Diamond News Archives

- Category: News Archives

- Hits: 1724

Much as the straw that eventually breaks the Everything Bubble’s back may well be something few saw coming, the global interplay of Fed debt buyers and sellers can shed light on dynamics common sense would never suggest to find.

Perhaps the least likely candidates to sop up over $1T in nothing-yielding Fed debt? Mutual funds. And yet, that’s exactly what they’ve done.

According to the Federal Reserve, it began normalizing its balance sheet in late 2017. In particular, the Federal Reserve holdings of US Treasury's have been reduced by a little less than $70 billion since peak holdings.

This is about a 2.7% reduction in the Fed's Treasury holdings, so far. The Fed plans to continue rolling off Treasury holdings as they mature, at somewhere between $30 to $50 billion monthly, in a "data dependent" fashion likely until they halve their current holdings (give or take hundreds of billions).

I'm "amazed and shocked" that as the Fed focused its balance sheet reduction solely on mid duration holdings and bought short duration...the short end rose significantly vis-a-vis the mid and long duration.

So important to note that as all recognizable sources of Treasury buying have wound down, ceased, or turned to outright selling...prices and yields haven't reflected this "free market" implication despite continued record federal trade and budget deficits. In a situation where nothing adds up, that in itself adds up (likewise, remember, Bernie Madoff's #'s never added up, and that was the point).

These domestic sources of buying are led by that juggernaut of funding known in the Treasury reports as "other". Not domestic banks, not domestic pensions, not insurers, not state or local governments...no it's mutual funds assisting the massive bid from "other", loading up like never before on US...

- Category: News Archives

- Hits: 2100

CPI measures prices. Full stop. End of story. And strong arguments can be made about how meaningful a figure it is; if an enormous component of ramping inflation is college tuition costs and they have zero bearing on your life, how significant can the CPI number be for you?

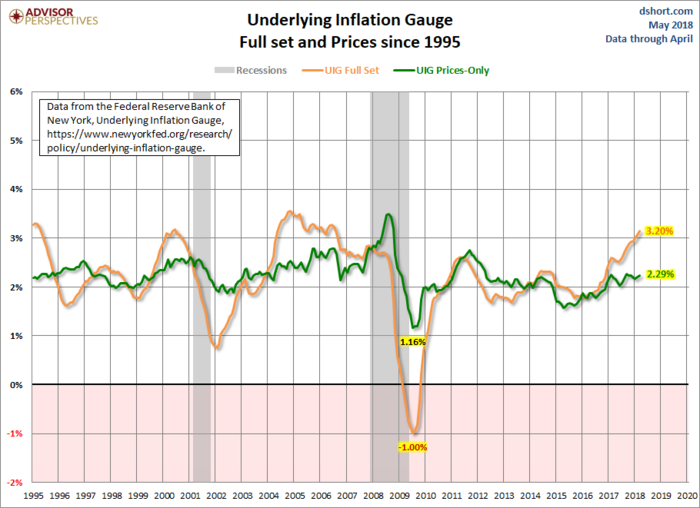

UIG, the Underlying Inflation Gauge, takes into account other predictive inflationary inputs on a macro level. It has proven to be a better forecasting tool than CPI, and it is starting to spike.

Economists at the NY Federal Reserve Bank introduced a new measure of trend inflation in September 2017, the Underlying Inflation Gauge (UIG), meant to complement the current standard measures. Investors and policymakers alike have an interest in the behavior of inflation over longer time periods.

The trend component of inflation is not an observed measure and a proxy measure is required to calculate it. To calculate trend inflation, transitory changes in inflation must be removed such as volatile components or specific items.

Core CPI, which is the most widely used and accepted form of estimating trend inflation, only focuses on price components. The UIG derives trend inflation from a large set of data that extends beyond price variables. Additionally, it has shown higher forecast accuracy than traditional core inflation measures.

The UIG can be a useful complement to the traditional core inflation measures. While the NY Fed economists caution placing too much emphasis on UIG as a forecasting tool, the UIG still offers meaningful information not provided in Core CPI.

ORIGINAL SOURCE: New Indicator: Underlying Inflation Gauge[1] by Jill Mislinski at Advisor Perspectives[2] on 5/10/18...

References

- ^ New Indicator: Underlying Inflation Gauge (www.advisorperspectives.com)

- Category: News Archives

- Hits: 2071

Welcome to your daily dose of completely disingenuous false modesty.

Any institution that has the power to set the primary interest rate for the leading world economic power wields tremendous power over the world economy. And that, of course, is merely the beginning of the Fed’s arsenal. Is there anyone who would believe that the Fed’s decisions, in our massively connected global financial world, effect only the US and even then, not that much?

On May 8, Jerome Powell, chairman of the U.S. Federal Reserve, Warned Against Overstating Impact of Fed Policy on Global Financial Conditions.

In an attempt to absolve the Fed of wrongdoing, Powell cautioned: "The influence of U.S. monetary policy on global financial conditions should not be overstated. The Federal Reserve is not the only central bank whose actions affect global financial markets. In fact, the United States is the recipient as well as the originator of monetary policy spillovers."

Powell then posted a series of charts and comments allegedly exonerating the Fed. "Research at both the Fed and the IMF suggests that actions by major central banks account for only a relatively small fraction of global financial volatility and capital flow movements," said Powell.

Powell also stated "The linkages among monetary policy, asset prices, and the mood of global financial markets are not fully understood."

Of course they are not "fully" understood, but it is also crystal clear that central banks have blown bubbles.

The Fed, by its very existence, has completely distorted the market via self-reinforcing observer/participant feedback loops. Thus, it is fatally flawed logic to suggest the Fed is simply following the market, therefore the market is to blame for the Fed’s actions. There would not be a Fed in a free market.

...

- Category: News Archives

- Hits: 2173

- Category: News Archives

- Hits: 1368

Gold rose overnight in a range of $1311 - $1318, but was capped at the quadruple top resistance area of $1318 -19 (5/3, 5/7, 5/8 and 5/9 highs).

It was fueled by a softening in the resurgent US dollar, which traded down from 93.17 – 92.80. The greenback was pressured by some strength in the euro ($1.1845 - $1.1891) and the pound ($1.3545 - $1.3615 – bid up ahead of BoE statement).

At 7AM, the pound tanked ($1.3490) after the Bank of England left rates unchanged, and on Carney’s subsequent dovish comments (wanted to see a pick up in the next few months before raising rates, lowered GDP and inflation forecasts).

The DX rallied back to 93, and pressed gold down to $1317 ahead of the NY open. News that Israel struck some Iranian targets in Syria after receiving rocket fire on the Golan Heights was supportive for gold, as well as a pullback in the US 10-year bond yield from 3.006% to 2.97%.

Global equities were mostly firmer and a headwind for gold with the NIKKEI +0..4%, the SCI up 0.5%, Eurozone shares ranged from -0.3% to +0.3%, and S&P futures were +0.1%. A continued advance in oil (WTI from $71.20 - $71.84, high since Nov. ’14, looming sanctions on Iran), supported equities.

At 8:30 AM, lower than expected reading on US CPI (0..2% vs. exp. 0.3%) and Core CPI (0.1% vs. exp. 0.2%) overcame a lower reading on Jobless Claims (211k vs. exp. 219k).

S&P futures popped to 2706, and the 10-year yield slipped further (2.948%). The DX tumbled, and took out its overnight low to reach 92..53. Gold rallied, and finally breached the quadruple top at $1318-19 to reach $1323, with some short covering seen.

US stocks...