Diamond News Archives

- Category: News Archives

- Hits: 828

Stefan Wermuth | Bloomberg | Getty Images

Sergio Ermotti, chief executive officer of UBS Group AG, speaks during a news conference, as the worlds largest wealth manager announces full year earnings in Zurich, Switzerland, on Monday, Jan. 22, 2018.

Corporate giants doing business abroad are painting a dreary picture of the world's economy.

With an ongoing trade war between the U.S. and China, Brexit uncertainty weighing on Europe and the U.K., and new weakness out of Japan, a group of business leaders say it's harder than ever to rake in profits.

This week, top executives at FedEx[1], BMW, UBS and others described bleak global business conditions while discussing quarterly results. Fitch Ratings also "aggressively" cut its forecast for the year.

The head of UBS[2] was the latest to blame the world's backdrop for weaker-than-expected results. Chief executive Sergio Ermotti told[3] a conference in London Wednesday that it "one of the worst first-quarter environments in recent history," Reuters reported. The Swiss bank slashed another $300 million from 2019 costs after revenue at its investment bank plunged. Investment banking conditions are among the toughest seen in years, especially outside the U.S., the CEO said.

Ermotti's remarks echo the sentiment from FedEx a day earlier. The multinational package delivery service reported sluggish[4] international revenue on Tuesday as a result of tough exchange rates and ongoing trade battles.

"Slowing international macroeconomic conditions and weaker global trade growth trends continue, as seen in the year-over-year decline in our FedEx Express international revenue," FedEx Corp. Chief Financial Officer Alan B. Graf, Jr. said in the firm's quarterly earnings report.

BMW is another with a less-than-rosy outlook. The German automaker...

- Category: News Archives

- Hits: 889

Washington hit Venezuela’s state-run mining company with sanctions on Tuesday, accusing “illegitimate” leader Nicolás Maduro of promoting and capitalizing on illegal gold mining to prop up his embattled administration.

In a statement, the U.S. Treasury’s Office of Foreign Assets Control, OFAC, said it was sanctioning the Venezuelan General Mining Company, Minerven, and its president, Adrian Antonio Perdomo.

Under the Treasury designation, Minerven and Perdomo’s assets in the United States will be frozen and U.S. citizens and residents are prohibited from doing business with them.

Treasury says Maduro and his security forces control the crime-riddled area in southern Venezuela where makeshift and illegal mining is running rampant. While the government buys the gold in devalued bolivares it’s selling the gold on the international market for desperately needed hard currency.

Sign Up and Save

Get six months of free digital access to the Miami Herald

“The mining and subsequent sale of gold has been one of the Maduro regime’s most lucrative financial schemes in recent years, as hundreds of thousands of miners have mined for gold in dangerous, makeshift mines in southern Venezuela, all of which are controlled by the Venezuelan military, which, in turn, corruptly charges criminal organizations for access,” the department said.

Along with homegrown gangs and criminal networks, there are increasing indications that Colombian guerrilla groups are profiting[1] from Venezuelan gold mining.

The crackdown comes as Washington is trying to economically asphyxiate the Maduro government, which it considers illegitimate. Most recently, the Trump administration essentially blocked Venezuelan oil sales[2] to the United States — a critical economic lifeline for the South American country.

The United States...

- Category: News Archives

- Hits: 1247

The Debswana Diamond Company (Debswana), a 50/50 joint venture between the Government of the Republic of Botswana and De Beers Group, is launching its Cut-9 project, to extend the life of Jwaneng Mine to 2035. The mine is expected to yield an estimated 53 million carats of rough diamonds from 44 million tons of treated material.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

Debswana will invest approximately US$2 billion over the life of the project. The shareholders of Debswana have approved the budget for 2019 so that the next phase of work can commence.

At its peak, Cut-9 is expected to create more than 1,000 jobs, the majority of which will be held by Batswana citizens. A local contract has also been awarded by Debswana to Majwe Mining, a joint venture between Bothakga Burrow Botswana and Thiess Botswana, to provide diamond mining services. The value of the contract is US$1.2 billion.

Formed in 1969, Debswana is a 50/50 partnership between the Government of Botswana and the De Beers Group. Debswana is a significant contributor to Botswana’s economy with more than 80 percent of its profits being returned to the people of Botswana. The Jwaneng Mine contributes approximately 70 percent of Debswana’s total revenue. Diamonds from Debswana, in turn contribute approximately 50 percent of public revenue, 33 percent of GDP, and over 80 percent of foreign earnings to Botswana....

- Category: News Archives

- Hits: 1175

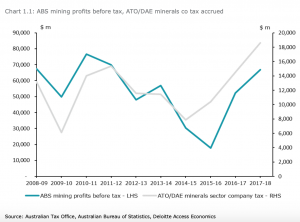

A report published by Deloitte Access Economics reveals that Australian mining companies paid A$30.6 billion in company tax and royalties in 2017-18 – the equivalent of all Federal Government spending on Australian schools, universities and vocational training.

According to the report, the dollar amount paid in company taxes in the past couple of years surpasses that of 2011-12, which was the peak of the resources boom. That amount adds up to A$18.6 billion.

The document, which was commissioned by the Minerals Council of Australia, also states that mining companies paid A$12 billion in royalties to State Governments in 2017-18 – more than three times the amount paid a decade ago.

“These figures show the benefits delivered to taxpayers by the nation’s largest export earner through billions of dollars paid to governments each year in taxes and royalties,” said Tania Constable, Chief Executive Officer of the industry group, in a media statement. “Yet there could be even more benefits delivered to the community if our politicians deliver reforms – in particular, an internationally-competitive tax rate – so Australia can secure investment in the mines of the future.”

In Constable’s view, Federal and State governments need to ensure consistent policies that encourage investment and productivity in the resources sector. She said this would guarantee mining continues to deliver highly-paid, highly-skilled jobs in different areas of the country, especially in remote ones.

The post Taxes and royalties paid by mining companies in Australia equivalent of Federal Government spending on education appeared first on MINING.com....

- Category: News Archives

- Hits: 870

Russian state-controlled miner Alrosa will assess the quality of Zimbabwe's diamond reserves over the next six months but would only start mining if it can take a majority stake in such a project, the company's chief executive said on Monday.

Zimbabwe is seeking to attract investment and has scrapped legislation that restricts foreign participation for some commodities. It has yet to do so for diamonds and platinum but has said that it will.

Zimbabwe is seeking to attract investment and has scrapped legislation that restricts foreign participation for some commodities

"Of course we'll only be ready to participate in projects in cases where we can have management control and operational control of the assets," Alrosa CEO Sergey Ivanov told Reuters.

That would mean a stake of at least 51 percent, he said, adding that he would be confident of achieving that if it gets to the stage of detailed discussions on how to advance a project.

Russia, along with China, has been a political ally of Zimbabwe since the days of its independence war against British rule, and this year Zimbabwe selected Alrosa and China's Anjin Investments to partner its state diamond company.

Alrosa, the biggest diamond producer by volume, as well as Anglo American's De Beers, the biggest in value terms, both say supply will shrink in the coming years as mines, such as Rio Tinto's Argyle project, become depleted.

Laboratory-grown diamonds will add some supply. But Alrosa, like De Beers, says man-made stones are a separate market and have no re-sale value, in contrast to natural gems.

De Beers last year began marketing laboratory diamonds as jewellery for the first time, but Ivanov said that Alrosa has no interest in following suit.

The company is, however,...