Diamond News Archives

- Category: News Archives

- Hits: 2172

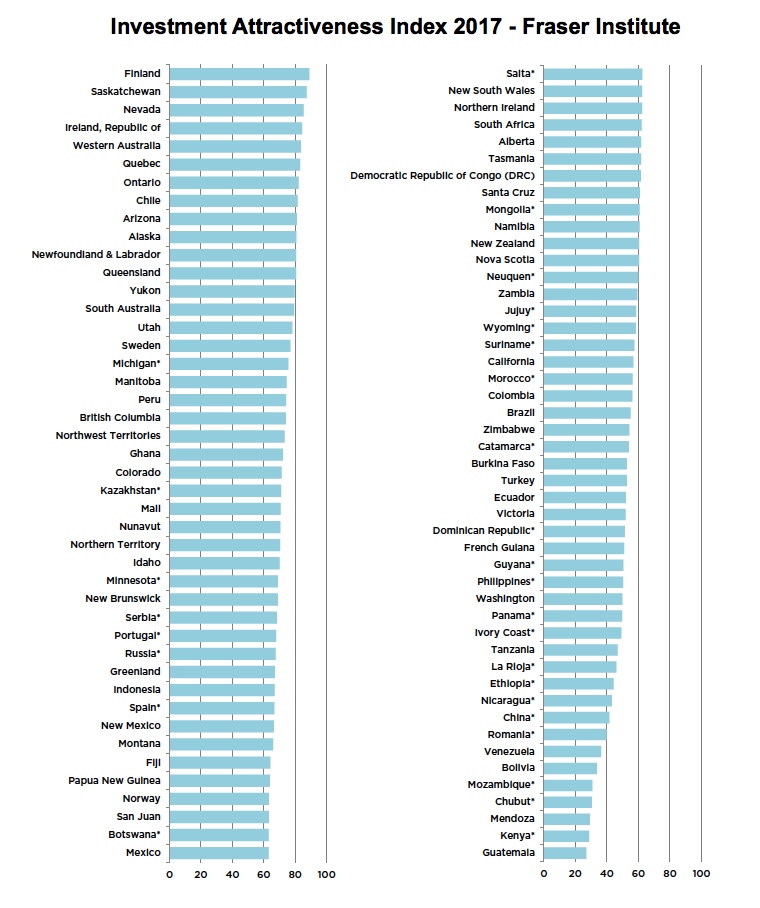

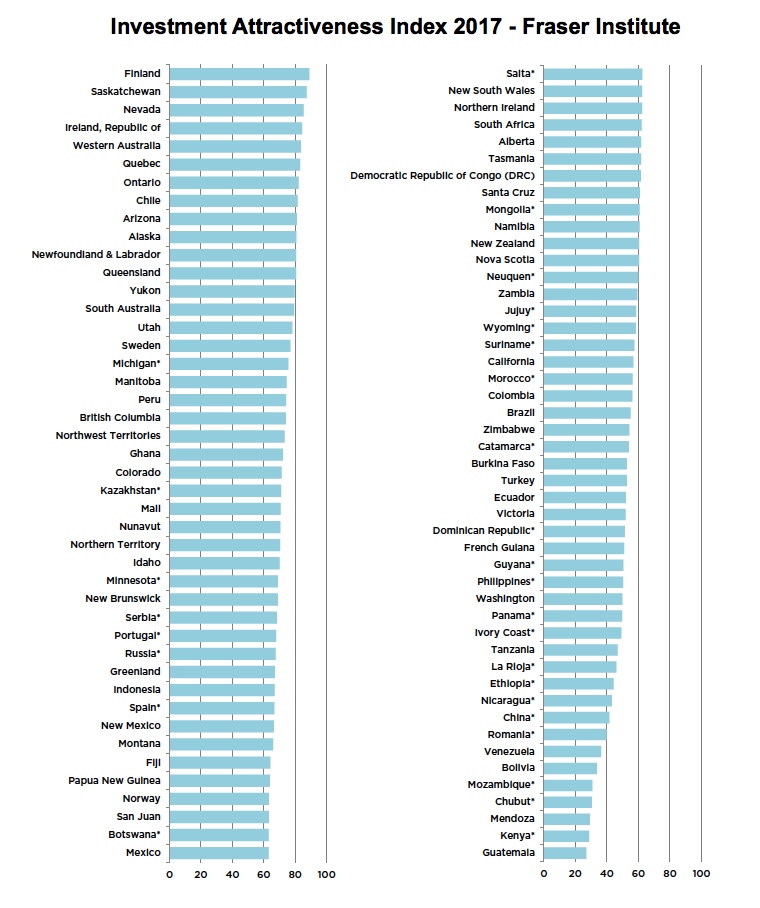

Canada is the world’s most attractive region for mining investment, based on the combined rankings of all its provinces and territories, the latest annual global survey of mining executives released Thursday by the Fraser Institute shows.

While the Maple Leaf country overtook Australia as regional destination number one, many of its provinces and territories did not fair well this year in the policy think-tank’s annual survey.

While Canada overtook Australia as regional destination number one, many of its provinces and territories did not fair well this year in the Fraser Institute's Annual Survey of Mining Executives.

Saskatchewan, which together with Manitoba topped last year ranking, fell down to second place in the ranking, leaving old-time favourite Finland leading the list of most attractive jurisdictions, with Nevada in third place.

Manitoba simply disappeared from the top ten, while British Columbia and Alberta continue to receive low marks from investors for regulatory uncertainty and concerns about disputed land claims.

Quebec ranked second in Canada (6th overall), followed by Ontario (7th), which improved its rank from 18th last year.

“Capital is fluid and one province’s loss can be another province’s gain because mining investors will flock to jurisdictions that have attractive policies,” says Kenneth Green, senior director of the Fraser Institute’s energy and natural resource studies.

“Sound regulatory regimes are an absolute must for policymakers who want to attract increasingly precious commodity investments,” he notes.

Overall, investment attractiveness fell slightly around the world.

Overall, investment attractiveness fell slightly around the world.

In Australia, every jurisdiction received lower scores on policy this year, indicating increasingly unattractive government regulations across the country. Western Australia ranked 5th overall, followed by Queensland (12) and South Australia (14).

In South America, Chile (8th) has jumped back into the top 10 having tumbled to 39th last year. And Peru, which ranked 28th last year, also rose to 19th in this year’s survey. Argentina is also much more attractive for mining investment this year, with the country’s overall score increasing by more than 50%.

When considering both policy and mineral potential in the Investment Attractiveness Index, Guatemala ranked as the least attractive jurisdiction in the world for investment, replacing the Argentinian province of Jujuy.

Here's the complete list:

The post Canada the world's overall top mining destination, despite Saskatchewan fall appeared first on MINING.com....

- Category: News Archives

- Hits: 2177

Canada is the world’s most attractive region for mining investment, based on the combined rankings of all its provinces and territories, the latest annual global survey of mining executives released Thursday by the Fraser Institute shows.

While the Maple Leaf country overtook Australia as regional destination number one, many of its provinces and territories did not fair well this year in the policy think-tank’s annual survey.

While Canada overtook Australia as regional destination number one, many of its provinces and territories did not fair well this year in the Fraser Institute's Annual Survey of Mining Executives.

Saskatchewan, which together with Manitoba topped last year ranking, fell down to second place in the ranking, leaving old-time favourite Finland leading the list of most attractive jurisdictions, with Nevada in third place.

Manitoba simply disappeared from the top ten, while British Columbia and Alberta continue to receive low marks from investors for regulatory uncertainty and concerns about disputed land claims.

Quebec ranks second in Canada (6th overall), followed by Ontario (7th), which improved its rank from 18th last year.

“Capital is fluid and one province’s loss can be another province’s gain because mining investors will flock to jurisdictions that have attractive policies,” says Kenneth Green, senior director of the Fraser Institute’s energy and natural resource studies.

“Sound regulatory regimes are an absolute must for policymakers who want to attract increasingly precious commodity investments,” he notes.

Overall, investment attractiveness fell slightly around the world.

Overall, investment attractiveness fell slightly around the world.

In Australia, every jurisdiction received lower scores on policy this year, indicating increasingly unattractive government regulations across the country. Western Australia ranked 5th overall, followed by Queensland (12) and South Australia (14).

In South America, Chile (8th) has jumped back into the top 10 having tumbled to 39th last year. And Peru, which ranked 28th last year, also rose to 19th in this year’s survey. Argentina is also much more attractive for mining investment this year, with the country’s overall score increasing by more than 50%.

When considering both policy and mineral potential in the Investment Attractiveness Index,

Guatemala ranks as the least attractive jurisdiction in the world for investment, replacing the Argentinian province of Jujuy.

Here's the complete list:

The post Canada the world's top mining destination, despite Saskatchewan fall appeared first on MINING.com....

- Category: News Archives

- Hits: 1357

Tech giant Apple Inc (NASDAQ: AAPL) is said to be in talks to buy long-term supplies of cobalt directly from miners as a way to ensure sufficient supply of the metal, an essential ingredient in the batteries that power its iPhone.

Citing anonymous sources, Bloomberg reports that the company is trying to secure contracts for several thousand tonnes of cobalt for five years or longer.

Electronics and car makers are racing to lock in supply agreements for cobalt amid fears of shortage.

Negotiations are said to be in a preliminary stage, which mean Apple may end up deciding not to go ahead with a deal, the article says.

The news underscores concerns that rapid growth in batteries demand may lead to a shortage of the raw materials needed to make them, particularly cobalt, lithium ad copper.

It also comes just a week after Samsung SDI, South Korea’s leading battery maker, unveiled plans to recycle cobalt from used mobile phones and develop lithium-ion batteries with minimum content of the metal, or no cobalt at all, as a way to offset soaring prices for the silver-grey commodity.

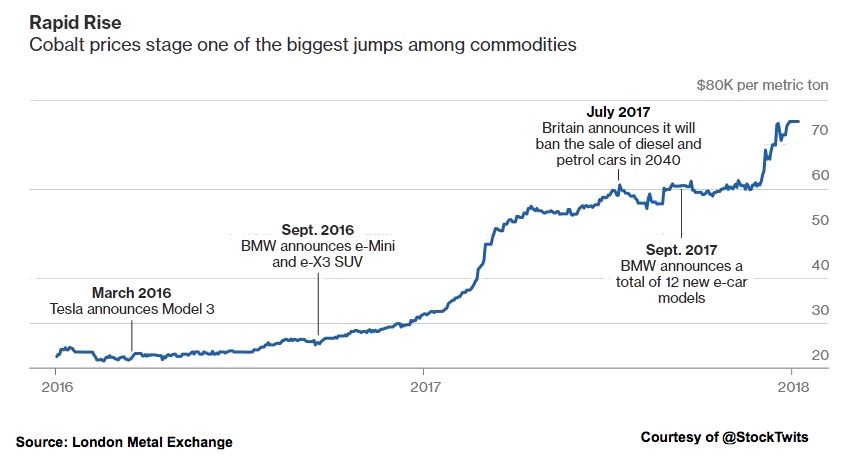

Cobalt prices went ballistic last year, with the metal quoted on the London Metal Exchange ending 2017 at $75,500 per tonne, a 129% annual surge sparked by intensifying supply fears and an expected demand spike from battery markets.

If anything, prices for the metal are expected to rise even further this year, as the Democratic Republic of Congo, responsible for more than half the world’s supply, recently hiked its taxes and royalties on the metal.

Cobalt prices have risen to $80K per tonne from just above $20K per tonne two years ago.

Cobalt demand from the electric vehicles industry is also forecast to grow from to 95,000 tonnes by 2026 from 12,000 tonnes last year, according to consultancy CRU.

BMW, for one, recently said it believes its needs for car-battery raw materials will grow 10-fold by 2025 and that it had been surprised by "just how quickly demand will accelerate".

Apple has increased its engagement with cobalt miners in recent years due to scrutiny from international human rights organizations. According to Amnesty International, about 20% of the cobalt mined in Congo is extracted by hand by informal miners including children, often in dangerous conditions.

The London Metal Exchange (LME), the world’s biggest market for industrial metals, has also stepped up efforts to make sure that cobalt mined by child labour doesn’t trade on the exchange, following several reports indicating that minors are being exploited to extract the coveted mineral

The post Apple in talks to buy cobalt directly from miners — report appeared first on MINING.com....

- Category: News Archives

- Hits: 1997

(IDEX Online) – The 61st Bangkok Gems and Jewelry Fair (BGJF) under the theme “Heritage & Craftsmanship" has opened. The fair is being held under the auspices of the Ministry of Commerce’s Department of International Trade Promotion (DITP).<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?> The fair aims to highlight Thailand’s cultural heritage and the craftsmanship of Thai artisans while setting the stage for local and international companies to engage in trade negotiations. The Ministry of Commerce said it is confident that the fair will play a vital role in the country's continuously increasing exports of gems and jewelry in 2018. Sontirat Sontijirawong, Minister of Commerce (pictured at the show), said that the gems and jewelry industry is a high-potential industry that is key to the Thai economy. "The strength of the industry lies throughout the value chain, from sourcing, manufacturing, to trading, with a workforce of approximately 1.2 million from upstream to downstream. Thus, the government is committed to implementing measures to ensure continuous growth of the industry while setting a goal of propelling Thailand to become the 'World’s Jewelry Hub'”. “The Ministry of Commerce has carried out policies to promote the growth of the gems and jewelry industry in order to increase the competitive edge for businesses while seeking new market channels and developing new products that cater to the latest industry trends. The Bangkok Gems and Jewelry Fair is a key platform that offers an opportunity for Thai companies, both large and small, to do business with high-potential businesspeople and buyers from around the world, learn about consumers’ needs, and expand their business networks and exchange knowledge with others,” Sontijirawong said. To align with the government’s “Thailand 4.0” and “Creative Economy” initiatives, the fair organizer is presenting new ideas in exhibition zones, from The New Faces featuring jewelry products from leading SMEs across the country with over 120 new exhibitors, the Innovation and Design Zone (IDZ) featuring innovative products from start-ups as well as jewelry that utilize new techniques, to The Niche Showcase featuring the latest trends in jewelry for niche markets. Moreover, insightful seminars and consultation workshops from Thai and international experts are offered as well as a mobile gems analyzing unit from the Gem and Jewelry Institute of Thailand (GIT) and other world-leading institutes. In 2017, the gems and jewelry industry was ranked the third exporting industry in Thailand after automotive and computers. Last year’s exports totaled nearly $13 billion, and when excluding unwrought gold, the industry saw an increase of 2.25%, compared to 2016, which was the first time in the past three years, the organizers said. “The outlook for gems and jewelry exports in 2018 is positive as trading partners of Thailand are recovering from stagnant...

(IDEX Online) – The 61st Bangkok Gems and Jewelry Fair (BGJF) under the theme “Heritage & Craftsmanship" has opened. The fair is being held under the auspices of the Ministry of Commerce’s Department of International Trade Promotion (DITP).<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?> The fair aims to highlight Thailand’s cultural heritage and the craftsmanship of Thai artisans while setting the stage for local and international companies to engage in trade negotiations. The Ministry of Commerce said it is confident that the fair will play a vital role in the country's continuously increasing exports of gems and jewelry in 2018. Sontirat Sontijirawong, Minister of Commerce (pictured at the show), said that the gems and jewelry industry is a high-potential industry that is key to the Thai economy. "The strength of the industry lies throughout the value chain, from sourcing, manufacturing, to trading, with a workforce of approximately 1.2 million from upstream to downstream. Thus, the government is committed to implementing measures to ensure continuous growth of the industry while setting a goal of propelling Thailand to become the 'World’s Jewelry Hub'”. “The Ministry of Commerce has carried out policies to promote the growth of the gems and jewelry industry in order to increase the competitive edge for businesses while seeking new market channels and developing new products that cater to the latest industry trends. The Bangkok Gems and Jewelry Fair is a key platform that offers an opportunity for Thai companies, both large and small, to do business with high-potential businesspeople and buyers from around the world, learn about consumers’ needs, and expand their business networks and exchange knowledge with others,” Sontijirawong said. To align with the government’s “Thailand 4.0” and “Creative Economy” initiatives, the fair organizer is presenting new ideas in exhibition zones, from The New Faces featuring jewelry products from leading SMEs across the country with over 120 new exhibitors, the Innovation and Design Zone (IDZ) featuring innovative products from start-ups as well as jewelry that utilize new techniques, to The Niche Showcase featuring the latest trends in jewelry for niche markets. Moreover, insightful seminars and consultation workshops from Thai and international experts are offered as well as a mobile gems analyzing unit from the Gem and Jewelry Institute of Thailand (GIT) and other world-leading institutes. In 2017, the gems and jewelry industry was ranked the third exporting industry in Thailand after automotive and computers. Last year’s exports totaled nearly $13 billion, and when excluding unwrought gold, the industry saw an increase of 2.25%, compared to 2016, which was the first time in the past three years, the organizers said. “The outlook for gems and jewelry exports in 2018 is positive as trading partners of Thailand are recovering from stagnant...

- Category: News Archives

- Hits: 2174

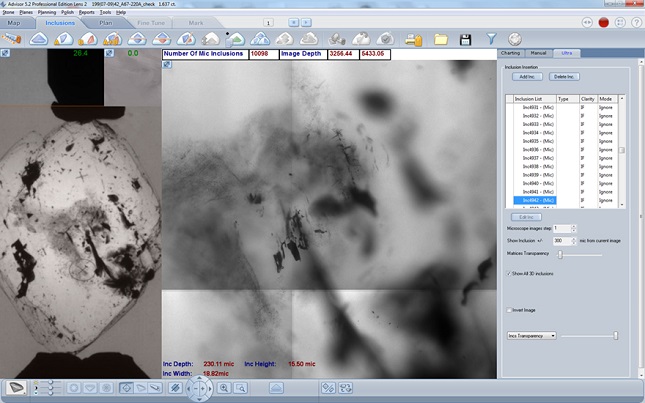

(IDEX Online) – Sarine Technologies has officially opened the Sarine Technology Laboratory, which it says will be the first in a network of advanced, automated gemological labs.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

Israel Diamond Exchange (IDE) President Yoram Dvash praised the company on its initiative. "IDE and Sarine have always had very good relations. We are always pleased to see that each new Sarine project starts in Israel; that is not something that we take for granted. I hope that together we can bring Israel back to its leading role in the global diamond trade."

The Sarine Technology Lab is initially offering services in Ramat Gan, which will include automated, accurate, consistent, and objective grading of a polished diamond's Clarity and Color, based on Sarine's breakthrough artificial intelligence-based technologies, said David Block, CEO of the Sarine Group. He added that Sarine will be opening a Technology Lab in India in May.

The lab will offer diamond authentication (simulant, natural or synthetic, treated) and 4Cs grading, all using the latest state-of-the-art technology.

"I believe that in another 5-10 years automated color/clarity reports will be the standard. Technology can provide grading services that are consistent and repeatable. Currently, the same diamond can receive a report with a difference of 2-3 grades from different labs. That clearly can't happen with our technology which we are continuously checking and improving."

He denied that the automated system would put people out of work on a vast scale since they would still be needed to operate the machines and carry out QA work. "The aim is to raise consistency in grading not to save labor costs."

Block said that the grading reports would be digital and interactive that clients can see on their smartphones and tablets as opposed to the current "dry reports" that are produced.

The automated grading information provided by Sarine Labs will be integrated into the Sarine Profile™ digital diamond report. Sarine Profile™ reports are customizable and may contain a combination of diamond information, including the new 4Cs and diamond detection, as well as light performance, imaging, Hearts and Arrows, and more, according to the customer’s brand identity.

Block added that the company would be open to selling the system to any industry player, including grading labs, once a number of issues have been ironed out, such as security....