Diamond News Archives

- Category: News Archives

- Hits: 917

HTTP/2 200 content-type: text/html; charset=utf-8 server: nginx/1.12.2 x-powered-by: Express x-request-id: d0909fbe-547f-469c-afcd-69d903ab2de3 access-control-allow-origin: * x-aicache-os: 172.31.4.109:81 x-aicache-os: 18.235.100.161:80 cache-control: max-age=15 expires: Mon, 10 Jun 2019 16:00:20 GMT date: Mon, 10 Jun 2019 16:00:05 GMT set-cookie: region=USA; expires=Sun, 08-Sep-2019 16:00:05 GMT; path=/; domain=.cnbc.com vary: User-Agent ...

Morgan Stanley: Even if the Fed cuts rates this summer, it could be too late to stop a recession- Category: News Archives

- Hits: 690

The Responsible Jewellery Council (RJC) made its mark at JCK Las Vegas with a panel discussion on responsibility and trust in the jewelry supply chain. The panel's members were: [photo - from left] Iris Van der Veken, Executive Director at RJC; Raj Metha, Director at Rosy Blue NV; Erik Jens, CEO at LuxuryFintech.com; Gina Drosos, CEO at Signet Jewelers; Jeff Corey, Owner of Day's Jewelers; Feriel Zerouki, Senior Vice President of De Beers Group, and Shekhar Shah, Director of Real Gems. The discussion was moderated by Brandee Dallow, RJC's Business Development Lead in North America.

In their contributions, the panel members made it clear that the jewelry industry cannot take its future for granted. Consumers can easily turn away from purchasing jewelry. After all, it is a luxury product that is not really 'needed.' However, to keep jewelry relevant, visible and desirable, trust and transparency are sine-qua non.

In its post-Vegas report, the RJC emphasized that "product integrity and disclosure across the value chain to protect consumer confidence is the most important issue. When a consumer walks in a store or buys online, he or she expect brands to be sustainable."

At the panel, an emphasis was placed on the importance of the United Nations' Sustainable Development Goals (SDGs) and their integration into the supply chain.

The RJC encourages its members and the industry at large to ask these questions:

- Are the SDGs being integrated into your business strategy?

- Which SDGs are the focus (materiality exercise) for business?

- What are the challenges of incorporating the SDGs into business strategy, the level of communication and measurement on SDG impacts?

Among the...

- Category: News Archives

- Hits: 1071

Gold remained choppy last night, trading either side of unchanged in a range of $1330.35 - $1337.15. It rose to $1336 against a drop in S&P futures (2837) during early Asian time after the White House said it still intended to impose tariffs on Mexican imports Monday - amid prior reports it was considering an extension. The yellow metal declined during the rest of Asian time and into early European hours, fading strength in the US dollar (DX from 96.98 – 97.18). The greenback was supported by softness in the yuan (PBOC Gov Gang says plenty of room for monetary policy easing), the yen (108.30 – 108.61, risk on, weaker Japanese Leading Index) and euro ($1.1280 - $1.1250, weaker German Industrial Production and Exports). Gold recovered to make its $1337.15 high during later European hours, helped by a pullback in the DX (97.02), with some position squaring seen ahead of the US Jobs Report. Global equities were firmer and a headwind for gold, helped by comments from the White House that “significant progress was being made” on the US-Mexico immigration / tariff talks. The NIKKEI was up 0.5%, the SCI was closed, European markets were up from 0.8% to 1.5%, and S&P futures were +0.3%. A continued rebound in the beleaguered oil market (WTI from $52.92 - $53.83, Saudis look to extend production cuts into 2nd half of year) was supportive of stocks.

At 8:30 AM, the US Payroll Report was much weaker than expected. Non-Farm Payrolls were only up 75k (exp. 175k), with downward revisions to the last two months totaling 75k, and Average Hourly Earnings also missed (0.2% vs. exp. 0.3%). The soft report immediately stoked hopes of a more aggressive response from the Fed, with FedWatch showing significant increases in the probability...

- Category: News Archives

- Hits: 835

BlueRock Diamonds (LON: BRD) shares were up 15% on the London Stock Exchange Friday after the miner announced it had recovered its largest diamond to date, a 24.9 carat gem quality stone.

BlueRock owns and operates the Kareevlei Diamond Mine in the Kimberley region of South Africa. The miner’s largest diamond prior was 16.28 carats, which sold for $78,947.

“This record recovery of such a high-quality diamond is an exciting milestone and underpins why we are so confident about the potential of the Kareevlei mine. We have a comprehensive development plan to increase production and look forward to providing further updates as we progress,” executive chairman Mike Houston said in a media statement.

The diamond will be put to tender, the results of which will be announced June 17, the company said.

BlueRock’s shares were priced at 11 pence on the LSE late Friday, on a day that saw trading volume at 61.9 million, mover six times the average daily trading volume is 9.5 million. The company has a £1.8 million market capitalization.

The post Bluerock Diamonds’ shares jump on record find appeared first on MINING.com....

- Category: News Archives

- Hits: 741

HTTP/2 200 server: nginx date: Fri, 07 Jun 2019 20:00:05 GMT content-type: text/html; charset=UTF-8 content-length: 53263 vary: Accept-Encoding, Cookie cache-control: max-age=3600, public x-ua-compatible: IE=edge content-language: en x-content-type-options: nosniff x-frame-options: SAMEORIGIN expires: Sun, 19 Nov 1978 05:00:00 GMT last-modified: Fri, 07 Jun 2019 19:45:02 GMT etag: W/"1559936702" x-backend-server: drupal-5958669d84-677jm age: 902 varnish-cache: HIT x-cache-hits: 380 x-served-by: varnish-0 accept-ranges: bytes ...

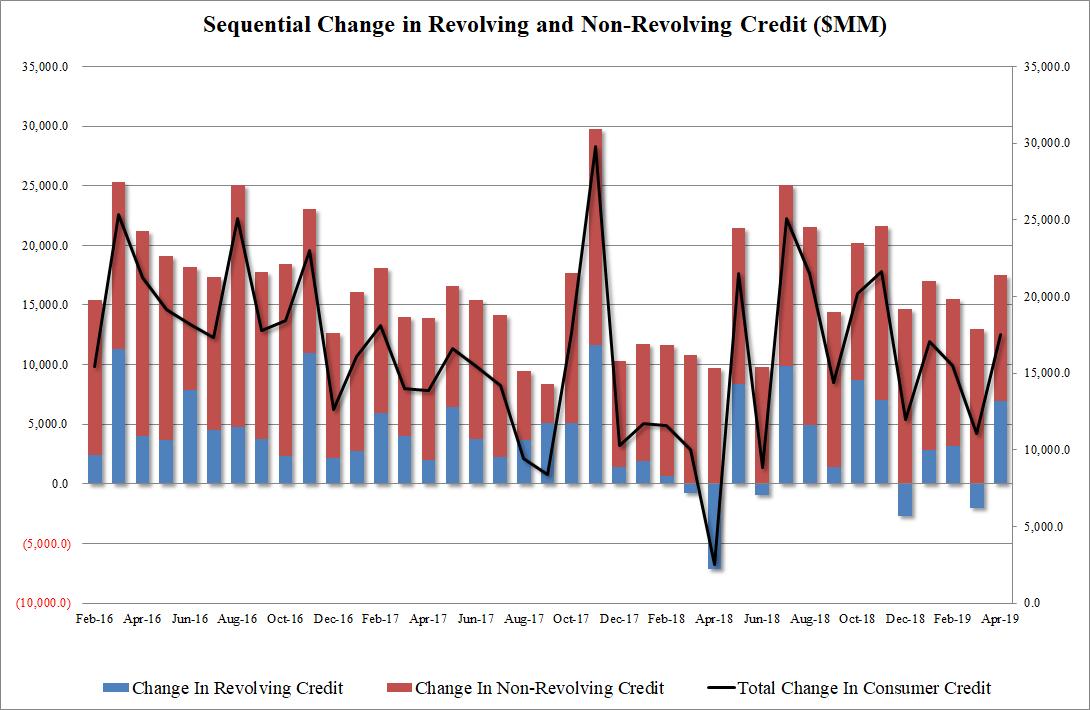

Consumer Credit Jumps The Most Since November As Credit Card Debt Soars | Zero Hedge Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)