Diamond News Archives

- Category: News Archives

- Hits: 2336

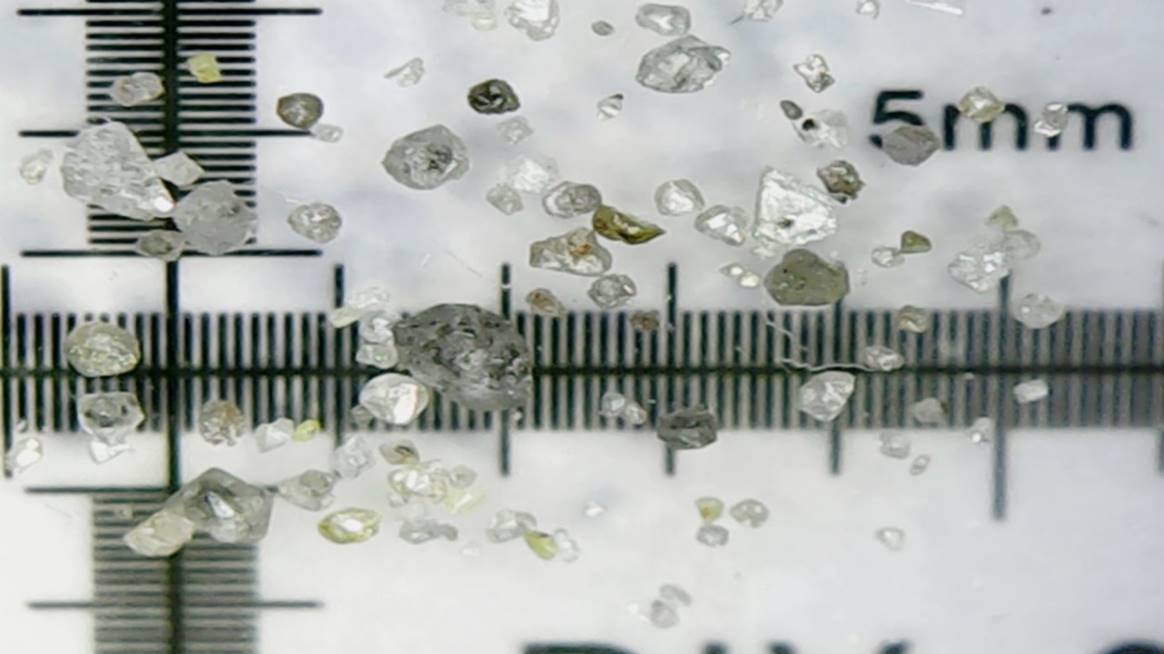

Lucapa Diamond Company Limited (ASX: LOM) (“Lucapa” or “the Company”) and its partners, Empresa Nacional de Diamantes E.P. (“Endiama”) and Rosas & Petalas, have completed the first sale for 2018 of alluvial diamonds from the Lulo Diamond Project in Angola.

The sale of 4,170 carats of Lulo diamonds achieved gross proceeds of US$9.14 million (A$11.43 million), representing an exceptional average price per carat of US$2,192.

The latest sale takes total sales of Lulo diamonds, from exploration and mining, to US$106.81 million at US$2,118 per carat.

Selection of Lulo diamonds from the first sale parcel for 2018 (Image courtesy of Lucapa)

With the latest sale completed, the next cash distribution to the Lulo partners and loan repayment to Lucapa will be considered as soon as the 2017 accounts of Lulo alluvial mining Sociedade Mineira Do Lulo are finalised (See ASX announcement 19 December 2017).

For and on behalf of the Lucapa Board.

Stephen Wetherall

Managing Director

About Lucapa

Lucapa is a growing diamond company with a portfolio of high-quality production, development and exploration assets in Angola, Lesotho, Australia and Botswana. The Company’s focus on high-value diamond production is designed to protect cash flows in a sector of the diamond market where demand remains robust.

Lucapa’s flagship asset is the Lulo Diamond Project in Angola, which is a prolific producer of large and premium-value alluvial diamonds. Lulo has produced 10 +100ct diamonds to date and is the highest US$ per carat alluvial diamond production in the world. Lucapa and its Lulo partners continue to advance their search for the primary kimberlite source of these exceptional alluvial gems, with three drill rigs now available in the ongoing kimberlite exploration program.

In keeping with the Company’s growth strategy, Lucapa has acquired a 70% interest in the advanced Mothae kimberlite project in diamond-rich Lesotho. The Mothae kimberlite pipe is a high-quality diamond resource located within 5km of Letšeng, the highest US$ per carat kimberlite diamond mine in the world. Lucapa is constructing a 150 tonne per hour (90,000 tonnes per month) diamond treatment plant, complete with XRT recovery technology, under its Phase 1 development program and is scheduled to commence highvalue production at Mothae in H2 2018. Bulk sampling will commence at Mothae in the March 2018 Quarter.

Lucapa is also advancing exploration programs at two other diamond projects – Brooking in the West Kimberley lamproite province in Western Australia, where the Company has recently discovered lamproite with high concentrations of micro and macro diamonds, and Orapa Area F in Botswana’s Orapa diamond field, where identified targets will be drilled in 2018.

Lucapa’s Board and management team have extensive diamond industry experience across the globe with companies including De Beers, Rio Tinto and Gem Diamonds. The Company was included in the ASX All Ordinaries Index in March 2017.

Forward-looking statements

This announcement has been prepared by the Company. This document contains background information about...

- Category: News Archives

- Hits: 2007

1 February 2018

Rio Tinto and The Perth Mint are delighted to unveil the first pavé set Argyle pink diamond gold coin.

Known as The Jewelled Phoenix, the coin is adorned with a delicately sculptured 18ct pink gold Chinese phoenix, hand set with a total of 1.22 carats of rare pink diamonds from Rio Tinto’s Argyle diamond mine in the east Kimberley region of Western Australia.

Perth Mint chief executive officer Richard Hayes said “Inspired by ancient Chinese legend, the fine detail and artistry of The Jewelled Phoenix has taken our craftsmanship to the next level.”

Revered as the immortal king of birds and embodying the values of virtue, compassion and trust, the phoenix is a symbol of happiness and prosperity. Only eight Jewelled Phoenix coins, a number considered extremely lucky in Chinese culture, will ever be released.

Rio Tinto Diamonds global marketing director Josephine Johnson said “Our Select AtelierTM , The Perth Mint, and our Authorised Partner , John Glajz, have created a unique and precious coin that is sure to command the attention of collectors the world over.”

, John Glajz, have created a unique and precious coin that is sure to command the attention of collectors the world over.”

The Jewelled Phoenix will be showcased at the prestigious 47th World Money Fair in Berlin from February 2-4, 2018.

To secure a rare Jewelled Phoenix coin, interested parties may visit The Perth Mint at 310 Hay Street in East Perth, telephone 1800 098 819 (Australia) or +61 8 9421 7218 (International).

Contacts

The post Argyle pink diamond coin unveiled in Berlin appeared first on MINING.com....

- Category: News Archives

- Hits: 2049

Mining and metal companies are rediscovering the downside of rallying prices: higher costs.

A sharp rebound in commodity markets in the past two years put producers in a profitability sweet spot after years of cost-cutting to cope with low prices. Now, as the upturn matures and the higher cost of energy and other materials starts to bite, some companies are beginning to struggle to maintain margins.

As the quarterly earnings season unfolds, companies from Alcoa Corp. to AK Steel Holding Corp. have seen their shares slump amid signs that cost creep is eating into profit. Machinery giant Caterpillar Inc. said it expects higher material costs to mostly offset price increases for its products. Freeport-McMoRan Inc. also flagged the effect of oil’s surge in its earnings call.

Unit costs for miners probably will rise 5 percent to 10 percent this year, with energy and currency looming as the biggest immediate pressures and wage inflation more likely toward year-end, according to Roger Bell, director of mining research at Hannam & Partners LLP. Costs may also rise as producers go after more “marginal tons” by mining trickier areas, he said.

“It’s going to be a theme that reemerges in 2018,” Bell said by telephone. “It always does when the commodity prices improve.”

Not all producers are exposed in the same way, with metal processors that buy most of their ingredients facing the larger brunt of higher raw-material costs.

Members of the Bloomberg World Mining Index have seen a sharp recovery in profitability as metal prices rebounded. The average gross margin has recovered to 27 percent from 16 percent two years ago, and is expected to reach 34 percent in 12 months’ time, according to analysts tracked by Bloomberg. Margins at steelmakers and iron-ore miners have also expanded but probably will plateau over the next year, the estimates show.

Delayed Effect

Alcoa mines the bauxite that it uses to make alumina and in turn aluminum, shielding it somewhat from cost creep. Still, as Chief Executive Officer Roy Harvey noted in an interview last month: “There’s not a lot of backwards integration opportunities when you produce your own raw materials.”

There’s also a delayed effect of higher input costs. Caustic soda, for example, takes six months to flow through to the balance sheet, Harvey said.

Fuel costs can account for 25 percent to 30 percent of costs for some miners and are largely beyond their control, Bell said. In the case of Cleveland-Cliffs Inc., energy was cited as one of the key culprits for an 11 percent jump in the cash cost of goods sold and operating expense rate in U.S. iron ore.

Better Placed

For U.S. Steel Corp., the higher cost of coal, iron ore, scrap, gas, electricity, other metals and electrodes are offsetting some of the steel price gains.

“Not one of those in itself is significant, but we add them up, it makes an impact on the...

- Category: News Archives

- Hits: 2041

Brooking diamond update

Lucapa Diamond Company Limited (ASX: LOM) (“Lucapa” or “the Company”) and its partner, Leopold Diamond Company Pty Ltd, are pleased to provide the following update on the macro and micro diamonds recovered from the Little Spring Creek prospect at the Brooking diamond project in Western Australia’s West Kimberley region (Refer ASX announcement 11 January 2018).

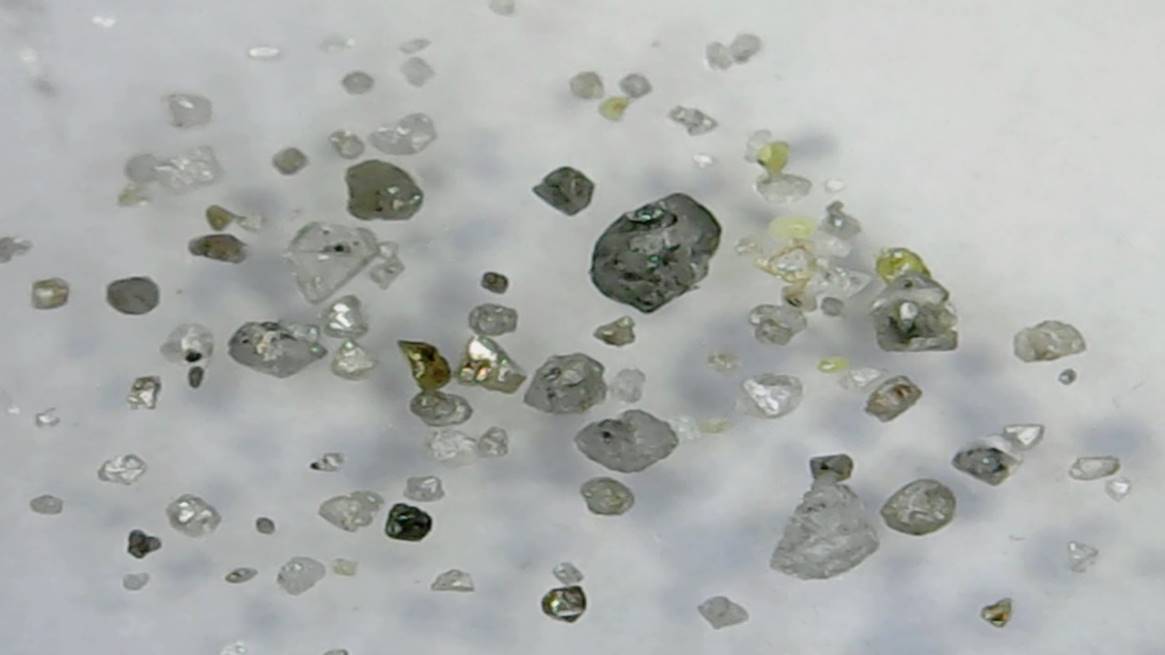

Subsequent review of the cleaned diamonds illustrate a relatively high white diamond content with yellow diamonds also being noted. The Brooking diamond project (80% owned by Lucapa) is located within 50km of the Ellendale mine which, when in production, was the world’s leading source of fancy yellow diamonds.

Macro and micro diamonds recovered from Little Spring Creek. (Image courtesy of Lucapa)

As set out in the ASX announcement of 11 January 2018, a total of 119 diamonds were recovered from 86.8kg of samples from lamproite intersected in the core of a single HQ (63mm diameter) hole drilled at the Little Spring Creek prospect.

The 119 diamonds recovered from the Little Spring Creek lamp roite drill core samples included seven macro diamonds and 112 micro-diamonds. Macro-diamonds are classified as individual stones greater than 0.5mm in at least one dimension. Diamonds smaller than 0.5mm are classified as micro-diamonds.

The largest of the seven macro-diamonds recovered from the Little Spring Creek core samples was approximately 1.0mm x 0.6mm x 0.5mm in size.

The photos of the Little Spring Creek diamonds on page one of this announcement were taken with a microscope camera subsequent to the diamonds being cleaned.

As set out in the ASX announcement of 29 January 2018, Lucapa is planning follow-up exploration programs at Little Spring Creek and other prospective targets identified within the 118km2 Brooking project.

This work will commence as soon as access to the West Kimberley region is available again after the northern wet season.

For and on behalf of the Lucapa Board.

Stephen Whetherall, Managing Director

About Lucapa

Lucapa is a growing diamond company with a portfolio of high-quality production, development and exploration assets in Angola, Lesotho, Botswana and Australia. The Company’s focus on high-value diamond production is designed to protect cash flows in a sector of the diamond market where demand remains robust.

Lucapa’s flagship asset is the Lulo Diamond Project in Angola, which is a prolific producer of large and premium-value alluvial diamonds. Lulo has produced 10 +100ct diamonds to date and is the highest US$ per carat alluvial diamond production in the world. Lucapa and its Lulo partners continue to advance their search for the primary kimberlite source of these exceptional alluvial gems, with three drill rigs now available in the ongoing kimberlite exploration program.

In keeping with the Company’s growth strategy, Lucapa has acquired a 70% interest in the advanced Mothae kimberlite project in diamond-rich Lesotho. The Mothae kimberlite pipe is a high-quality diamond resource located within 5km of Letšeng, the highest US$ per carat...

- Category: News Archives

- Hits: 1958

(IDEX Online) – ALROSA recovered two gem-quality stones, weighing 97.92 carats and 85.62 carats, from the Yubileynaya pipe at Aikhal Mining and Processing Division last month. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?> The 97.92 carat rough diamond (pictured above), is a transparent octahedron yellow-hue crystal with small sulfide and olivine inclusions near the surface. It measures 26 х 17 х 21 mm. The second rough diamond (pictured below) is also a transparent yellow-hue crystal. It is an isometric octahedron crystal with small disseminated inclusions. It measures 27.89 х 27.20 х 27.14 mm. Evgeny Agureev, Director of the USO ALROSA, Member of the Executive Committee, said: "We are happy to announce the new finds. Large stones over 50 carats are very rare. Such diamonds are traditionally sold at auctions where they are in good demand. ALROSA manufactures the rarest and clearest diamonds at its cutting division, DIAMONDS ALROSA, and sells them on itself." Yubileynaya pipe was discovered in 1975 and ranks among the largest primary diamond deposits both in Yakutia or anywhere else in the world, the miner said. The deposit is traditionally ALROSA's leader in the recovery of large diamonds.

(IDEX Online) – ALROSA recovered two gem-quality stones, weighing 97.92 carats and 85.62 carats, from the Yubileynaya pipe at Aikhal Mining and Processing Division last month. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?> The 97.92 carat rough diamond (pictured above), is a transparent octahedron yellow-hue crystal with small sulfide and olivine inclusions near the surface. It measures 26 х 17 х 21 mm. The second rough diamond (pictured below) is also a transparent yellow-hue crystal. It is an isometric octahedron crystal with small disseminated inclusions. It measures 27.89 х 27.20 х 27.14 mm. Evgeny Agureev, Director of the USO ALROSA, Member of the Executive Committee, said: "We are happy to announce the new finds. Large stones over 50 carats are very rare. Such diamonds are traditionally sold at auctions where they are in good demand. ALROSA manufactures the rarest and clearest diamonds at its cutting division, DIAMONDS ALROSA, and sells them on itself." Yubileynaya pipe was discovered in 1975 and ranks among the largest primary diamond deposits both in Yakutia or anywhere else in the world, the miner said. The deposit is traditionally ALROSA's leader in the recovery of large diamonds.  ...

...