Diamond News Archives

- Category: News Archives

- Hits: 1772

- Category: News Archives

- Hits: 1908

Federal Reserve policy makers seem to be working at cross purposes.

In laying out plans to ease some constraints imposed on banks after the financial crisis, the Fed is moving to free up tens of billions of dollars for financial institutions to lend to promote faster economic growth.

At the same time it is reducing its balance sheet and gradually raising interest rates to restrain credit creation and keep the economy in check.

“The timing is not the most opportune” for relaxing the banking rules, said Mark Zandi, chief economist at Moody’s Analytics Inc. in West Chester, Pennsylvania.

Those steps will complicate the Fed’s effort to engineer the soft landing of an economy that is already being juiced by tax cuts and government spending increases. To help bring that about, officials plan to keep raising interest rates over the next few years, though they’re expected to hold policy steady at their meeting next week.

“By itself this would risk putting regulatory policy on the same pro-cyclical trajectory as fiscal policy,” said Lou Crandall, chief economist at Wrightson ICAP LLC in Jersey City, New Jersey, though he added that the economic impetus from the former is dwarfed by that from the latter.

In unveiling a proposal[1] on April 11 to ease leverage limits on Wall Street banks, the Fed and the Office of the Comptroller of the Currency said the step might lower the amount of capital lenders are required to hold in their main subsidiaries by $121 billion. The move would give banks added flexibility to extend credit.

Deposit-Shunning Banks Get Big Break as U.S. Eases Leverage Rule[2]

It came on the heels on an announcement[3] by the...

- Category: News Archives

- Hits: 1924

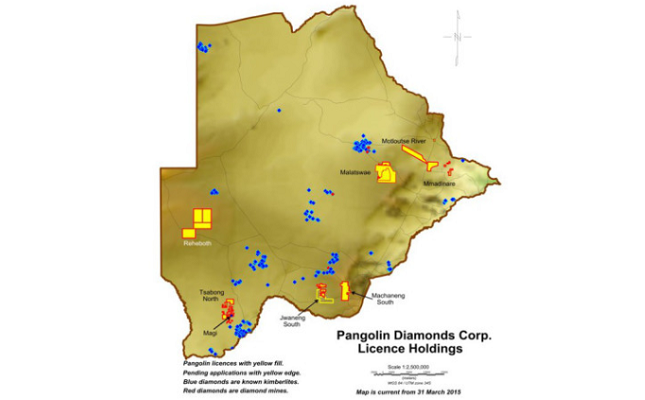

(IDEX Online) – Pangolin Diamonds Corp. has recovered a white diamond from its wholly-owned Jwaneng South Kimberlite Project in an area 100 km south of the Jwaneng diamond mine in the Southern District Botswana.

The diamond was recovered from an unscreened 60 litre sample collected within a 10 square metre area of a GPS controlled sample site, the firm said. This material was dry screened in the field to recover the +0.425 – 4.0 millimetre size fraction. The sample was then transported to Francistown, Botswana and processed through Pangolin’s 1-tph DMS plant.

The white diamond measuring approximately 1 mm in its long axis is a fragment of the original diamond. The presence of a chrome spinel inclusion on the broken surface of the diamond is interpreted to be an indication that the diamond is close to source and transport distance is minimal. In addition to the diamond, ilmenites with surfaces showing little or no wear through transport have also been recovered from soil samples from the same area during three phases of soil sampling.

A detailed groundmagnetic survey has been completed over an area of 144 Ha area and a magnetic anomaly has been identified in the south of the area. The diamond is located adjacent to the groundmagnetic anomaly.

An additional groundmagnetic survey extending the existing survey area to the south and to the east is currently being implemented. In addition, high density soil sampling is being undertaken over the identified groundmagnetic anomaly.

An evaluation has commenced on the AK10 diamondiferous kimberlite pipe, located in the Orapa Kimberlite Field. The AK10 kimberlites located 4 kilometres east of the Karowe diamond mine owned and operated by Lucara...

- Category: News Archives

- Hits: 1902

There is no need for Russian and Chinese businesses to pay each other in dollars and euros, when they can settle in rubles and yuan, according to Zhou Liqun, chairman of the Union of Chinese Entrepreneurs in Russia.

Read more

“The leaders of the two countries should think over improving relations, especially in financial cooperation. Why make payments with foreign currency? Why dollar? Why euro? They can be made directly in the yuan and the ruble,” he told RIA Novosti on the sidelines of the Valdai Discussion Club conference in Shanghai, titled “Russia and China: Contemporary Development Challenges.”

According to Zhou Liqun, American and European sanctions gave Russia and China a chance to build up trade and economic cooperation. “Of course, there are sanctions, there are problems, but there is hope and opportunity,” he added.

China is Russia’s largest trading partner, accounting for 15 percent of Russian international trade last year. In January 2018, it grew to 17.2 percent. Germany, which holds second place among Russia’s trade partners, has a share of about eight percent.

The countries have been gradually ditching the dollar and the euro in trade. In 2017, nine percent of payments for Russian imports to China were made in rubles; Russian companies paid 15 percent of Chinese imports in the renminbi. Just three years ago, the numbers were two and nine percent, respectively.

For more stories on economy & finance visit RT's business section[1]...

References

- ^ RT's business section (www.rt.com)

Venezuela’s 2Y Sovereign Yield Rises To Above 250% (Inflation Rises To 7,459%) – Confounded Interest

- Category: News Archives

- Hits: 2035

Things in Venezuela keep getting worse and worse under the incredible incompetence of

Nicolás Maduro, Venezuela’s President.

The two-year sovereign yield for Venezuela is now over 250%!

According to Professor Steve Hanke at Cato,[1] Venezuela’s inflation rate hit 7,459% as of March 14, 2018.

And here is the Venezuelan yield curve on the day Maduro took power (yellow) compared to today (green).

Well done, Nicolás! … NOT!!!!!!!!!!!!!!

Bernie Sanders: “These days, the American dream is more apt to be realized in South America, in places such as Ecuador, Venezuela and Argentina, where incomes are actually more equal today than they are in the land of Horatio Alger.”

At least Bernie didn’t say “Staggering inflation and insanely high interest rates are more apt to be realized in Venezuela than in the land of Horatio Alger.” But then he would have been correct!

...