Diamond News Archives

- Category: News Archives

- Hits: 786

April 9, 2019

The doses of Delusionol(tm) required to believe "this time it's different" are becoming dangerous.

Here we go again, another tech bubble is expanding like a supernova and the financial media is declaring (as it does during every bubble) "this time it's different." File Tech Bubble 2.0 under memories are getting shorter or this time is never different:

The "Uber of dog-walkers" is worth a cool $1 billion pre-IPO. Or maybe it's the AirBNB of dog-walkers, but who cares? Just as any company with no hope of profits skyrocketed once it put blockchain or crypto in its name during the cryptocurrency mania of late 2017, now calling a dead-on-arrival start-up "the Uber of...." is enough to justify a billion-dollar valuation.

A scooter-rental company in a very crowded field of never-will-be-profitable scooter start-ups is worth a cool $1 billion--but heading to a $10 billion valuation because... well, it's the Uber of scooters.

Meanwhile, Uber and Lyft will never be profitable because their market is already commoditized. Companies only generate billions of dollars of profit when they scale up within a moated sector to become a quasi-monopoly with pricing power and the ability to buy up or crush any competitors. Without a defensible quasi-monopoly, margins are low and pricing power is zero.

The truth is neither Uber nor Lyft will ever be profitable: their fixed cost structure is high, their pricing power is essentially zero and there is no way to establish a quasi-monopoly in a sector with a wide range of commoditized competing transportation options.

The cost of operating a very complex vehicle will never be near-zero, and neither...

- Category: News Archives

- Hits: 1087

Shares in Canada’s Stornoway Diamond Corp. (TSX:SWY) fell on Tuesday after it announced that it would halt operations at its Renard 65 open pit mine, in the province of Quebec.

The company transitioned Renard, Quebec’s first diamond mine, primarily underground operations in August last year, but mining the pit had continued until now.

Current ore stockpiles at Renard 65 are sufficient to maintain planned contribution to the process plant until the second quarter of 2020, the miner said.

The Montreal-based diamond producer explained that the current ore stockpiles at Renard 65 were sufficient to maintain its planned contribution to the process plant until the second quarter of 2020. It also said the move was not expected to impact revenue this year.

Last year, however, Stornoway booked a non-cash impairment of C$83.2 million on the carrying value of the property, plant and equipment because of persistently low rough prices, a deferred income tax expense of $77.4 million and $227.1 million for the cost of goods sold.

Shares in the company dropped as much as 2.4% on the news and were trading last at 10 Canadian cents.

In the first three month of 2019, the company has been doing better. It sold 429,506 carats for C$47 million at an average price of C$110 per carat (about $83).

While Stornoway produces a variety of stones, it is more exposed to the low quality end of the market, and those diamonds have been selling for much less in the past six months than five years ago due to an unforeseen oversupply.

As per December 2018, Renard had indicated resources of 3.7Mct in 8.7Mt grading 42.3 carats per hundred tonnes, excluding reserves. It also had 13Mct held in 23.4Mt at 55.8cpht inferred, with...

- Category: News Archives

- Hits: 1047

Students at the University of British Columbia's Norman B. Keevil Institute of Mining Engineering are partnering with tech company Riivos Inc. to design their Mine and Plant Feasibility Study capstone projects.

The projects are part of their required courses and in order to complete them, the students are using a Riivos-built mining financial technology software that allows them to quickly and easily input and analyze the financial and physical components of their feasibility studies. According to Riivos, this helps them spend less time building spreadsheet models and more time optimizing their mine project economics.

"In this year-long study, students are getting exposure to business problems that the industry is facing and they're coming up with solutions," said Andrea Arduini, the UBC professor leading the Feasibility Study course, in a media statement. "Our students need to be able to see the holistic picture of how decisions can have a wider impact not only on the mine, but also on the environment and on the community."

The projects challenge students to use the knowledge and skills gained during their studies to solve real-world problems.

Arduini explained that the Riivos-UBC partnership stemmed from a team of recently-graduated UBC mining engineers working at the San Francisco-based enterprise SaaS.

The former students -she said- wanted to expand the breadth of skills training available at their alma mater and identified an opportunity to improve the understanding of financial modeling, financial metrics, and how mine plans factor into high-level financial statements.

"Our aim in building this application for UBC mining students is to help them run more scenarios, more quickly, so they can test feasibility and define the cases that will produce optimal results," said Tom Struttmann, Group Executive of Riivos Mining and Industry Advisory Council Chair at...

- Category: News Archives

- Hits: 794

Mark Cutifani, chief executive of Anglo American, has mounted a strong defense of the diamond industry, saying the benefits of digging gems out of the ground should not be underestimated.

Speaking during Anglo American’s sustainability briefing earlier this month Cutifani was asked if there was any social benefit to diamond mining. Mark Cutifani consequently pointed to Botswana, where its De Beers subsidiary has a joint venture with the government.

“Botswana’s GDP per person is one of the top three in Africa and it’s off the back of diamond mining,†he told analysts and investors gathered at its headquarters in central London. “There is no commodity in the world that means as much to a group of people in terms of lifting them out of poverty than diamonds in Botswana.â€

“In terms of revenue and the benefits to the people of Botswana, it can’t be understated. From the president to people living on the ground, they understand the importance of diamonds and the contribution to society,†he added....

- Category: News Archives

- Hits: 1044

On Alrosa’s (MICEX: ALRS) Capital Markets Day on March 18th, the company said the most frequently asked questions it gets during 1-on-1 meetings with investors are those related to the impact that “synthetic” diamonds will have on the business.

Three days later, on a Mountain Province Diamonds (TSX: MPVD) analyst call following the company’s full year 2018 results, a portfolio manager posed more of a statement than a question in the Q&A portion of the call starkly reflecting a wider sentiment of institutional investors’ view of the diamond mining industry at the moment.

The PM bluntly addressed their opinion on the threat they believe lab-created diamonds pose to natural, saying “while I appreciate the attempts to kind of dance around the issue of lab-grown diamonds…I think we all have to just accept the fact that technological improvements will continue, technological progress moves forward and lab-grown diamonds will continue to be a much larger factor.” Further, he added an anecdote, “for those of us who have millennial children, they couldn't care less whether it's lab-grown or natural…if it sparkles, looks good and is a diamond, I think that's what people are going to focus on.”

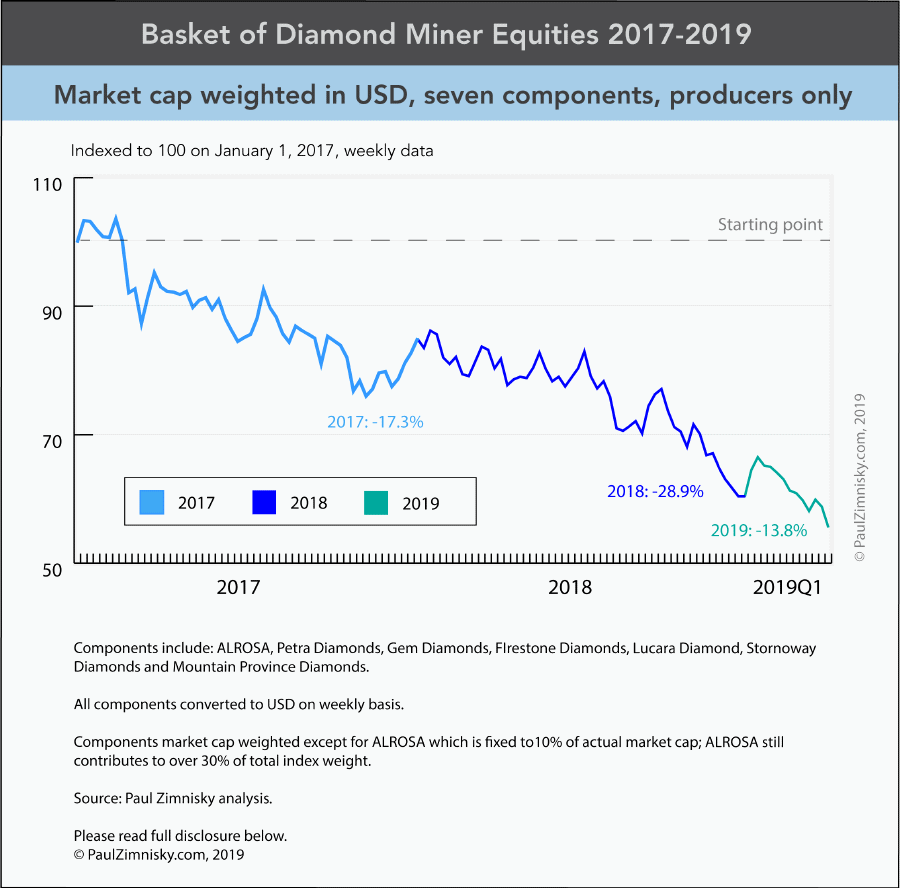

While frustration such as this is understandable for any investor that has had exposure to the space in recent years given the utter underperformance –diamond mining stocks have felt like a vortex that takes your money and does not give it back. However, it appears that sentiment has reached a level implying that the independent diamond mining industry will not survive, which is seemingly a stretch too far.

Yes, lab-created diamonds will inevitably take some market share from natural diamonds, especially at the lower price points, just as moissanite and cubic zirconia did, however the extent is...