On Alrosa’s (MICEX: ALRS) Capital Markets Day on March 18th, the company said the most frequently asked questions it gets during 1-on-1 meetings with investors are those related to the impact that “synthetic” diamonds will have on the business.

Three days later, on a Mountain Province Diamonds (TSX: MPVD) analyst call following the company’s full year 2018 results, a portfolio manager posed more of a statement than a question in the Q&A portion of the call starkly reflecting a wider sentiment of institutional investors’ view of the diamond mining industry at the moment.

The PM bluntly addressed their opinion on the threat they believe lab-created diamonds pose to natural, saying “while I appreciate the attempts to kind of dance around the issue of lab-grown diamonds…I think we all have to just accept the fact that technological improvements will continue, technological progress moves forward and lab-grown diamonds will continue to be a much larger factor.” Further, he added an anecdote, “for those of us who have millennial children, they couldn't care less whether it's lab-grown or natural…if it sparkles, looks good and is a diamond, I think that's what people are going to focus on.”

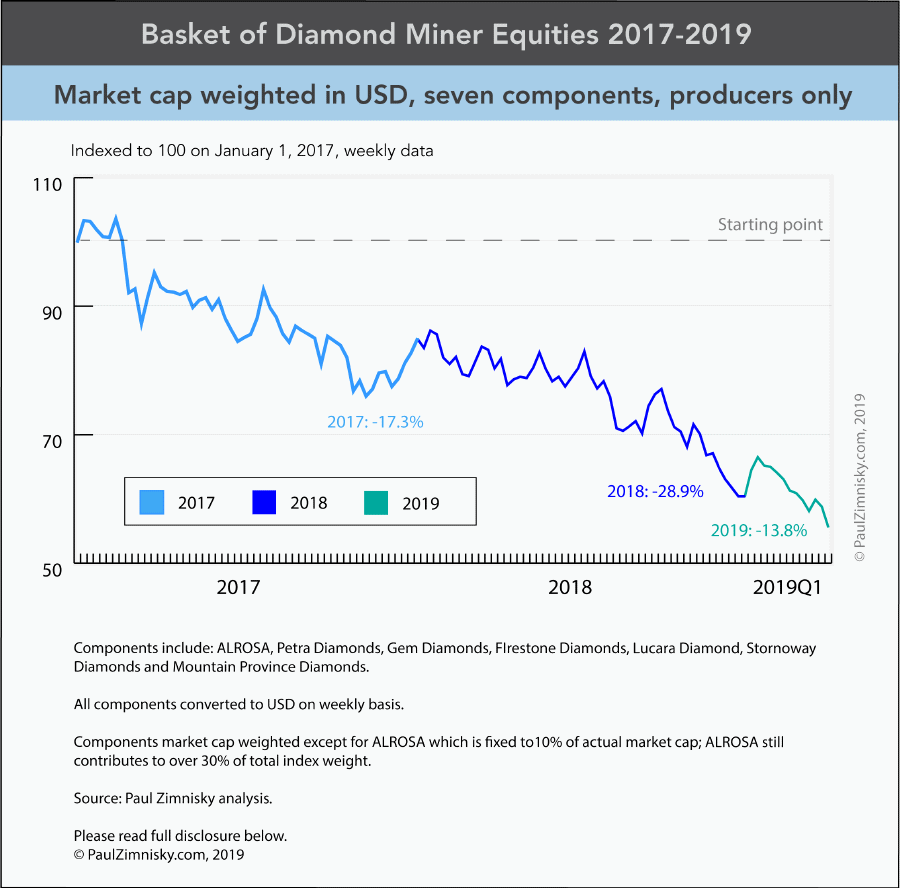

While frustration such as this is understandable for any investor that has had exposure to the space in recent years given the utter underperformance –diamond mining stocks have felt like a vortex that takes your money and does not give it back. However, it appears that sentiment has reached a level implying that the independent diamond mining industry will not survive, which is seemingly a stretch too far.

Yes, lab-created diamonds will inevitably take some market share from natural diamonds, especially at the lower price points, just as moissanite and cubic zirconia did, however the extent is...