Diamond News Archives

- Category: News Archives

- Hits: 1899

(IDEX Online) – De Beers has announced that its Forevermark diamond brand will enter the German market after signing with an exclusive licensee partner, and is also in advanced-stage discussions with potential partners in France and Italy. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

The expansion into new European markets comes on the back of a successful global performance throughout 2017 and in 2018 to date, the company said.

In Germany, Forevermark is partnering with Heinz Mayer, an Idar-Oberstein-based diamond jewelry specialist. Heinz Mayer will launch the Forevermark collection to the German jewelry retail trade at the Baselworld trade fair, presenting the opportunity for luxury retailers to bring the brand to German consumers later in 2018.

Forevermark is also in advanced discussions in France with Groupe Marcel Robbez Masson, and in Italy with World Diamond Group. The expansion into new European markets follows the brand’s successful performance in 2017, during which it posted 19 percent growth in numbers of diamonds sold globally.

Stephen Lussier, Chief Executive, Forevermark, said: “Forevermark is delighted to add new licensee partners in key European markets and to further expand the brand’s global reach. The flow of international travelers through Europe from key consumer markets such as the USA, China, India and Japan is an important influence on brand selection, and bolstering the brand’s visibility in leading European destinations is a powerful next step following the successes of 2017.

“We have sought out strong partners whose values match our own, and who can deliver a locally relevant range of Forevermark diamond jewelry in their countries. We now look forward to further expansion through the year as we continue to offer more consumers the opportunity to buy Forevermark’s beautiful, rare and responsibly sourced diamonds.”...

- Category: News Archives

- Hits: 1988

Canada-listed Fura Gems (TSX-V:FUR), a new gemstone mining and marketing company headed by the former COO of Gemfields (LON:GEM), has kicked off initial production at its Coscuez emerald mine in Colombia.

The early output of 1,720 carats of emeralds, including 826 carats of top quality ones, was achieved through a bulk-sampling program carried out within eight weeks of the completing the acquisition of the mine, which Fura grabbed from Gemfields in October.

The company, which began operations almost a year ago, in May 2017, said the quality gems found during the early stages of bulk sampling at Coscuez, confirmed the worth of the emerald mine.

“We will continue to build our geological knowledge of the license area and also strive to modernize Coscuez,” President and chief executive Dev Shetty said.

Some of the emeralds recovered during the first weeks of the bulk-sampling program. (Image courtesy of Fura Gems.)

Through the bulk sampling program Fura expects to collect 30,000 tonnes of material from the mineralized body on or before the end of the year, using existing tunnels;

The main goal, the company said, is to gather the most representative samples from the mineralized body at different levels from all accessible tunnels and workings within Coscuez.

Located in the mountainous department of Boyacá, Coscuez is probably one of the best-known emerald deposits in the world. Shetty told MINING.com last month that the mine produced over 95% of Colombia’s emerald supply in the 1970s.

The country’s production of green gemstones dropped from its world-leading position in the early 2000’s with 10 million carats a year to 2.6 million a decade later, losing ground to Zambia and Brazil, mainly as a result of social conflict, violence and instability triggered by drug lords. But since a final peace agreement signed in 2016, foreign companies are once again landing in the country, which is still the world’s largest supplier of emeralds in terms of value.

The post Fura Gems kicks off initial production at iconic Coscuez emerald mine appeared first on MINING.com....

- Category: News Archives

- Hits: 2015

Russian miner Alrosa (MCX:ALRS), the world’s top diamond producer by output, has unveiled its synthetics detector, aimed at cracking down on dishonest suppliers that mix lab-made stones with mined diamonds.

The portable machine, named ALROSA Diamond Inspector, screens polished diamonds and jewellery, identifying synthetics as well as treated stones or simulants.

Alrosa expects the detector's relatively low price and high accuracy will make it popular both in Russia and abroad.

The company expects that its relatively low price and high accuracy will allow the detector to be in demand both in Russia and abroad.

The device was developed by the diamond miner together with specialists from the Federal State Budgetary Institution Technological Institute for Superhard and Novel Carbon Materials (TISNCM).

A joint venture, Diamond Scientific and Technological Center LLC, will be in charge of its production and sale, and its price will be about half of those currently available in the market, Alrosa said.

“One of the main competitive advantages of ALROSA Diamond Inspector is the use of three optical detection methods, which give high assessment reliability,” Vladimir Sklyaruk, general director of Diamond Scientific and Technological Center LLC, said in the statement.

Alrosa’s efforts to ensure the authenticity of its diamonds complement rival De Beers’ recently launched initiative to create the first industry-wide blockchain platform, which will enable greater tracking of gems being traded worldwide.

The technology, which the Anglo American’s unit began developing last year, will allow tracing each diamond throughout the entire value chain — from mine to buyer.

The post Alrosa launches synthetics diamonds detector appeared first on MINING.com....

- Category: News Archives

- Hits: 1998

(IDEX Online) – Crimes committed against U.S. jewelry firms reported to the Jewelers’ Security Alliance (JSA) increased by 12% to 1,394 in 2017 from 1,245 in 2016, according to the JSA's Annual Crime Report for 2017.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

Total dollar losses from crimes committed against U.S. jewelry firms decreased by 0.4% to $72.1 million in 2017 from $72.4 million in 2016.

In 2017 JSA recorded a large dollar increase in cyber-enabled thefts by deception and impersonation. The average loss from this type of crime was over $1.2 million.

There were five homicides of jewelers in 2017, compared to six homicides in 2016.

In the 10-year period from 1996 to 2006, 82 jewelers were killed, while in the 10-year period from 2007 to 2017, 41 jewelers were killed, which represented a 50% decline.

Other figures include:

- Reports of smash and grab robberies increased by 14.5% to 71 from 62, with more than 50% of smash and grab robberies taking place in mall locations.

- Grab and run thefts increased by 32.4% to 556 from 420

...

- Off-premises crimes, including traveling salesperson losses, fell to 39 in 2017, the lowest total in over 20 years

- Category: News Archives

- Hits: 2010

By Paul Zimnisky

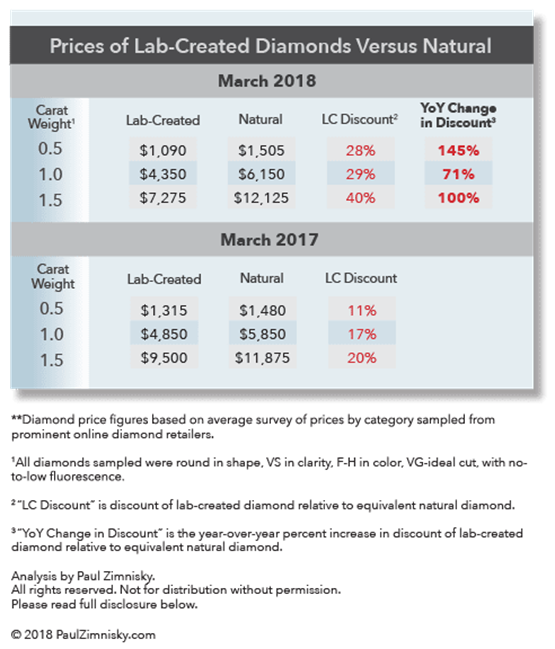

The discount of gem-quality lab-created diamonds, manufactured for use in jewelry, relative to natural diamonds has doubled from 11-20% a year ago to 28-40% today, according to a survey of prices.

For example, a white, 1-carat round diamond that is VS (very-slightly included) in clarity, F-H (near-colorless to colorless) in color, VG-ideal cut, with no-to-low florescence was selling for approximately $4,850 in March 2017 but is now $4,350 in March 2018, a 10% decline.

However, over the same period of time the price of an equivalent natural diamond went from $5,850 to $6,150, representing about a 5% increase. Thus, the discount of the lab-created diamond relative to the natural equivalent was approximately a 17% in March 2017, but is now about 29%, a 71% year-over-year increase.

See table below for more examples:

Lab-created diamonds are becoming less expensive relative to natural equivalents as investment in lab-diamond production technology has rapidly improved production economics in just the last few years. This has led to rapid relative supply growth and an environment that is more price competitive for lab-diamond manufactures.

However, actually gauging lab-diamond supply growth is difficult. The global proliferation of lab-diamond production facilities in recent years, from China to Russia to the U.S., has made tracking production figures challenging, especially given that the companies involved are private and proprietary in nature. Further complicating the process is the range in quality and scale at which lab-diamonds are being produced.

Natural diamond production quality can be segmented as approximately 40% gem-quality, 20% near-gem-quality, and 40% industrial-grade. Gem-diamonds are used in jewelry, industrial-grade diamonds are used for abrasive and other industrial application, and near-gem diamonds are used for both jewelry and more-specialized industrial application, with the split of use dependent on market prices and demand.

Small parcels of near-gem-quality lab-created diamonds manufactured in China. Image source: Paul Zimnisky

It is important to note that natural industrial-grade diamonds are simply seen as a by-product, as the presence of gem-quality diamonds in a deposit are what drive the economics behind natural diamond production decisions.

In the case of lab-diamonds, the ability to create higher-quality gem-diamond product economically is a relatively recent development –within the last decade. Even with the recent developments in technology, current lab-created production of true gem-diamonds only represents <10% of global output, estimated at <5M carats, which compares to natural gem-quality output of ~60M carats (based on 40% of an estimated total natural production of 147M carats in 2018).

The business of manufacturing lab-created diamonds for industrial application (typically referred to as synthetic diamond) has been around for decades, and the industry currently supplies >99% of global industrial diamond supply for use as abrasives (production is in the billions-of-carats for context).

Lab-production of near-gem-quality diamonds is where supply analysis gets especially challenging. Producers of synthetic industrial-quality diamonds have been advancing their production capability through improved technology which has enabled them to increase...