Please note: The articles listed below contain historical material. The data provided was current at the time of publication. For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance[1] page.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

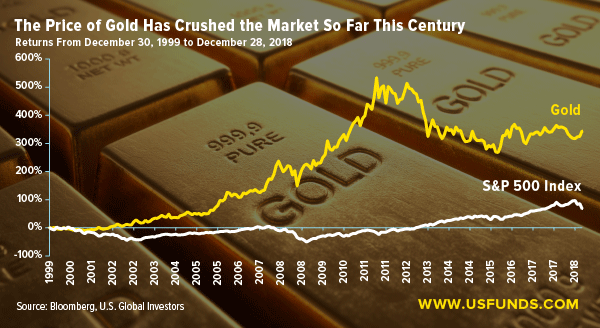

With only one trading day remaining in 2018, I’m pleased to report that the price of gold has so far beaten the S&P 500 Index for the month of December (4.4 percent versus minus 10 percent), the fourth quarter (7.4 percent versus minus 15 percent) and the year (minus 2 percent versus minus 7 percent). Since stocks have stumbled recently, this might not come as such a shock.

What might surprise some of you is that gold has also outperformed the market for the century (344 percent versus 67 percent).

What this means is that, even though the yellow metal is still down from its 2011 peak, it has proven itself as a valuable diversifier in most any investor’s portfolio. And if stocks are headed for another big pullback next year, it could become even more valuable.

Looking back over the past 12 months, I’m not surprised to see that my five most popular and widely shared posts of 2018 involve gold (with one exception). Below I count them down, beginning with a story about Texas, the home state of U.S. Global Investors.

5. Texas Gold Investors Just Got Their Own Fort Knox[3]

The Texas Bullion Depository, the first of its kind in the U.S., officially opened to the public in Austin in early June, capping three years of planning and construction. At...