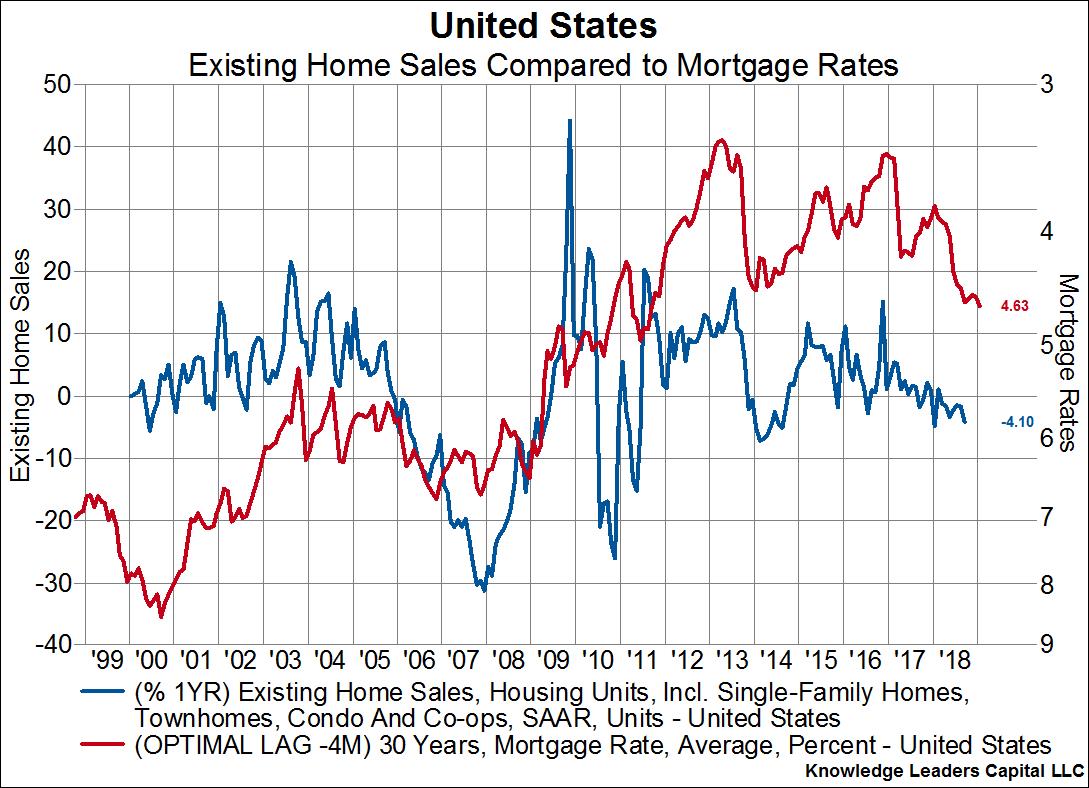

What’s more is that we should expect continued slowing in housing going forward. As the next chart below shows, mortgage rates (the red line on the right, inverted axis) lead the growth rate of existing home sales (blue line on the left axis) by four months.

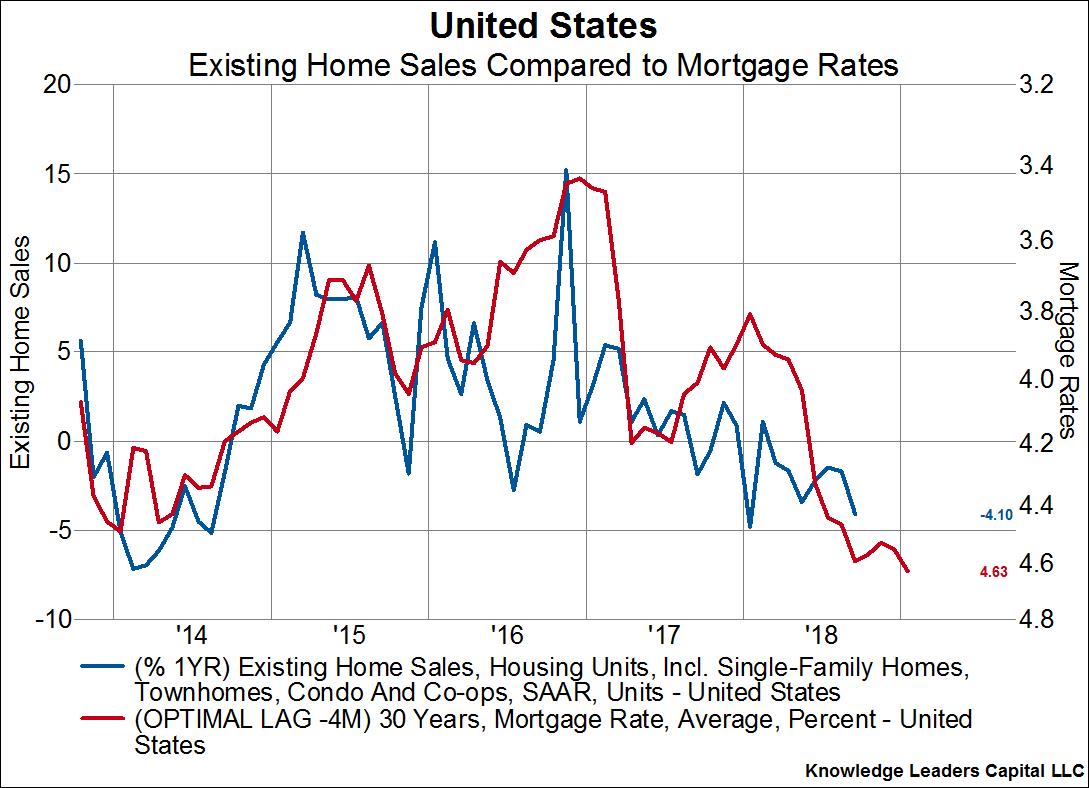

Here is a closeup showing the same relationship over just the last five years. Higher mortgage rates are telegraphing a 7% year-over-year drop in existing home sales by January 2019.

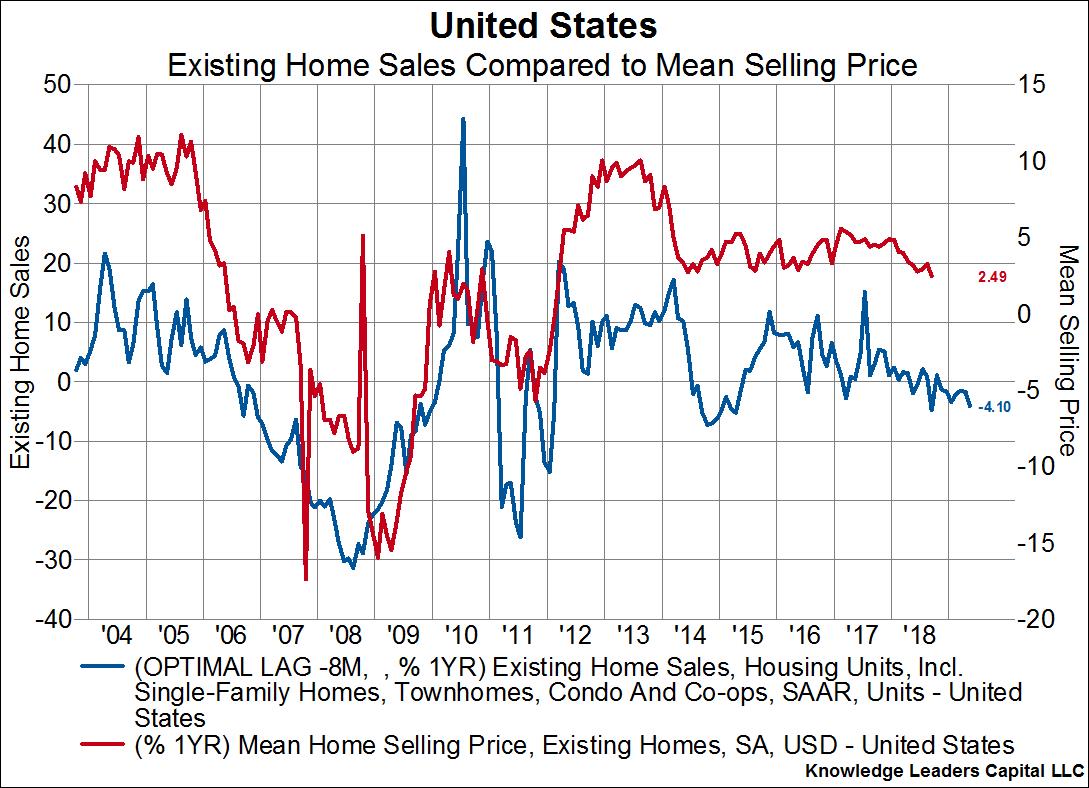

The slowdown in home sales is likely to put pressure on prices. The below chart overlays the mean home selling price (red line, right axis) on top of existing home sales (blue line, left axis). Existing sales lead the selling price by eight months, and are telegraphing the slowest year-over-year growth in home prices since early 2012 when prices were on an upswing.

...