Diamond News Archives

- Category: News Archives

- Hits: 1309

HTTP/1.1 200 OK Content-Type: text/html; charset=utf-8 Server: Apache/2.4.6 (CentOS) PHP/7.0.23 X-Powered-By: PHP/7.0.23 X-Aicache-OS: 172.31.15.184:80 Cache-Control: max-age=15 Expires: Mon, 04 Jun 2018 12:15:18 GMT Date: Mon, 04 Jun 2018 12:15:03 GMT Transfer-Encoding: chunked Connection: keep-alive Connection: Transfer-Encoding Set-Cookie: region=USA; expires=Sun, 02-Sep-2018 12:15:03 GMT; path=/; domain=.cnbc.com Set-Cookie: AKA_A2=A; expires=Mon, 04-Jun-2018 13:15:03 GMT; path=/; domain=cnbc.com; secure; HttpOnly Link: ;rel="preconnect" Vary: User-Agent US-China ties in focus as American Institute in Taiwan launches new office

The American Institute in Taiwan, a non-profit that operates as the de-facto U.S. embassy in Taipei, is set to launch its new office that day and a senior U.S. official — many theorize it could be National Security Advisor John Bolton[4] — is widely expected to attend.

The $250 million facility is reportedly twice the size of the current building and represents a major strengthening of U.S.-Taiwan relations. But it could also add strain to a U.S.-China relationship that's already weighed down by trade tensions[5].

Jonathan Ernst | Reuters

Jonathan Ernst | Reuters

President Donald Trump visits the Forbidden City with China's President Xi Jinping in Beijing on November 8, 2017.

...

- Category: News Archives

- Hits: 1271

(IDEX Online) – Mountain Province Diamonds Inc. recovered a 95-carat diamond from the Gahcho Kué mine located in the Northwest Territories, Canada. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

It is the largest gem quality stone and the fourth-largest stone recovered from the mine since production commenced just under two years ago.

The diamond was included in the fancies and specials parcel acquired by Mountain Province in the most recent Gahcho Kué production split. The 95-carat white octahedron diamond is of top clarity, the miner said.

Reid Mackie, Vice President Diamond Marketing, said: “The recovery of this diamond firmly establishes Mountain Province as a reliable producer of exceptional, high quality, Canadian diamonds in very large sizes and bodes well for the future discovery of similar gems.”

The diamond will be offered at Mountain Province’s upcoming rough diamond tender with viewings to be held from June 11-22 in Antwerp.

Mountain Province Diamonds is a 49% participant the Gahcho Kué, with De Beers Canada owning the rest....

- Category: News Archives

- Hits: 1416

Miners are responding to a rosier metal outlook by increasing spending on exploration and releasing more assay results.

Base metal prices are up. Copper bounced off its 2015 nadir of $4,500 a tonne and in the last few months has found a range of $6,600 to $6,700 a tonne, a metal price that ING says is good level to sustain investment. Nickel is on a tear. It jumped to $15,340 a tonne today, its highest close since January 2015

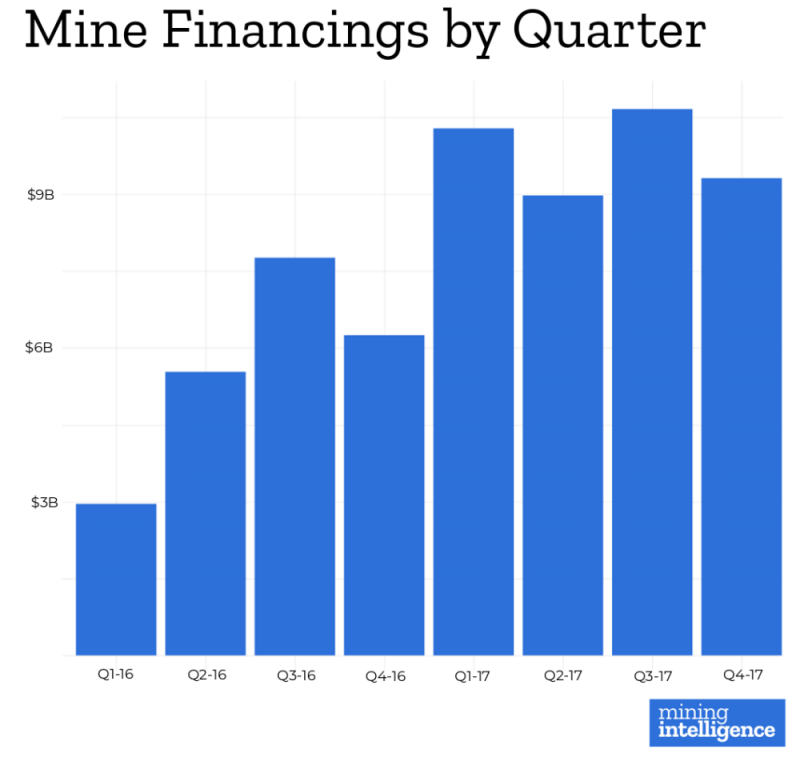

With better metal prices miners are asking for more money. In 2017 miners sought financing totalling $39B compared to $22B in 2016 according to data from Mining Intelligence. Amounts are compiled from publicly-traded companies worldwide that declared intentions to raise funds.

The size of the ask was larger, too. The average funding request was up 25% over the past two years.

Juniors and miners are exploring.

Global mining exploration is expected to increase 15% to 20% year-over-year.

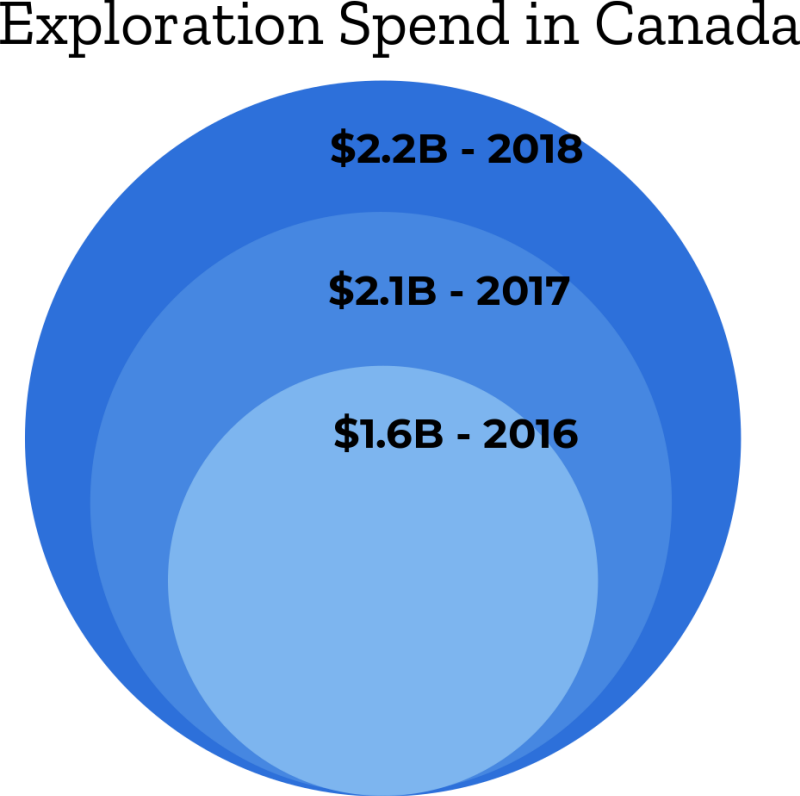

In Canada the exploration spend has grown 37% in the last two years, and total exploration spend in 2018 is forecast at $2.2B.

And consequently more core is heading to the lab.

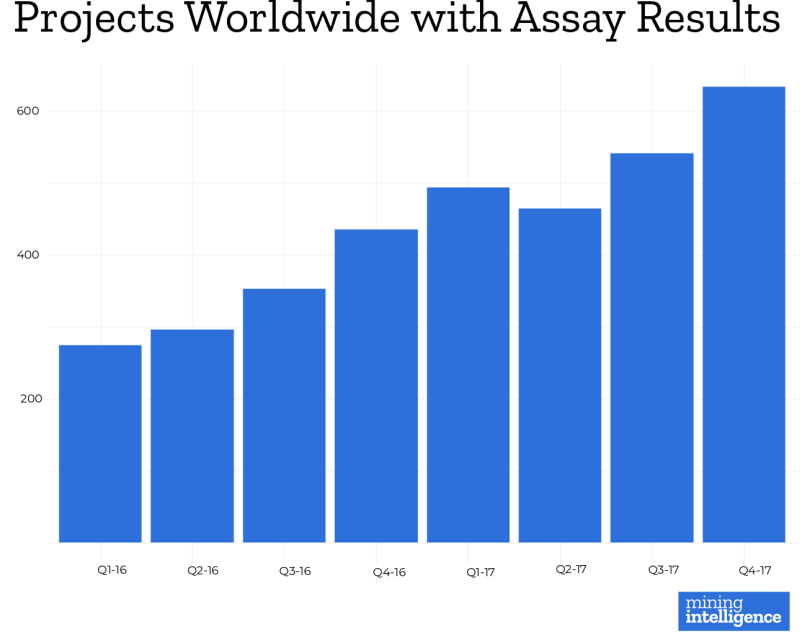

The number of projects worldwide with assay results increased 57% in 2017 over the previous year.

Sign up for Mining Intelligence and get rich insights about miners, juniors and projects. Our online tool puts rich data at your fingertips.

Creative commons image of diver by Ollie Harridge.

The post Metal prices, financing, exploration and assays are all up appeared first on ...

- Category: News Archives

- Hits: 1328

Miners are responding to a rosier metal outlook by increasing spending on exploration and releasing more assay results.

Base metal prices are up. Copper bounced off its 2015 nadir of $4,500 a tonne and in the last few months has found a range of $6,600 to $6,700 a tonne, a metal price that ING says is good level to sustain investment.

With better metal prices miners are asking for more money. In 2017 miners sought financing totalling $39B compared to $22B in 2016 according to data from Mining Intelligence.

And the size of the average funding request was up 25% in the past two years.

Juniors and miners are exploring.

According to National Resources Canada, the exploration spend has grown 37% in the last two years.

Total exploration spend in 2018 is forecast at $2.2B.

And consequently more core is heading to the lab.

The number of projects worldwide with assay results increased 57% in 2017 over the previous year.

Sign up for Mining Intelligence and get rich insights about miners, juniors and projects. Our online tool puts rich data at your fingertips.

Creative commons image of diver by Ollie Harridge.

The post Metal prices, financings, exploration and assay results are all up appeared first on MINING.com....

- Category: News Archives

- Hits: 1372

Overnight, gold was very steady along with other markets, trading narrowly between $1297..75 - $1300.65 while awaiting today’s US Payroll Report.

The DX was somewhat stable between 93.88 – 94.20, as the euro stabilized off news that Italy reached a deal on a new government, and ending a crisis that rattled global markets for days.

Global equities were mixed, with losses in Asia (NIKKEI off 0.1%, SCI down 0.7%), but firming in the Eurozone (+0.7% - 1.2%), while S&P futures were +0.4%. Weaker oil prices (WTI from $67 - $66.34, rising US production) weighed on stocks.

At around an hour before the Payroll Report was to be released and in an unprecedented move, Trump - who sees the data ahead of time - put out a tweet saying: “Looking forward to seeing the employment numbers at 8:30 this morning”.

This sent S&P futures up to 2719, and the US 10-year yield up to 2.902%. The dollar popped to 94.22, and gold plunged.

The yellow metal took out stops below the overnight low and yesterday’s low just under $1298, and $1296 (5/30 low) to reach $1294 – where support at the $1293 – 94 double bottom (5/24 and 5/29 lows) held.

At 8:30 AM, the Payroll Report was indeed better than expected. Non-Farm Payrolls rose by 223k (exp. 190k), with a +15k revision to the prior two months reports.

The Unemployment Rate ticked down to 3.8% (exp. 3.9%), and Average Hourly Earnings were up 0.3% (exp. 0.2%). S&P futures climbed higher, (+20 to 2726), while the 10-year yield rose further to 2.926%.

The DX soared to 94.35, and pressed gold lower. The metal fell further, tripping stops under the $1293-94 support level to reach $1289.25, where it found support at $1288-89...