Diamond News Archives

- Category: News Archives

- Hits: 888

Following long months without a captain at the helm, the giant fashion jewelry company Pandora hopes to see the newly appointed President and CEO, Alexander Lacik steer the ship into more profitable lanes. But this week, the company announced that its Chief Operating Officer, Jeremy Schwartz, had announced his immediate resignation.

The year 2018 was an awful year for Pandora. The stock lost about 50 of its value as the company missed its quarterly earnings forecasts and saw its CEO Anders Colding Friis resign in the summer of 2018.

According to Pandora, the resignation of Schwartz was the result of mutual agreement between the Chairman of the Board of Directors and Jeremy Schwartz. Pandora said Schwartz “will be available as advisor to Alexander Lacik to support the onboarding to Pandora.â€

Peder Tuborgh, Chairman of the Board of Directors, says: “I have sympathy for Jeremy’s decision considering the overlap of competencies between him and Alexander Lacik. I would like to thank Jeremy for his significant contributions to Pandora. Together with Anders Boyer, he has been instrumental in driving the diagnosis phase of Programme NOW, and he is leaving a clear roadmap to execute onâ€.

Pandora designs, manufactures and markets hand-finished and contemporary jewelry made from high-quality materials at “affordable prices.†Pandora jewelry is sold in more than 100 countries on six continents through more than 7,700 points of sale, including more than 2,700 concept stores....

- Category: News Archives

- Hits: 1013

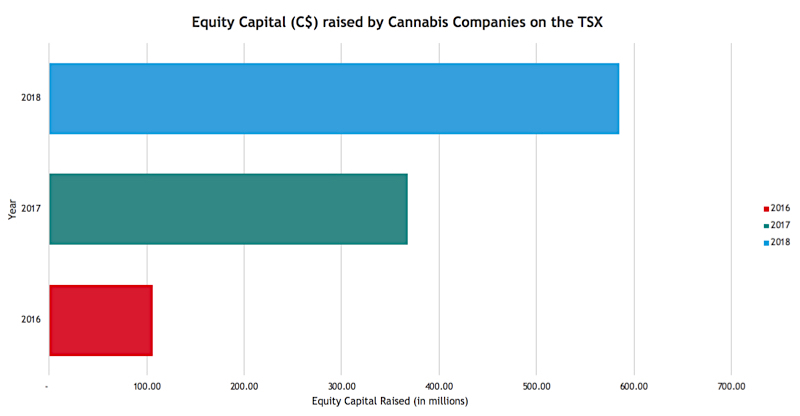

A growing interest in Canada’s emerging cannabis sector, which spiked after recreational use of marijuana was legalized in October, is sucking investment away from mining and hitting juniors hardest, a new study shows.

According to BDO's Sherif Andrawes, investments in Canadian cannabis companies increased from C$43 million to C$770 million from the first half of 2016 to the same period in 2017, a massive surge year on year. In contrast, total mining companies listed on the Toronto Stock Exchange and TSX-V dropped 25% from 2017 to 2018.

The booming cannabis industry is sucking investment away from mining, and hitting juniors hardest.

“Industry investors traditionally attracted to the junior mining space now have a secondary option. Valuations are higher and forecast demand for the product is being touted in the billions,” the report says.

The analyst, in fact, found that financing for juniors has decreased by 58% for those listed in the TSX and 23% for TSX-V from 2017-2018.

The main problem, Andrawes says, is that investing in mining exploration faces the risk of demand ultimately outstripping supply, with the consequent price spikes and market volatility. Forecast consumption of metals in a world driven by the electrification of industries will inevitably go up, the report notes. But without junior miners being able to secure the right capital, the industry “will forever be stuck in the boom-bust cycle,” BDO warns.

Source: BDO.

While spending in exploration has increased in the past two years, it has been focused on brownfield projects, also known as near-mine assets, located in areas where mineral deposits have been previously discovered.

Struggling to find investors

“Raising money is extremely difficult,” Patrick Downey, head of Canadian junior gold exploration...

- Category: News Archives

- Hits: 886

(IDEX Online News) - In general, for rounds March was all about reversing the trends of February, when the market dared a little, only to be whistled back in March.

Parallel to trends in the previous month, prices of round diamonds under a carat remained rather stable, with a few goods, especially in the higher colors and clarities, losing a few percent. Prices of goods between 80 points and a carat 'seesawed' a bit, by either gaining or losing a few percent in the higher and commercial colors and clarities. We observed some categories recovering from slight losses incurrent in February.

Prices of carats up to a 1.25 carat in high colors and mid-range clarities recovered from their slight losses in February, while stones from 1.25 to 1.5 ct. didn't change, with very little movement in prices of good up to two carats.,

In goods above two carats, we saw goods in commercial colors drop back to prices paid in January. The same trend was also visible in the 3-4-carat categories, where the downward price curve extended from D- L, but seldom ventured beyond the VS2 clarity range. Again, this was almost a complete reversal of the gains these categories made in February. Clearly, the rounds market, across the board, is a market in waiting.

Prices of small fancies, under half a carat in both top and commercial colors made a come-back from last month's downturn, and in some categories continued to rise gradually. The same trend was observed, with a few exceptions for fancies up to carat, with price gains broadening into the commercial colors and lower clarities.

Following the...

- Category: News Archives

- Hits: 1026

In the spring of 1692, an energetic young Scotsman named John Campbell started a new business in central London.

Campbell was a goldsmith, and his business sold jewelry and other crafted metals like plates and silverware.

But Campbell’s new company had another business line as well: banking. And the company he started eventually became Coutts & Co., a bank that still exists today in the UK.

Since the dawn of the Bronze Age thousands of years ago, metal workers (‘smiths’, from the word ‘smite’– to strike) were prominent, highly valued members of society.

Smiths were instrumental in construction, architecture, science, warfare, and art.

And they also provided some of the world’s earliest banking services.

For most of human history, money was metal– primarily gold and silver. And people knew that storing large quantities of gold and silver in their homes made their wealth prone to theft.

Goldsmiths already had tight security in their shops due to their significant inventories of precious metals.

So it was commonplace for other residents in town to store their own gold with the local smith, piggybacking on his security, in exchange for a nominal fee.

This was banking in its most traditional form: customer paid a fee to store wealth at a goldsmith’s shop.

By the time John Campbell set up his bank in the late 1600s, however, times had changed. Goldsmith-bankers had begun making loans… keeping only a small portion of their customers’ gold on reserve in the vault, and loaning out the rest at interest.

This is essentially the same model of banking that still exists today.

Giant institutions control trillions of dollars that we depositors dutifully provide to them.

Banks keep a tiny portion of this capital...

- Category: News Archives

- Hits: 1014

Russian state-controlled miner Alrosa, the world's biggest producer of rough diamonds in carat terms, raised $11.8 million in its first New York diamond auction of the year, as it seeks to increase its activity in the United States.

Rebecca Foerster, president of Alrosa, North America, said sanctions against some Russian companies did not diminish the appeal of Russian high quality diamonds.

Alrosa resumed operations in New York last year after they lay dormant for two years because of what the company said were "organisational changes" and concerns related to the previous team.

It held two diamond auctions there in 2018, which between them raised $18.3 million from international buyers.

By comparison a single New York sale in March this year of large stones, all of more than 10.8 carats and some as large as 50 carats, raised $11.8 million.

"The United States is a target market for growth. It's by far the largest diamond market," Foerster said in an interview.

She said this year Alrosa was aiming for four sales of rough diamonds in the United States, including the March sale that has just taken place, as well as two auctions of polished stones.

Diamond analysts say supply is expected to contract, potentially boosting prices, as mature mines decline and new production lags

In an email, Alrosa said it was seeking to double U.S. activity annually "over the next few years".

"No politics"

While Alrosa has no intention of launching its own jewellery brand, Foerster said it was marketing diamonds based on guaranteeing their origin, in line with customer demand for sustainable gems.

"It's becoming more and more of a necessity," she said. "All our diamonds come from a collection of mines in Russia. We can...