CPI measures prices. Full stop. End of story. And strong arguments can be made about how meaningful a figure it is; if an enormous component of ramping inflation is college tuition costs and they have zero bearing on your life, how significant can the CPI number be for you?

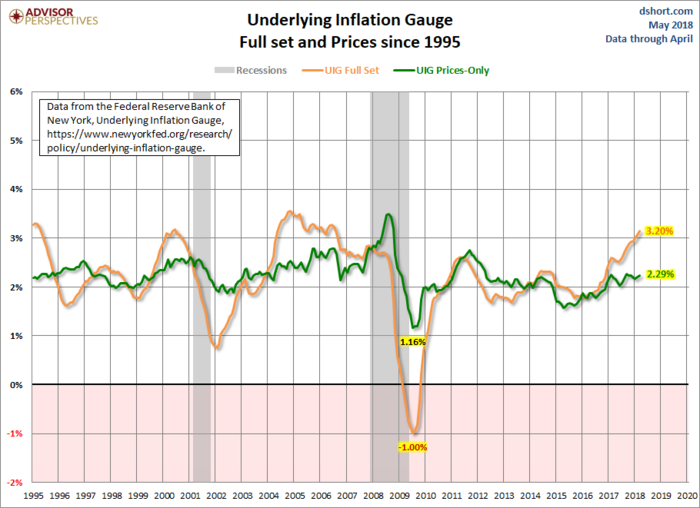

UIG, the Underlying Inflation Gauge, takes into account other predictive inflationary inputs on a macro level. It has proven to be a better forecasting tool than CPI, and it is starting to spike.

Economists at the NY Federal Reserve Bank introduced a new measure of trend inflation in September 2017, the Underlying Inflation Gauge (UIG), meant to complement the current standard measures. Investors and policymakers alike have an interest in the behavior of inflation over longer time periods.

The trend component of inflation is not an observed measure and a proxy measure is required to calculate it. To calculate trend inflation, transitory changes in inflation must be removed such as volatile components or specific items.

Core CPI, which is the most widely used and accepted form of estimating trend inflation, only focuses on price components. The UIG derives trend inflation from a large set of data that extends beyond price variables. Additionally, it has shown higher forecast accuracy than traditional core inflation measures.

The UIG can be a useful complement to the traditional core inflation measures. While the NY Fed economists caution placing too much emphasis on UIG as a forecasting tool, the UIG still offers meaningful information not provided in Core CPI.

ORIGINAL SOURCE: New Indicator: Underlying Inflation Gauge[1] by Jill Mislinski at Advisor Perspectives[2] on 5/10/18...

References

- ^ New Indicator: Underlying Inflation Gauge (www.advisorperspectives.com)