Diamond News Archives

- Category: News Archives

- Hits: 1108

- Category: News Archives

- Hits: 6346

One of the great tyrannies of the stock market is the quarterly reporting cycle. Public companies routinely cut off their corporate noses to spite their corporate faces[1], prioritizing extreme short-term results at the expense of longer-term company health and sane, sustainable planning.

Why? Because today’s CEO knows that if he angers today’s shareholders, it’s highly likely he’ll be yesterday’s CEO and replaced by someone else. And CEOs, more than anything else, can be counted on to act in their own self-interest. Collecting giant compensation for as long as possible[2] is the name of their game.

It is identical to the dynamic that drives politicians. Their foremost concern is getting elected, and then re-elected. So they will say and do whatever they have to, inconvenient truths easily discarded for out-and-out lies that increasingly fool an ever-lazier, less-engaged voting public[3]. They will employ drastic short-term measures (and fiat currency manipulation, by definition, is a doomed-from-the-start short-term measure) that are incalculably damaging to countries and societies over even the medium term, and absolutely, unquestionably will ruin them over the long term[4].

But what if you’re in office for life? Such is the reality of Chinese president/strongman/emporer/call-him-what-you-will Xi Jinping. He has a huge political upper hand against an adversary who needs to worry about getting votes in a couple years. He can afford to play 3D chess against other heads of state playing checkers. So why isn’t he doing so?

The prime directive for any ruling Chinese leader is to avoid a Tiananmen Square redux at all costs[5]. So while he needn’t worry about getting votes, the ghosts of relatively recent, violent societal upheaval drive similar behaviors to Western leaders. Namely, an...

- Category: News Archives

- Hits: 1516

That's a bold headline. And it's true, unless "It's all different this time." Which it never has been, ever, in the history of the stock market.

One of the great Achilles Heels of blind buy and hold investing is the reliance on “average return.” The S&P, since its inception in 1923, has returned just over 12% per year[1]. On average. As Lance Roberts points out, that number is of little relevance[2] if you don't have a 100-year investment timeline.

What about the bleak corridor of 2000 to 2009? During that span, the S&P returned an average of -1% per year[3]. And what if you stuck to your buy and hold guns just prior to retiring at the end of 2002? You endured a three-year stretch that offered returns of -9%, -12%, and -22% to cap it off. How rosy would your retirement look if the last three years of your preparatory investing lopped 42% off the total you had managed to accrue all your life prior?

The knee-jerk reaction to this cautionary fright tale is “That’s all well and good, but nobody knows when those corrections are going to happen, so it’s best to just ride them out and hope for the best.”

That’s not true. The most accurate stock market predictor there is now says the S&P 500 will return -2.5%, on average, for the next 12 years[4]. The market is beyond overvalued. The most accurate, widest-scope version of Warren Buffett’s favorite valuation tool, which compares the total value of the stock market to GDP, says the market has never been more overvalued, never gripped by greater bubbled-out mania, than it is right now[5].

Everyone makes their own...

- Category: News Archives

- Hits: 1185

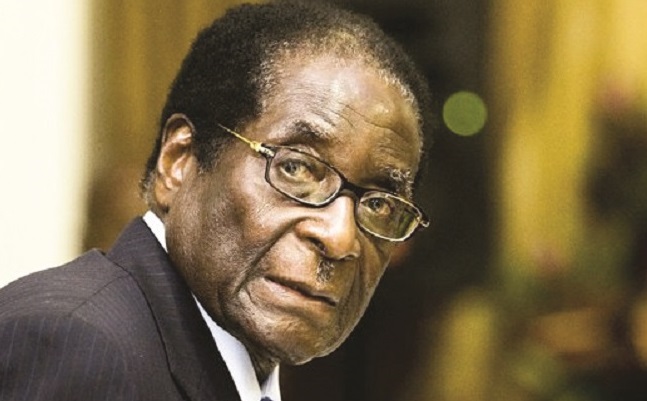

(IDEX Online) – Zimbabwe’s former president Robert Mugabe will not be summoned before parliament to answer questions about diamond mining operations during his time in office and the fate of huge revenues not received by the government, according to reports.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

The country's lawmakers have backed down from demanding that Mugabe appear before them to answer questions in what would have been his first public appearance since being forced out of office last November.

Parliamentarians had pushed for 94-year-old Mugabe to appear and answer questions on comments that he had made that the state had not received at least $15 billion in revenue by mining companies operating in the Marange gem deposits.

Although the figure is widely seen as vastly inflated, politicians have nonetheless complained for the past several years that the country's treasury had not received sufficient revenues based on the activity taking place in Marange.

Mugabe has twice failed to appear before parliament's Mines Committee and was given a final chance to do so on Monday. Following consultations with the Speaker, the committee said it had now decided the former leader did not have to attend the hearing.

In reality, it was highly unlikely that Mugabe would be brought before the committee since top politicians from the ruling ZANU-PF party, including President Emmerson Mnangagwa, who was formerly Mugabe's deputy, opposed it. ...

- Category: News Archives

- Hits: 1917

Jamie Dimon, CEO of JPMorgan, enjoys saying things that are demonstrably false so long as they cast his bank and its business prospects in a positive light.

There’s the gut buster that Too Big to Fail banks are no longer a problem[1]. Even though they are larger[2] than they were prior to the Great Recession and still employ the same impenetrably murky accounting of derivatives[3] that ultimately destroyed Lehman Brothers.

That they are marginally better capitalized is neither here nor there; no amount of capital would have saved Lehman from its gigantic, unregulated derivatives bets. The elephant in the room now, as it always was, is that once panic grips the system and a bank is seen as inherently unstable, all of its counterparties vanish, feeding that panic and leaving the bank to die.

Which it won’t be allowed to if it’s been deemed Too Big to Fail. At which point the government steps in to bail it out.

Dimon’s most recent hilarity suggests that American consumer debt levels are low[4]. Try and square that with the statistics below.

#1 78 million Americans[5] are participating in the “gig economy” because full-time jobs just don’t pay enough to make ends meet these days.

#2 In 2011, the average home price was 3.56 times[6] the average yearly salary in the United States. But by the time 2017 was finished, the average home price was 4.73 times[7] the average yearly salary in the United States.

#3 In 1980, the average American worker’s debt was 1.96 times[8] larger than his or her monthly...