Diamond News Archives

- Category: News Archives

- Hits: 1108

This is the predictable path because it's the only one that's politically expedient and doesn't cause much financial pain until it's too late to stave off collapse.

While many fear a war between the nuclear powers or the breakdown of civil order, I tend to think the Crisis of 2023-26 is more likely to be financial in nature.

War and civil breakdown are certainly common enough in history, global/nuclear war has been avoided in recent history, largely because wars are typically launched by those who reckon they can win the war. Launching a nuclear strike against a nation with the ability to launch a counterstrike (from submarines, for example, and missiles that survived the first strike) guarantees the destruction of whatever concentrations of population and assets the attacker may have.

The breakdown of civil order has not occurred in developed-world nations for quite some time, as central states can marshal military forces to restore order and issue / borrow money to buy the compliance of the restive populace.

Financial crises, in contrast, remain a constant feature of the modern era, and developed-world nations are perhaps even more vulnerable to financial disorder than developing nations.

As I've often noted, systems tend to follow an S-Curve of rapid expansion followed by slower growth during maturity and culminating in stagnation, decline or collapse.

Successful economies generate a double-bind once they reach the stagnation-decline phase: the populace (and capital) both expect strong permanent growth as a birthright, and they see the previous boost-phase and maturity phase as evidence that the economy "should" continue delivering outsized returns on capital and widespread prosperity essentially forever.

They are willing to accept a temporary slowdown/decline as part of the process of prosperity, but their patience quickly runs out if...

- Category: News Archives

- Hits: 1096

(IDEX Online) – The Diamond Producers Association (DPA), an international alliance of the world's leading diamond mining companies, has appointed Kristina Buckley Kayel as Managing Director of its North American division.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

Buckley Kayel assumes her new role on February 4, and will be responsible for developing and implementing the DPA’s consumer marketing and communications strategy, with a focus upon the “Real is Rare. Real is a Diamond.” platform, as well as representing the DPA in local trade bodies and organizations within North America. She will report directly to Jean-Marc Lieberherr, the Chief Executive Officer of the DPA.

Buckley Kayel’s "unique background and extensive experience in strategic marketing, communications and digital leadership roles well positions Buckley Kayel to spearhead the DPA’s mission to restore, protect and promote the integrity and reputation of natural diamonds, especially among the younger U.S. consumer base, which is the largest market globally in terms of diamond demand," the DPA said.

Lieberherr said: “Kristina’s experience in the fine jewelry sector, along with her comprehensive communications expertise, business acumen and creativity, gives her a unique industry perspective. We are excited to have her join the Diamond Producers Association and work with us to strengthen and build upon our mission in the United States.”

For the last decade, Buckley Kayel led marketing and communications for the heritage French high jewelry brand, Van Cleef & Arpels (owned by Compagnie Financière Richemont SA) for the Americas. She oversaw media, digital, public relations, special events, strategic partnerships, educational platforms and visual merchandising.

Prior to joining Van Cleef & Arpels, she worked in marketing and communications positions...

- Category: News Archives

- Hits: 1065

As a general rule, the most successful man in life is the man who has the best information

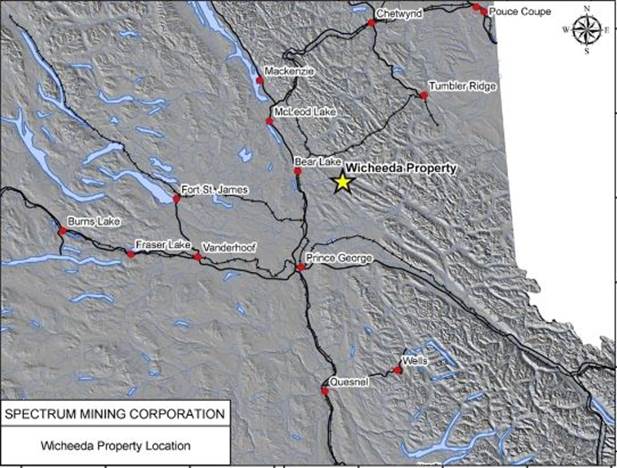

We probably have more rare earth deposits in Canada, or controlled by Canadian-listed juniors, than anywhere in the world. But Spectrum Mining Corporation, a private company, controlled one of the best – the Wicheeda Lake REE claims 80km north of Prince George, BC.

Wicheeda Lake

In 2008 Spectrum contracted Falcon Drilling Ltd. of Prince George, B.C. to drill 4 BTW size diamond drill holes, totaling 866 meters, at varying azimuths and dips from 1 drilling platform into their Wicheeda Lake "Main Zone" cerium soil anomaly.

All 4 drill holes intersected potentially economic Ce, Nd, Sm, Nb and La rare earth mineralization over drill core lengths varying from 66m to 231m starting at their collars.

In 2009, eleven NTW diamond drill holes totaling 1835m were drilled into the "Main Zone” from 2 new drilling platforms. Drill site 2009-A was located approximately 100m northeast of the 2008 drill site and seven 150m long drill holes were completed from it at various azimuths and dips. All seven holes intersected significant intervals of rare earth mineralization varying from 56m to 148m long starting at their collars.

Drill site 2009-B is located approximately 100m north of drill site 2009-A and approximately 150m northeast of the 2008 drill site. Four drill holes were completed from it at various azimuths and dips. Again all four holes intersected significant intervals of rare earth mineralization varying from 95m to 147m long starting at their collars.

The Wicheeda Lake deposit is open in all directions.

Defense Metals Corp

First Legacy Mining Corp., now Defense Metals Corp (TSX.V:DEFN) after a name change, entered into an option agreement with...

- Category: News Archives

- Hits: 889

HTTP/2 200 server: nginx date: Thu, 03 Jan 2019 16:00:04 GMT content-type: text/html; charset=UTF-8 content-length: 48534 vary: Accept-Encoding, Cookie cache-control: max-age=3600, public x-ua-compatible: IE=edge content-language: en x-content-type-options: nosniff x-frame-options: SAMEORIGIN expires: Sun, 19 Nov 1978 05:00:00 GMT last-modified: Thu, 03 Jan 2019 15:59:02 GMT etag: W/"1546531142" x-backend-server: drupal-6c48f6bd77-nq6s8 age: 62 varnish-cache: HIT x-cache-hits: 57 x-served-by: varnish-1 accept-ranges: bytes ...

"Growth Has Stopped": Manufacturing ISM Crashes Most Since The Financial Crisis | Zero Hedge Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)

- Category: News Archives

- Hits: 943

(IDEX Online) – The Indian Diamond Color & Colorstone Association (IDCA) Board of Directors has unanimously re-elected Nilesh Sheth of (Nice Diamonds) as President.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

Sujan Doshi (S. A. Diamonds, Inc.) was elected as the Vice-President; Shekhar Shah (Real Gems, Inc.) will take over as Secretary and Shiksha Naheta (Empresa Jewels) will join as the Jt. Secretary, while Rajeev Pandya (Ashi Diamonds, LLC) was also re-elected as the Treasurer, the IDCA said.

IDCA Board members continuing as directors for 2019 include: Shrenil Bhansali (Fairway Diamonds, Inc.), Shailesh Jhalani (Prompt Gem Imptrs Inc.), Haridas Kotahwala (Royal India USA, Inc.), Prakash Mehta (Interings, Inc.), and Mehul Shah (Shivani Gems, Inc.).

Nitin Jobanputra (Sanghvi Diamonds, Inc.), Sailesh Lakhi (Sparkles & Colors USA, Inc.) and Prashant Mehta (Dia Expressions) are the new inductees in the 2019 board.

Roopam Jain (Jay Gems, Inc.), Jay Mehta (Indigo Jewelry, Inc.) and Prateek Nigam (Oriental Gemco NY, Inc.), completed their terms as Directors, and IDCA thanked board members for their commitment and service to the association....