Diamond News Archives

- Category: News Archives

- Hits: 1255

(IDEX Online) – Chow Tai Fook Jewellery Group Limited posted a 20% increase on the year in revenue to HK$29.7 billion ($3.8 billion) in its interim results for the six months ended 30 September. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

The jeweler said the results were due to stabilizing consumer demand and reviving Mainland [China] visitation which fuelled the jewelry market.

Profit increased by 8.8% to HK$1.94 billion ($248 million) due to renminbi depreciation.

The jewelry retail landscape exhibited positive momentum in Greater China during the period, thanks to steady economic recovery and improving consumer sentiment. The Group’s operations in Hong Kong and Macau grew robustly in 1HFY2019 due to reviving local consumer consumption demand and recovering tourism from Mainland China.

Same store sales growth in Hong Kong and Macau soared by 24.4% during the period. In Mainland China, same store sales rose by 4.9% in the period.

In Mainland China, in order to gauge market potential in lower tier cities and shopping malls, there were 233 net openings in the period reaching 2,682 stores, while the retail network footprint remained stable at 99 in Hong Kong and Macau as at 30 September 2018.

During the period, the Group also opened 4 points of sale in other markets, including Korea, Japan, Malaysia and Singapore.

"The Group’s robust sales growth in 1HFY2019 is a testament to both improving consumer sentiment and the continued efforts in executing the strategic priorities," the firm said. "Nevertheless, such growth momentum is expected to be moderated in 2HFY2019, as the escalating comparison base, rising US-China trade tensions and...

- Category: News Archives

- Hits: 1234

Closely followed trader Art Cashin said Monday that he's "quite doubtful" of the number of interest rate hikes the Federal Reserve[1] has projected for 2019.

A rate hike in December is still "locked in," the UBS director of floor operations at the New York Stock Exchange predicted in a "Squawk on the Street[2]" interview. He argued the Fed will want to avoid appearing "bullied" by President Donald Trump[3], who has been critical of the central bank's policies under Fed Chairman Jerome Powell[4].

The target range for the central bank's benchmark federal funds rate, which banks charge each other for overnight lending, stands at 2 percent to 2.25 percent. After its most recent hike, in September, the Fed projected three rate increases for next year. The Fed has already raised rates three times this year, and Wall Street expects another in December.

Stocks surged last week after Powell appeared to walk back comments on Oct. 3 that rates were a long way from so-called neutral. In a speech Wednesday, Powell said rates are "just below" neutral, perhaps indicting that concerns about a more aggressive path higher for rates may no longer be warranted. The S&P 500[5] had its best week in seven years.

Cashin also said market gains could be capped Monday due to "lack of clarity" on trade following President Donald Trump[6] and Chinese Xi Jinping[7]'s agreement over the weekend to halt new tariffs for a 90-day period while talks continue....

References

- ^ Federal Reserve (www.cnbc.com)

- ^ Squawk on the Street (www.cnbc.com)

- ^

- Category: News Archives

- Hits: 993

Many precious findings are still hidden under the ground.

Archaeologists found a treasure of Celtic coins in Mošovce near Turčianske Teplice. The finding of 40 coins contains the most precious coins that Celts minted in this era, so-called tetradrachms.

“The Celts had highly-developed coin system; tetradrachms have four times the higher value of other nominals,” explains Karol Pieta, deputy of director from Archaeological Institute of Slovak Academy of Sciences (SAV) in Nitra, as quoted by the SITA newswire.

Tetradrachms are about nine to ten grams in weight, as if they have four drachms inside, which were the smallest coins in that time, Pieta explains.

It is highly probable that they are minted from silver originating from a Carpathian (Slovak) deposit. The economic power of Celts in the Slovak area was to a considerable extent based on using natural resources, especially gold, silver and iron. The Turiec region belonged among the key economic and cultural centres of Celts in Slovakia, Pieta added.

Archaeologists are carrying out a systematic research in the cadastre of Mošovce village as well as in the cadastres of other villages in connection to wood mining, due to the bark beetle calamity.

“Amateur archaeologists”

They were lucky to overtake raiders who find precious findings with metal detectors in Slovakia and then sell them or exchange with other collectors.

“An archaeologist does not find only precious and expensive objects, he/she looks for a connection and thanks to detail work in terrain, he/she may interpret the finding further,” said Pieta, as quoted by SITA.

The coins were scattered in a steep slope. Archaeologists found a place where they were packed in a small knot of organic substance and thanks to soil erosion, they scattered...

- Category: News Archives

- Hits: 1296

(IDEX Online) – A survey released by the Diamond Producers Association (DPA) and KRC Research found that over 53 million Americans (21%) plan to purchase a diamond between Thanksgiving and Valentine’s Day, with men and millennials most likely to purchase them.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

Of those who plan to buy a diamond, more than 20 million plan to buy a diamond engagement ring.

The survey confirmed that there is clear confusion among diamond purchasers about the differences between natural diamonds and laboratory-created diamonds, including differences in value, rarity, physical growth structure and origin, the DPA said in a statement.

“Diamonds shine especially bright this year,” said gemologist and diamond expert Grant Mobley. “Consumers, especially millennials, are seeking ways to share authentic, emotional and lasting symbols of love with the special people in their lives.”

But Mobley warned that this year the arrival of synthetic, or lab-created, diamonds can cause consumer confusion at the jewelry counter. He urged diamond shoppers to do their homework, so that they can ensure they are confidently buying a natural diamond, the DPA said.

According to the survey, nearly half of diamond purchasers (44%) were unaware of the significant differences in value, rarity, physical growth structure and origin between natural diamonds and laboratory-created stones. However, more than seven in 10 (71%) were more likely to buy a natural diamond over a laboratory-created diamond as they learned the differences. The key differences between natural diamonds and laboratory-created diamonds include:

- Natural diamonds are significantly more valuable than laboratory-created diamonds.

...

- Each natural diamond is

- Category: News Archives

- Hits: 1188

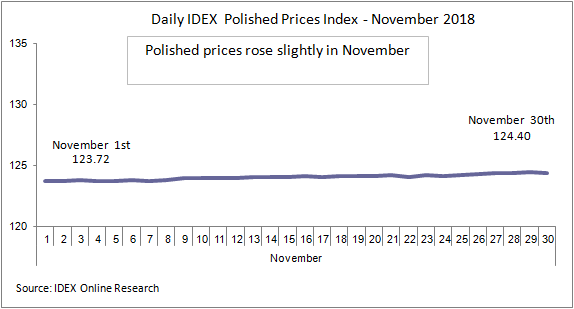

(IDEX Online News) – The IDEX polished diamond price index was up slightly in November during the month. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

The Index began the month at 123.72 and ended at 124.40.

<?xml:namespace prefix = "v" ns = "urn:schemas-microsoft-com:vml" /?>

Outlook

There were highly promising polished October export figures released by the Indian and Belgian diamond industries in November, with rises on the year in October of 19% and 17%, respectively. Meanwhile US polished diamond imports in September increased by 10%.

All eyes will now, naturally, be on the sales figures for the holiday season and the Chinese New Year in February.

Proof of the high inventory levels and that wholesalers and retailers are fully stocked for the holiday season came with De Beers' results for the ninth sale of 2018 published towards in November.

For the first time this year, sales fell below the $500 million mark, coming in at $440 million following the $475 million figure posted in the previous sale.